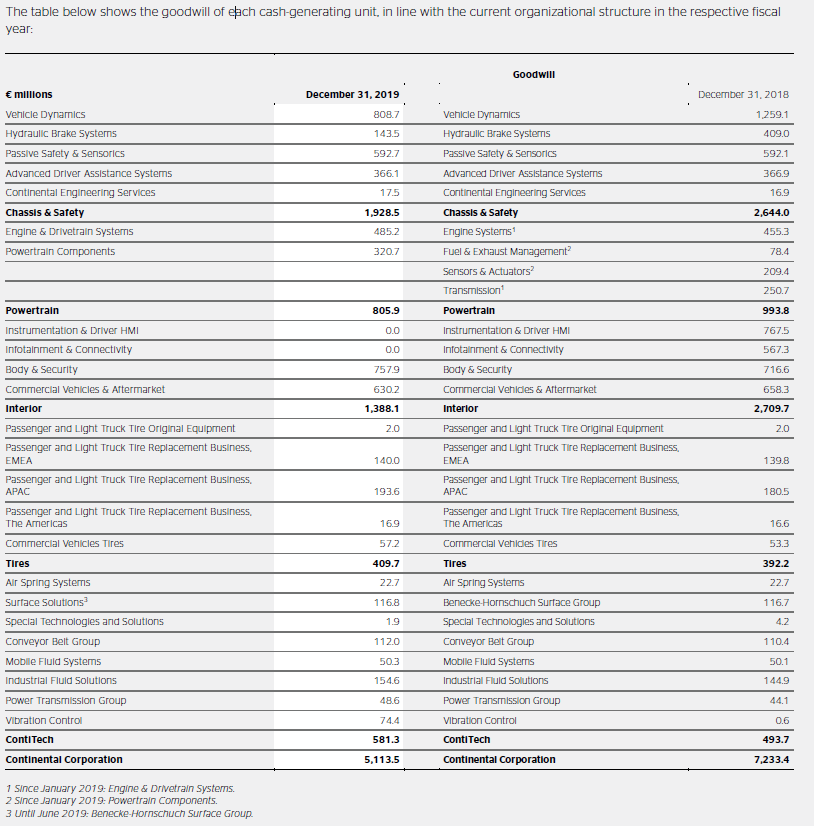

Continental AG (Conti) did not show any goodwill impairments in Q1/2020 (only some minor asset impairmets). However, in contrast to this, the big German automobile supplier popped-up top of our analytical screen in terms of Q1/2020 goodwill impairment necessities. How can one brigde these two sets of information?

Source: Quarterly Report Q1/2020, p. 32.

This is the topic of our today’s blog post. We explain why the alarm in our screen was triggered, what the potential problems are with the Conti-approach, but also what could be possible explanations for its proceeding.

Preface 1: As a consequence of our screen results, we addressed several questions to Conti IR to get some clarification but the company informed us that it could not answer these questions because of its disclosure policy. This is well tolerated here. But we also want to highlight that we only asked for information which the company would have given anyway if it had published a full annual report at the end of Q1/2020, i.e. only for information that we could find in the annual report (AR) 2019, but in an updated Q1/2020 version. We certainly did not at all want to bring the company into the position of giving out information which could somehow be seen as non-public in general or even as insider information – far from it! However, we also understand that Q1/2020 is not the time of delivering an annual report, so everything ok for us.

Let’s go with our analysis. First of all, the reasons for the accounting alarm of our screen are mainly the following:

- Conti recorded noticeable goodwill impairments in the fiscal year 2019, particularly on 30 September 2019.

- For some of the Cash Generating Units (CGUs) subject to these impairments the goodwill has not been written down to zero in 2019.

- Conti’s stock price decreased in Q1/2020 by 43.1%. This compares to the Euro Stoxx ‘only’ losing 25.6% and the Stoxx Europe Automobiles & Parts Sector Index ‘only’ losing 37.5% (we use the information given by Conti here, our numbers differ a bit but not in a meaningful way)

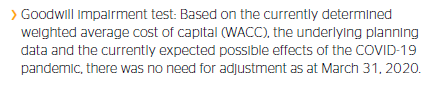

- Conti bond yields increased massively during Q1/2020. Amongst others, this has been reinforced by a downgrading of both credit rating agencies S&P’s and Moody’s from BBB+ (Baa1) to BBB (Baa2) during this quarter.

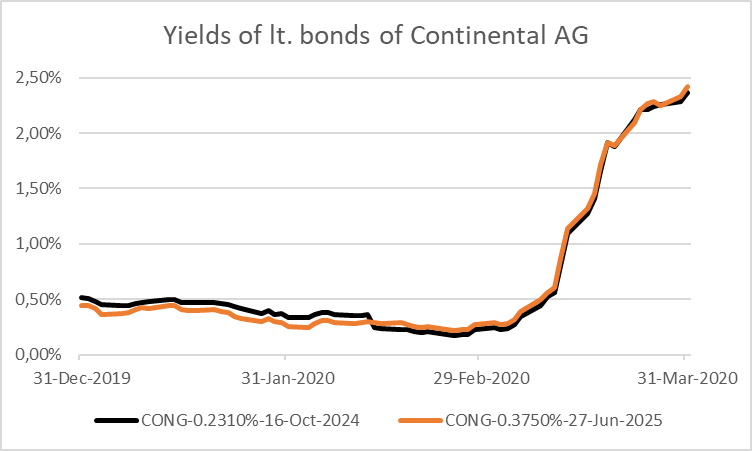

- General development of market risk at the end of Q1/2020 which indicates an increase in discount rates for reasons of value-in-use determination. Below we highlight the development of implied volatilities for the Euro Stoxx around 31 March 2020 (form more details on this, see our blog post on development of market risk HERE)

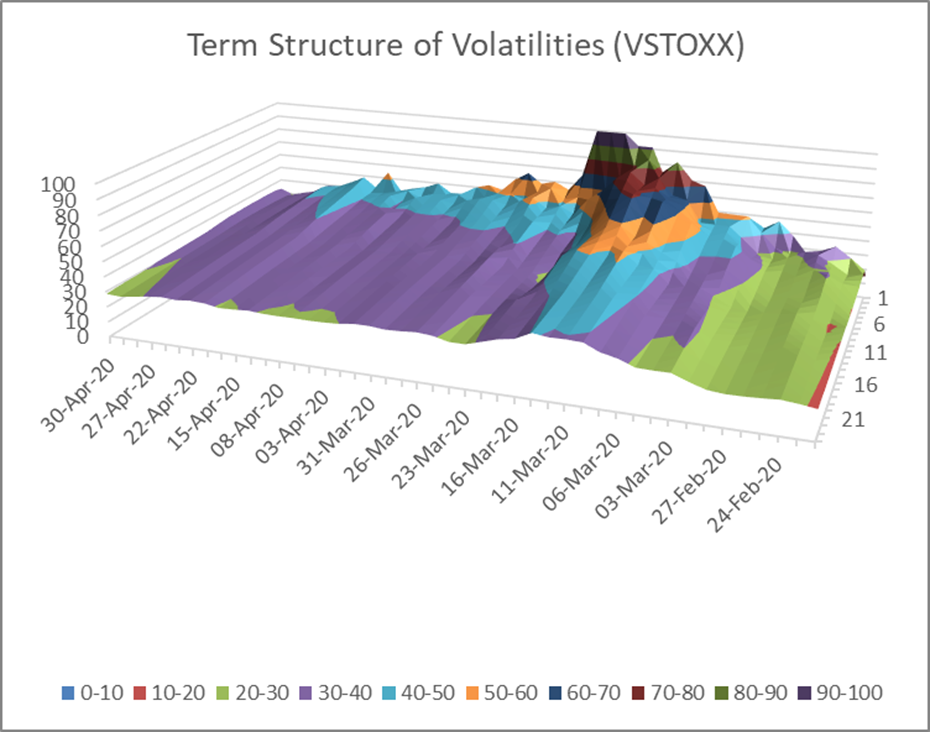

- Coronavirus must have been a so called “triggering event” which led to an extraordinary impairment testing (usually Conti’s annual impairment testing is done in November each year)

The first two bullet points are relevant here because they show where parts of the goodwill positions stand in economic terms at the beginning of Q1/2020 (or the end of FY 2019; what exactly Conti has impaired in FY 2019 and which CGUs are affected is shown in the appendix of this blog post: ‘Conti’s 2019 goodwill impairment activities’). To better understand our conclusion here we very quickly recap how economic and accounting values of acquired businesses develop in practice.

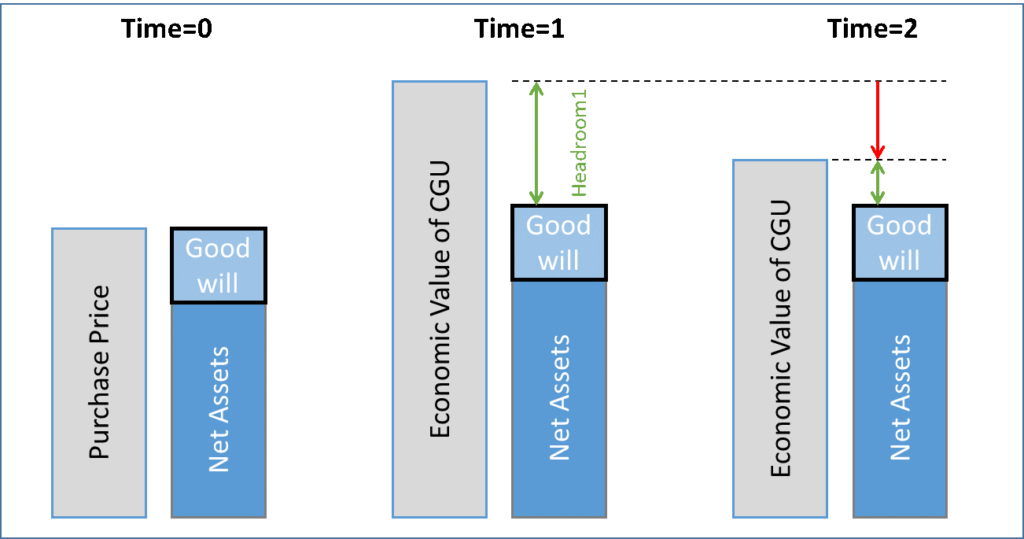

Assuming a company is bought and treated as a separate CGU, then all of the accounting values at time of first recognition should be “fair” in economic terms. I.e. after the acquisiton price is allocated to different assets, liabilities and finally the goodwill position (the so called Purchase Price Allocation PPA) all of these positions should – in sum – show the fair economic value of the acquisition (time=0 in the figure below). This, however, might change over time. Assuming the new participation might increase in economic value over time (or better the value of the CGUs on which the allocation has been performed increases over time) then we would see a decoupling of economic and accounting values. There is no rule to up-value single assets in accounting terms if they perform well (this also the basis of our whole accounting understanding, the ‘historical cost accounting’ principle, with only some minor, here not relevant exceptions). As a consequence, over time economic values of CGUs might be (much) higher than accounting values of the related net-assets (time=1 in the figure below).

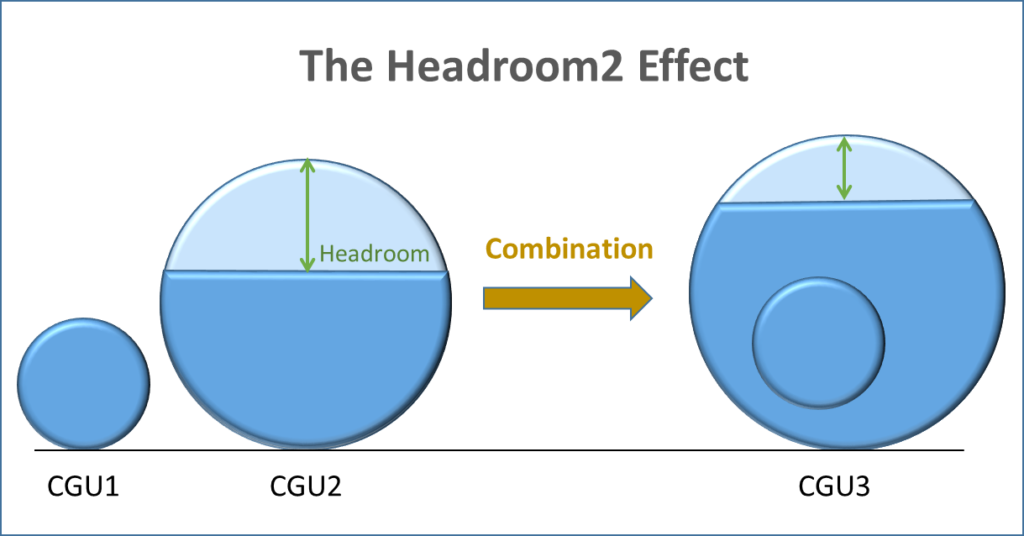

If now (starting from time=1 in the above figure) some economic value deterioration takes place, this does not necessarily mean that a goodwill (or whatsoever) impairment has to be recorded. This is highlighted by time=2 in the above figure. It could well be that only part of the value-headrom has shrunk but accounting levels are not touched. That is why we call this the headroom1-effect. For outside investors it is nearly impossible to find out how much headroom1 single CGUs have, but this is ok. It is not the idea of goodwill accounting to provide always information on fair economic values of the goodwill position. It is just to check for potential impairments.

However, if the goodwill of the CGU has just been impaired in the quarter of reporting we know very well how much headroom1 exists. Answer: nothing (or at least not much). The very recent impairment should have brought the goodwill position again down to its economic value, and ‘hard’ to its economic value. This is the idea of goodwill impairment, and this is what we can also more or less read from Conti’s 2019 goodwill impairments. The value of the accounting goodwill positions of its single CGUs should be equal to its economic positions at the beginning of Q1/2020 (or the end of FY 2019) – not much headroom1 left!

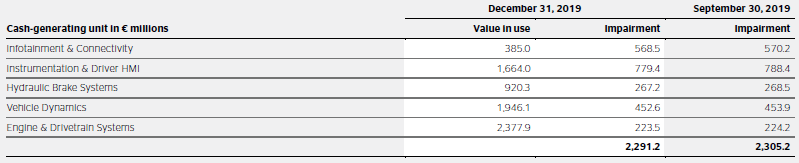

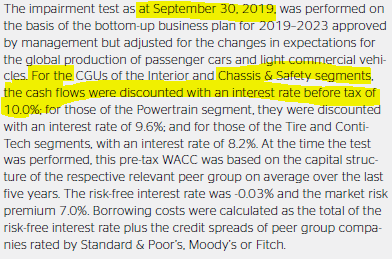

Source: Annual Report 2019, p. 130

Admittedly, as the impairments took place on 30 September 2020 we cannot hard-mark the economic values to the accounting values at 31 December 2020 (i.e. there was some time for a small decoupling of economic and accounting values of the CGU) but this is to be discussed later in this blog post. At least we can say, any remaining difference between economic and accounting values should not be material.

The third bullet point just highlights how the price of conti at the stock market has developped in Q1/2020 which should be an indication of the development of fair economic values. The fourth and the fifth bullet point just complement the third bullet point in terms of indications for economic value development in Q1/2020 of the whole company but they also set a framework for the technical aspects of the concrete impairment testing: they highlight where discount rates should be for the present value calculation which forms the basis of the determination of the value-in-use: much higher than at 31 December 2019.

The sixth and final bullet point is quite clear. Extraordinary impairment testing is necessary if there is a so called ‘triggering event’. According to IAS 36 such triggering events are certain indications that there might be value reduction in at least some CGUs. I think there is no doubt that coronavirus is a triggering event (this is also the case for all the other companies).

What are the concrete consequences from our screening?

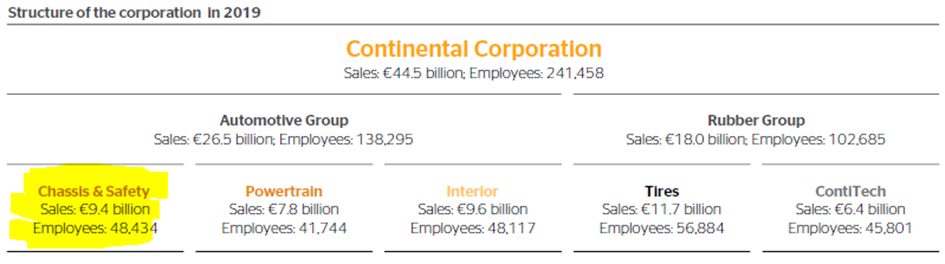

For our analysis, we mainly focus below on the ‘Vehicle Dynamics CGU’ which was part of the Chassis & Safety division until end of 2019.

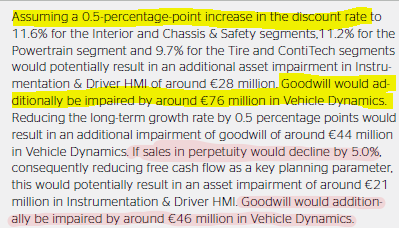

- Due to the fact that Conti has just impaired goodwill in Q3/2019, the goodwill position should be more or less at its economic value at the start of Q1/2020 – at least not far away. Any detrioration in the business and/or valuation environment should immediately further trigger more goodwill impairments. This is also what Conti’s disclosure in its AR 2019 suggests:

Source: Annual Report 2019, p. 130, own emphasis

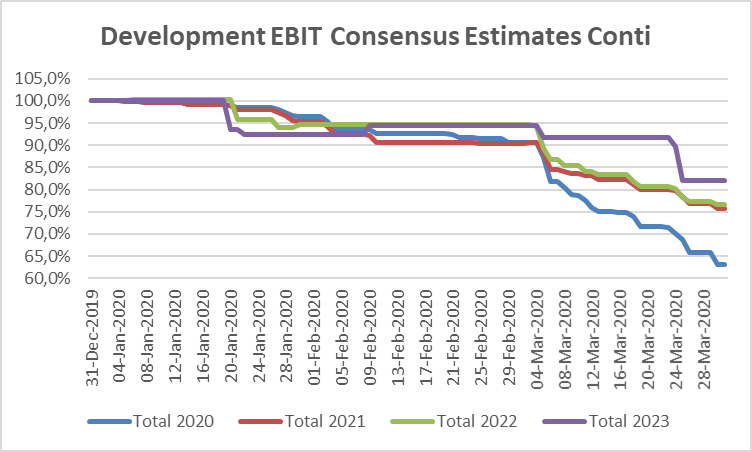

- The business environment has in fact deteriorated in Q1/2020 for Conti. Without going into all the details we only highlight the most relevant aspects here: not a big surprise, the business outlook is much weaker for Conti as a group. Below we show the development of consensus estimates for group EBIT during Q1/2020, separately depicted for the years 2020, 2021 and 2022 (except for 2023 [4 analysts], consensus numbers cover a minimum number of 18 analysts in each period).

Source: Refinitiv Eikon

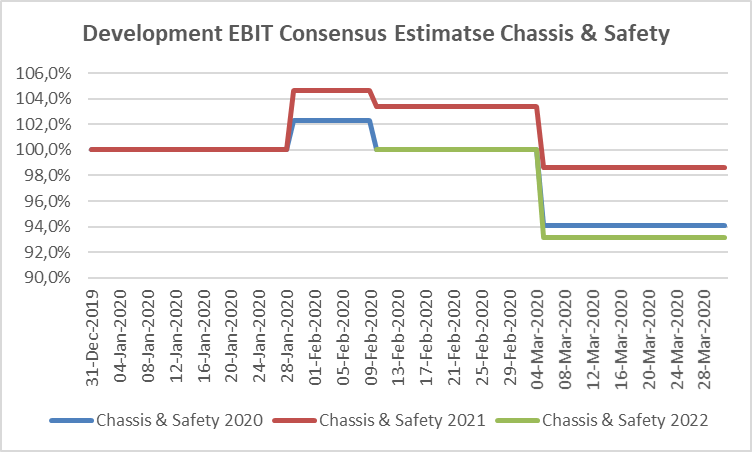

Admittedly, the development is not that clear if we look at the single segments. E.g., if we foucs on the Chassis & Safety segment we can see the following consensus estimate development:

Source: Refinitiv Eikon

However, the number of analysts that provide estimates for this particular segment is rather low (2-3), at least according to our Refinitiv database. So, the numbers are not really meaningful. This low number for the segments is not abnormal in such databases but it could also be reinforced as Conti engaged in a reorganisation at the end of 2019 and hence the “old” segments are no longer relevant for many analysts (more on this reorganisation later). However, Refinitiv does not provide any estimates based on the new group structure. So we have to live with this weak set of data. At least, these data do not indicate any improvement in analysts’ mood for the Chassis & Safety segment

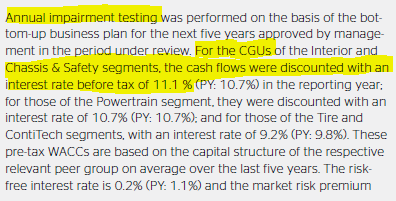

- The valuation environment has also changed a lot towards lower CGU values in general for Conti. Again, without going into all the details, there should be no question that the market risk premium (and the whole required market return even if we give conti the credit of lower risk free rates) has increased massively for valuations performed at 31 March 2020. We have explained this already in one of our recent blog posts HERE. Following a very rough application of our model (and using the market risk premium used by Conti in december 2019 (7.5%) as a starting point) we get to fair new market risk premium of about 8.2% at 31 March 2020. Moreover, the cost of credit of Conti have seen a nearly unprecedent increase in Q1/2020 – as measured by the yields of its 2024 and 2025 maturing bonds (see figure above). Even if Conti measures its cost of debt by use of a peer group (as they note in their AR 2019: “These pre-tax WACCs are based on the capital structure of the respective relevant peer group on average over the last five years. The riskfree interest rate is 0.2% (PY: 1.1%) and the market risk premium 7.5% (PY: 6.75%). Borrowing costs were calculated as the total of the risk-free interest rate plus the credit spreads of peer group companies rated by Standard & Poor’s, Moody’s or Fitch.”, Source: Annual Report 2019, p. 129/130), the idea of a peer group is certainly to take the likes of its own credit profile, and hence the results should not be much different than from looking at its own outstanding bonds. And even if there should be admittedly some capital structure effects (more weighting of debt now, less of equity), from an economic point of view the cost of capital must have strongly increased in Q1/2020 as a result! By the way, the capital structure is the only parameter that might probably not have changed in Conti’s impairment testing as the company states that it uses the five-year-average, but even if they had moved to more timely and closer-to-market parameters, the net effect on the cost of capital is clearly strongy an increasing one. By the way, the comments of Conti’s CFO during the Q1-call provide – together with the fact that no guidance was given for 2020 – support for the low visibility and hence high uncertainty that the company faces (“It remains to be seen how the markets develop. It is even hard to predict when we finally have a knowledge of how the markets are going to develop.”, Source Thomson Reuters Streetevents, Transcript Q1 2020 Continental AG Earnings Call). This is all ok for us. Uncertainty is simply to high at the moment. We are neither able to make clear forecasts in most investment cases. But this lack of visibility is exactly the uncertainty which must flow into the discount rates of business valuations. Lower visibility is the clearest fundamental sign of increasing discount rates.

- Putting it all together, we should have expected a (quite material) goodwill impairment in Q1/2020 for the Vehicle Dynamics CGU.

What could be arguments for allaying our concerns?

- Impairments in FY 2019 took place mainly in Q3/2019. It could be that in the meantime – i.e. in Q4/2020 – Conti’s Vehicle Dynamics CGU has improved quite a lot so that the company has build some headroom1. But this must have been enough headroom to cushion everything that happenend in Q1/2020. And it must have been build basically within 2 months as annual impairment testing took place in November 2019 (for more on this September-November value brigde, see later in this blog post).

- It could well be that in Q1/2020 some CGUs have a better outlook than the rest. And we do not even want to exclude here that the Vehicle Dynamics CGU’s outlook has turned to the positive in the eyes of management (although our data at least say that the outlook has not improved in Q1/2020, see the discussion above). But again, this improvement must have been enough to overcompensate any discount rate effects here.

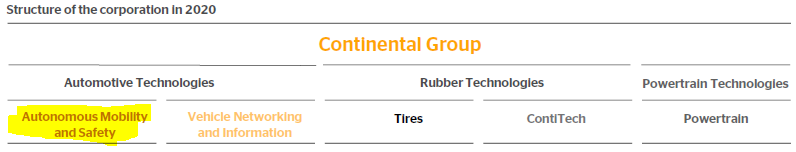

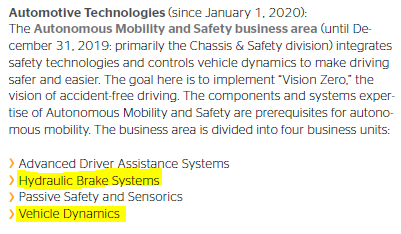

Source for both: Annual Report 2019, p. 39, own emphasis

- Conti performed a reorganisation with the start of 2020. The company changed its structure to a totally new segmentation (see above). This might have given rise to the headroom2 This effect relates to the aspect that in the course of a reorganisation certain CGUs are integrated in other CGUs or change their structure in some different way. This could lead to a totally new impairment basis for single CGUs where e.g. a new headroom is built just by combining e.g. CGU1 without any headroom with another bigger CGU2 with a lot of headroom. As a result the combined new CGU3 has a combined new headroom and the way to impairment of the former CGU1 goodwill is now much longer. We only show this here very quickly by means of a figure below. You can find a very detailed description of this effect in the always brilliant Footnotes Analyst blog HERE. To be fair, we do not know, whether this is the case. It could well be. But if Conti has reorganised its CGUs in the context of the group reorganisation – in particular the Vehicle Dynamics CGU – then the question arises what the company wants to tell investors with its comment in the AR 2019 that the Vehicle Dynamics CGU would further suffer from goodwill impairments if revenue expectations go down further and/or discount rates increase further (see the text above, Annual Report 2019, p. 130). This would be a meaningless information if the Vehicle Dynamics CGU is now swallod by another CGU.

- With the reorganisation of the group, it could be that Conti wanted to put the Vehicle Dynamics division on ‘fresh feet’. In fact, the impairment in 2019 was material and it wouldn’t be the first time that companies impair a bit more than necessary just to allow the division to now start-on with a bit of new headroom (headroom3) so that the likelyhood of being hit by any new impairments in the future is rather low (for a similar case of so called ‘kitchen sinking’ see our blog on ProSiebenSat1 HERE. This proceeding would be in-line with another strange phenomen that we could observe: between September 2019 and November 2019 the pre-tax discount rate for goodwill impairment testing in the Chassis & Safety segment increased by 110 (!) bps. This is not unusal in the market environment at that time, but what is interesting is that despite this increase in the discount rate – and no change in the mid- and long-term growth rate assumptions – the freshly (30 September 2019) impaired goodwill positions have not been impaired any further as a result of the second impairment test at 30 November 2019 (‘annual impairment testing’).

Source of both: Annual Report 2019, p. 129, own emphasis

![]()

Source: Annual Report 2019, p. 130

- And finally, it could be that Conti simply didn’t change anything in Q1/2020 in its valuation setting. It just left the cash flow expectations and the cost of capital at the old December 2019 level. Unfortunately, we think that this is at least partly an explanation of what was going on in Q1/2020 at Conti, and it is perhaps not only Conti’s mistake. E.g., for some reasons, German auditors paved the way for this by not really making clear that they want to change a lot in the cost of capital in Q1/2020. Again, we do not want to speculate on motivations here, but our criticism on this can be found HERE and HERE (the later one only in German).

What about the temporary-dipping-phenomenon?

Goodwill impairment in times of crisis not rarely follows a strange temporary-dipping-phenomenon. Full reporting has to take place only in the annual report. And if companies think that value destruction in some of its CGU might be a temporary phenomenon in one of the quarters 1-3 then sometimes they might keep the value of the CGUs high at ‘hope’ initially and wait for what the financial year end will show. This dipping-phenomen is particularly relevant in practice as once goodwills are impaired, companies cannot reverse this proceeding at a later point of time (Reversal of goodwill impairment losses is prohibited [IAS 36.124]).

The coronavirus crisis started for most companies in the first quarter of their financial year. So there is a lot of hope-time in general. We have seen such patterns in some individual crises of companies. Sometimes it played out for companies (i.e. valuations normalised), sometimes not. But usually investors do not really look through this proceeding, as once they see the full disclosure the numbers are ok. By the way, the great financial cirisis 2008/2009 did not show a lot of such behaviour as it started out in the third/fourth quarter of 2008 – so not much room for maneouvring for companies.

We do not want to say that this is within the motivation of Conti here, not at all. We only want to highlight that the lack of information in this current case (which forces us to speculate) would not be possible when coronavirus crisis would have started out some 3 month earlier here in Europe. We would see much clearer about what exactly the reasons are for the missing Vehicle Dynamics CGU goodwill impairment in Q1/2020, and this would help investors a lot. It is not about doing bad things, it is only about clear transparency which is missing.

Summary: From our outlines you can read: We simply don’t know what was going on at Conti in Q1/2020. It could well be that there are good reasons for not recognising any goodwill impairments in the Vehicle Dynamics CGU (strongly improving outlook overcompensating increasing discount rates, CGU being swallowed by another CGU) but we have no access to this information. It could even be that we missed some information in the past (as we are not a Conti-expert) and that for whatever reason Conti IR didn’t want to give it out again. But this does not help here either.

On the other hand, we have to say that there are also some indications that not everything is in line with a fair view on the Vehicle Dynamics CGU. But again: These are only indications. We simply don’t know. And this is one of the ultimate bad things about goodwill impairment testing. When it is really important to have transparency (now, in this tricky phase of the coronavirus crisis) then you do not get it in many cases, as it is the case here with Conti.

Disclaimer: We hold a “symbolic” and very small stake in Conti, not at all meaningful in economic terms – just enough to be able to ask questions to Conti IR without any bad conscience. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all.

Appendix

Conti’s 2019 goodwill impairment activities