The Wirecard case provides a lot of lessons for analysts and investors. However, one aspect has not been discussed a lot so far. The question: Did all this happen despite our well-functioning accounting and reporting system? Or did IFRS rather push the Wirecard developments?

It turns out the truth is somewhere between the extremes. This is discussed in this blog post where we shed light on three issues that – while certainly not being the root of all evil – at least supported the way the Wirecard story developped over time: cash, goodwill accounting, and revenue recognition.

The different Faces of Cash

The cash position on the balance sheet is a very tricky one in general. It is in most cases disclosed more or less as one single number (with some minor restrictions to this) – but from an economic point of view it rather has totally different faces. Not all cash is equally well accessible. Sometimes cash sits in the direct cash account of the reporting company (best accessible) but often at least parts of the cash are somehow – in a soft or a hard way – restricted: some cash sits in subsidiaries and takes time to be streamed up to the mother company, some cash sits in countries with repartriation issues, some cash is used as a collateral for some sort of transactions, and so on and so on (much more on this restricted cash problem can be found in one of our former blog posts HERE)

In the case of Wirecard, a part of the cash should have been in escrow accounts in order to back the insurance-like services of the German company (more on the original business model of Wirecard can be found HERE). However, over the years it was absolutely unclear how much. This possibility for intransparent disclosure helped Wirecard to mask the fact that quite a lot of this cash was unaccessible.

Unaccessible is admittedly a euphemism here: In the end it was clear that the cash is not locked in escrow accounts but rather not existent at all. However, if a more detailed split-disclosure had been mandatory for cash, analysts and investors would at least have seen which part of the cash is directly available for use (non-restricted) and hence would have had a much clearer picture of the liquidity situation of the company.

And Wirecard is not alone: As long as there is no solution on how to disclose a split-down of the cash account we will always have to live with the hard surprises – in particular for companies that are already in trouble – of some cash not being accessible when needed. The sheer materiality of this aspect combined with the not too tricky implementation of a split-down disclosure should clearly be a wake-up call for standard setters to make this balance sheet position more transparent.

Goodwill Impairment – The Headroom2 Problem

While the whole goodwill impairment accounting topic always attracts a lot of different critique, we want to focus on one particular point here: The headroom2 problem and the possibilities for companies to shield the goodwill of acquisitions from future impairments. We have explained the functioning of this technique in detail in one of our former blog post HERE.

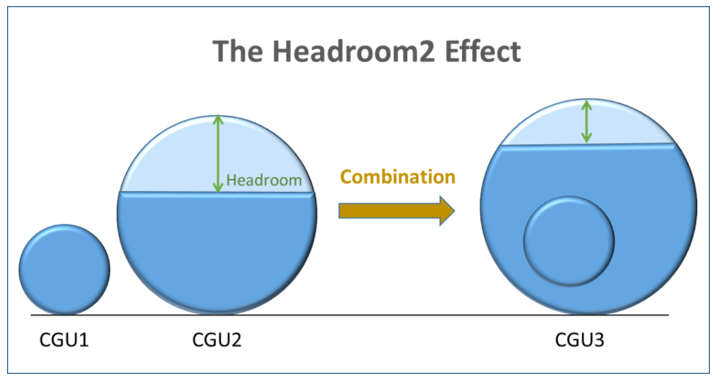

Starting point of this technique is the fact that a goodwill impairment testing does NOT necessarily test the goodwill of a former acquisition for potential impairment, but rather tests the cash-generating unit (CGU) to which this goodwill has been transfered after the deal for potential impairment. The trick is now to bring a unit which is running risk of being impaired (CGU 1 in the graph below) into a larger unit which is far from any impairment risk (i.e. which has a lot of headroom, CGU2). Then the newly combined unit (CGU 3) certainly has less headroom but still enough to not being impaired.

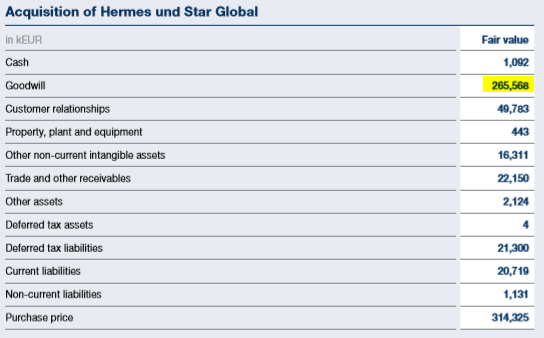

Wirecard has very successfully played this headroom2 game. In 2015, Wirecard bought the payment activities of the Great India Retail company (mainly the Indian company Hermes I Ticket Pte. Ltd. and Star Global Currency Exchange Pte. Ltd.) for a price of roughly 314 mio Euros from an investment vehicle. As it turned out, the company has been bought only shortly before by this investment vehicle for only 35 mio Euros. The full circumstances of this deal are still in the dark. In particular, we do not know so far who the economic beneficiaries of the investment vehicle are.

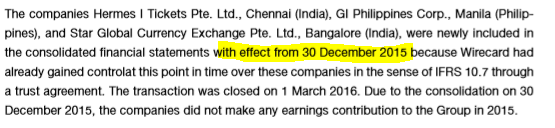

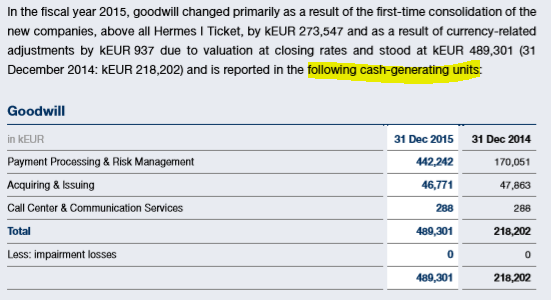

Whatever these circumstances are, however, the acquired companies were fully consolidated in Wirecard’s group accounts with effect from 30 December 2015, and during the purchase price allocation (PPA) process a lot of goodwill was uncovered.

Source: Wirecard AR 2015, p. 104, own emphasis.

Source: Wirecard AR 2015, p. 165, own emphasis.

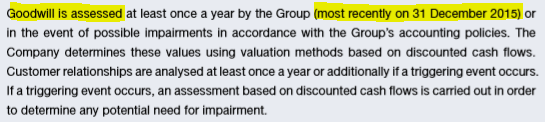

Wirecard, however, did not run the acquired companies as separate cash-generating units for a single day. Because at 31 December 2015 the annual goodwill impairment testing took place – and there certainly was the risk that auditors would question the price differences between 35 mio Euros on the one-hand side and 324 mio Euros on the other hand side [or would have found an overpricing of this transaction by means of a DCF model] – Wirecard immediately integrated these assets into the “Payment Processing & Risk Management” cash-generating unit.

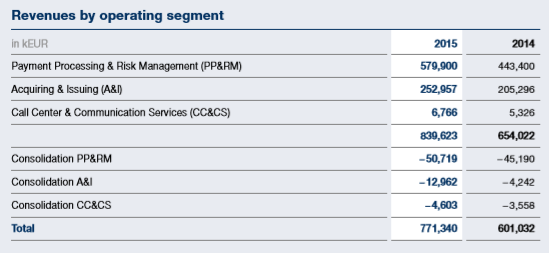

Source: Wirecard AR 2015, p. 204, own emphasis.

Source: Wirecard AR 2015, p. 205, own emphasis.

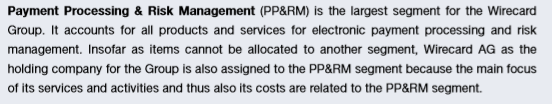

The “Payment Processing & Risk Management” CGU is equal to the “Payment Processing & Risk Management”-segment of Wirecard. And from segment reporting of Wirecard we can see that this segment was by far the biggest segment of the group (it generated roughly 70% of the total group revenues). Lots of different business activities were subsumed under the roof of this unit. Even the activities of the holding company, the Wirecard AG itself, were part of it. And as these original activities of Wirecard are free of any accounting goodwill (because they have grown organically) it goes without saying that the headroom2 in this segment was very high.

Source: Wirecard AR 2015, p. 221.

Source: Wirecard AR 2015, p. 238.

As a consequence of this fast restructuring move no goodwill impairment was recorded in 2015 (nor was there a goodwill impairment in 2016, 2017 and 2018).

Certainly, Wirecard is a very special case. But the headroom2-game is something that many companies play – sometimes more, sometimes less aggressively. It is also generally known that this deficiency of IAS 36 (Impairment of Assets) exists. However, so far no improvement efforst were undertaken in this regard. But perhaps this changes in the near future: The IASB – also supported by the EFRAG (European Financial Reporting Advisory Group) – is planning to fight the headroom problem. This can be read in the IASB’s March 2020 discussion paper on goodwill accounting (“Business Combinations—Disclosures, Goodwill and Impairment”, HERE). One idea in this paper is to make the impairment testing structure more granular – i.e. disaggregating the cash generating structure and hence limiting the possibilities for the headroom arbitrage. Lets hope that the IASB will ultimately reach a good solution to this important accounting issue.

IFRS 15 – The missing Customer Perspective

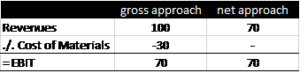

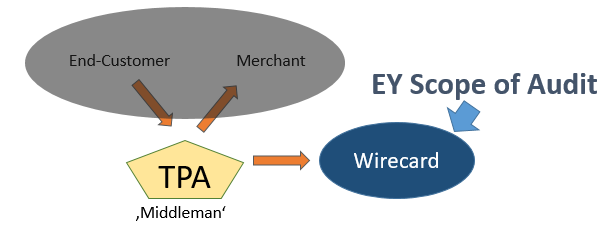

Wirecard applied a so called gross revenue accounting in its Asian business, i.e. it booked the full processing fee of the transactions as revenue and then showed the fee for the third party acquirer (TPA) as costs of goods sold (COGS). This is only possible when Wirecard controls the whole transaction process down to the customers according to IFRS 15 Revenue recognition.

However, Wirecard was helped by a one-sided understanding of testing whether the company is the principal in the transaction (which lead to gross revenue accounting) or only an agent (which would have lead to net revenue accounting). As we have already set out in a former blog post (HERE) usually this test focuses purely on the reporting entity’s perspective.

In the Wirecard case, this focus on the reporting company led to the situation that the auditors didn’t reach out to the ultimate customers (the Asian merchants) to understand the control-structure, and hence couldn’t find out that many of these ultimate customers didn’t exist at all.

However, from a pure economic point of view it does not make a lot of sense to only look at the reporting company when analysing who is in the driver seat of the transaction. If the ultimate customer doesn’t see the reporting company as the real counterpart in the transaction but rather the ‘middleman’ then he/she will stick to the ‘middleman’ and not to the reporting company once the business relations between reporting company and the ‘middleman’ change. And then the reporting company will lose the customer (because it does not control the transaction and is not the principal) even if contracts between the reporting company and the ‘middleman’ show it differently. It is clearly the understanding of the ultimate customer that determines the principal/agent question here.

The argument that checking at the ultimate customer level might be a too complicated way of tackling this problem is, by the way, not a valid one because such a switch in perspective is absolutely not new to IFRS 15. For example, in the Basis for Conclusion (BC) of IFRS 15 – a document of supporting comments to this reporting standard issued by the IASB – paragraphe BC87 clearly highlights that an entity should take the customer’s perspective when determining what its promised goods and services of a contract are. This makes absolutely sense in this context. And considering that identifying promised goods and services is probably a topic less sensitive to questions of perspective than the principal/agency-issue, a stronger focus on customers’ points of view when analysing gross vs. net revenue accounting seems to be mandatory.

Disclaimer: We hold no direct economic stake in Wirecard – in whatsoever direction. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all.