On 10 April 2020, the IASB has issued a paper intended “to support the consistent application of requirements” in IFRS 16 Leases: “IFRS 16 and covid-19 – Accounting for covid-19-related rent concessions applying IFRS 16 Leases”. Below, we present the main messages of this paper (from a lessee’s perspective). And we explain why this is a) not satisfactory for investors and b) even limits the room for manoeuvring of companies that wanted to interpret the standard more in line with investors’ views.

IFRS 16 is the relatively new accounting standard that deals with lease accounting. From a lessee’s perspective the main point is (in simplified language) that now all leases are shown on the balance sheet whereas before introduction of IFRS 16 some of them – operating leases – could circumvent recognition on the balance sheet. We have intensively discussed the economic consequences and implications of the introduction of IFRS 16 in three different blog posts last year HERE, HERE and HERE.

Now, in the course of the Coronavirus crisis a new issue popped up: Some countries set rules, and some lessor companies deliberately agreed to, soften the payment duties of lessees (in particular for those which are somehow victim to the forced closure of their rented assets, such as many retail companies). This softening has many faces, but quite often lessee companies are just granted a delayed payment of rents, such as e.g. in Germany where tenants that suffer from hardship caused by COVID-19 can postpone their rental payments for April, May and June 2020; however, these rents have to be paid by end of June 2021 at the latest. Such postponement is also the most realistic case in countries where there is no direct rule on rental payment softening, such as Italy (Italy works with a tax credit system for rent payment victims of the Coronavirus crisis). E.g. on 12 March 2020, Eurocommercial Properties N.V., a Dutch real estate company with a shopping mall portfolio in Northern Italy, commented that it is reviewing requests for rent deferrals from shop owners but that this „does not waive any contractual rent or lease obligations from our tenants.“

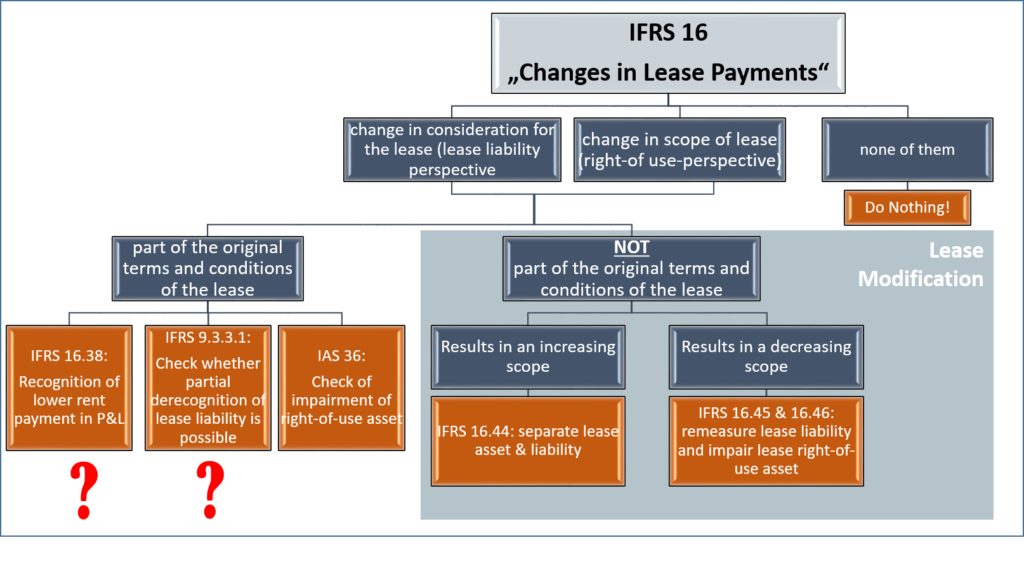

The IASB clarification on how to deal with rent concessions when applying IFRS 16 is summarized in the graph below. In this graph we have listed the main messages from the IASB text in a structured way. It is important to note that the IASB clarification is not a new view on IFRS 16, and hence “it does not change, remove nor add to, the requirements of IFRS 16.”

In a first step it has to be determined whether the change in lease payments changes the amount of the lease liability and/or the scope of the right-of-use assets. In most cases this will be the case in the Coronavirus triggered rent concessions (if not, then nothing happens). In a next step it is necessary to understand whether this change in scope or liability of the lease is a) covered by the original terms and conditions of the lease or b) not covered by these terms. Although the paper is not fully clear here, it seems as if the IASB rather sees the current events as mainly falling under the case-a)-definition, i.e. that coronavirus-triggered lease payment softening is covered by “force majeure” which in turn is often part of the lease clauses and terms. We come back to the concrete treatment in the two here-presented cases later.

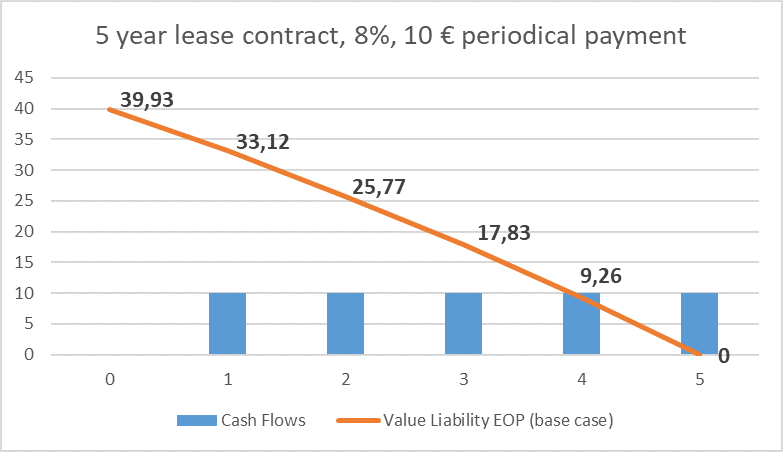

Let’s first have a look at what happens in economic terms in case of a rent concession. Imagine a lessee company enters into a lease contract with 5 periods maturity and periodical lease payments of 10 Euros. The company determines that an applicable discount rate is here 8%. The following graph shows the timely development of the lease liability (EOP: end of period) under normal (i.e. no change) circumstances.

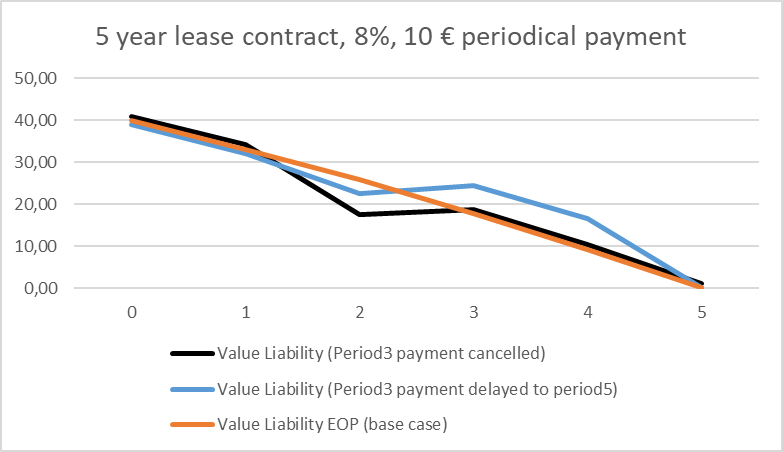

Now, let’s distinguish two cases – both having their initial trigger at the very beginning of period 3. In case (1) it becomes clear at this point in time that the period 3 payment is delayed to period 5, i.e. the company does not have to make a 10-Euro-payment at the end of period 3 but rather has to make 2 such 10-Euro-payments at the end of period 5 (blue line below). In case (2) at the beginning of period 3 the company learns that the period 3 payment is cancelled – without any need for doing the payment at a later time (black line below).

In the graph we can see that now the timely development of the liability takes a different shape – depending on which case (1) or (2) is the relevant one. While in both cases we can see a temporary reduction of the lease liability, in case (1) it increases during period 3 and stays higher than the original liability until the end of the lease term, and in case (2) it comes back to the development track of the original liability at the beginning of period 4, i.e. once the event of the payment cancellation is in the past. But whatever case is the relevant one here: A fair accounting of these liabilities should follow the respective value paths.

For the right-of use asset there might be a reduction in value – i.e. the necessity of an impairment – according to the future expectations of the government-closure-related related changes in cash inflows. It is worth highlighting here that although any potential value changes of the asset and the liability have an identical root (the Coronavirus crisis) the concrete value paths are not directly related. It might well be that the right-of-use asset now develops totally independently from the liability. Or putting it differently: Any postponement or cancellation of rental payments is not necessary directly value-related to the foregoing operating cash flows from not being able to run the business during time of closure.

Let’s now have a look at what IFRS 16 says companies should do when dealing with rent concessions. First we start with the situation where these lease payment changes are not seen as part of the original terms and conditions of the lease contract (again: IASB rather does not see this as being the general case). In this case, the Paragraphs IFRS 16.44-16-46 apply for lessees. These paragraphs mainly say that in case the scope of the lease decreases (here clearly the case) a remeasurement of the lease liability and a decrease in the right-of-use asset is necessary. IFRS 16.45 explicitly says to “remeasure” the liability (not: to reduce) so an increase is also possible.

Unfortunately, however, IFRS 16.45 also says that companies should use for discounting the rate implicit in the lease (RIL) “if that rate can be readily determined”. This rate will now be very high as it is the rate that balances the (reduced) right-of-use asset with the – at least in case (2): delay of payment – more or less similar lease payments. This is not at all an economic solution as it will lead to an unnaturally low new lease liability. [Comment: We have already explained why the RIL is THE super weak spot of the whole IFRS 16 anyway in one of our former blog posts (HERE), the same arguments apply here even in a stronger form]. Only “if the interest rate implicit in the lease cannot be readily determined” companies can apply the incremental borrowing rate for discounting.

If we find that the lease payment change is in fact covered by the original terms and conditions then things are even more complicated. In this case, IFRS 16 points to paragraph IFRS 16.38 b. where “variable lease payments not included in the measurement of the lease liability … [should be recorded in the P&L] … in the period in which the event or condition that triggers those payments occurs.” Furthermore, the IASB refers to the possibilities of additionally derecognising parts of the lease liability according to IFRS 9.3.3.1 and of impairing the right-of-use lease assets according to IAS 36. Of course, double counting is prohibited. Important: A fair remeasurement of the liability is not possible – as far as we read IFRS 16 – as IFRS 16.36-16.43 do not cover the Coronavirus situation.

The problem with this solution is that it is not clear what happens to the lease liabilities over time. Should a company in case (2: delay of payment) in our example above recognise in period 3 (the period that triggered all future payment details) a net-zero amount in the P&L? I.e. minus 10 Euros for period 3 and plus 10 Euros for period 5. And then doing just a little IFRS 9.3.3.1 adjustment to the liability without taking care of the value path of this liability in the periods 4 and 5? This would clearly underestimate the lease liability path over time.

And even in period 3 it is not clear whether we really have to do a downward adjustment to the liability. E.g. in Germany delayed rental payments have an interest component by law (roughly 4% currently) and as long as this interest component is higher than the leasing discount rate we can already see an increasing leasing liability in period 3 – which means that IFRS 9.3.3.1 is not applicable anyway.

Summary

- Although the IASB paper (10 April 2020) only emphasises what IFRS 16 says anyway, it rather highlights the weaknesses of this standard in the current situation.

- Lessee companies that thought about treating the Coronavirus situation as some sort of “lease modification” are now rather forced to not treat it like this.

- The “lease modification” assessment would have allowed companies to fairly revalue the lease liability and the right-of-use asset (at least if they would have forgotten for a moment to apply the rate implicit in the lease for discounting the future lease payments). We had such discussions with companies in recent days.

- The non-lease-modification way is quite a problematic one in our eyes. Although the original thinking of standard setters is clear (if you have it in your original terms and conditions, even only as ‘force majeure’, then we do not want you to remeasure your liabilities over time!) it now becomes evident that in fact no one had this situation on the agenda once companies entered their leasing contracts. And despite this lack of intention it now seems impossible to follow an economic path – in particular with regard to the subsequent accounting for lease liabilities – because the IASB recommends sticking to the words of the standard.

- It is not at all that we want the IASB to go away from the standard. We simply find it quite unsatisfactory that we are now again (see the practical problems with IFRS 9 in the current crisis HERE) in a situation where we are probably exposed to a conflict of accounting and economic treatment. Anyway, a 2020 year-end underestimation of lease liabilities (which might be the case for lessee companies having postponed lease payments in Germany to June 2021) is certainly not what we would want to see. It would be nice if the IASB proves us wrong by finding a better “clarification” of IFRS 16.