In a very interesting article about the analytical state of the new lease accounting under US-GAAP and IFRS, the always brilliant Footnote Analyst (HERE) showed recently amongst others that the big credit rating agencies do not agree in terms of how to consider the payment obligation from lease contracts. While Moody’s and S&P’s classify it as part of Net Debt (such as the new lease accounting suggests), Fitch does not see it as part of Net debt but rather as an operating liability as it does not differ too much from typical service contracts. So, who is right? Or better: What is debt? And what is not?

We start with some bad news: German industrial giant Siemens AG has payment duties over the next three years which we roughly think should add up to more than 140 bn Euros. This compares to a stated Net Debt figure according to the annual report of only 22 bn Euros (including Siemens Financial Services) and a market cap of just 65 bn Euros. These are the facts! So is Siemens already insolvent? Well, now the good news: NO, not at all! We are comparing apples with oranges. Of course these future payment duties are existent, they stem from long-term contracts, employee remuneration duties, and, and, and… But from an economic point of view there are also lots of cash-inflows to be expected: mainly revenues! So perhaps our presented view on Siemens is not perfect from a financial analysis point of view. Lots of these payment duties will be perfectly covered by incoming payments – that’s how business works. Ongoing payment duties, and ongoing incoming payments. In the case of Siemens we can perfectly assume for the next years that the latter one exceeds the former one in a steady state. So Siemens will be in a good financial shape also in the next years (if not something unforeseen happens).

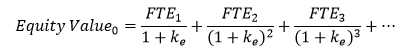

But if you want to find out from a technical point of view how all expected future payment duties and all expected future incoming payments relate (and how this finding translates into a relevant value number for shareholders), you have to simply apply a DCF-model. For reasons of simplicity here: we start with the Equity-Approach.

With FTE: Flow-to-Equity, ke: cost of equity.

In this approach all future pay-outs are directly mapped as part of the periodical cash flows. Of course there is some sort of interdependence between cash inflows and cash outflows. Some of the cash outflows are contractual and fixed over at least the next years, but some will only show up if the business performes as expected (no company will hire new employees or build new facilities if the revenues break down). Some of them have their roots at the time of valuation in past events, some will get triggered only by future (expected) events. And some of them are clearly operating in nature (salaries) while some are clearly financial in nature (loan repayments).

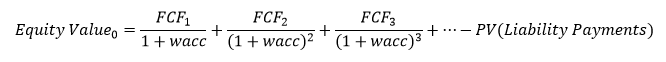

Whatever the nature of these future cash outflow is, from a technical point of view you can perfectly set up a new DCF-model: one with values the company without considering some future cash payment duties in a first step, and then deducts the present value of these (not in the DCF included) payment duties in a second step. Voilà the entity approach of a DCF model:

With FCF: Free cash flow before considering payments from or to the isolated liability category or categories, wacc: weighted average cost of capital which use the isolated liability category (-ies) as a debt component in the calculation, PV(.): present value.

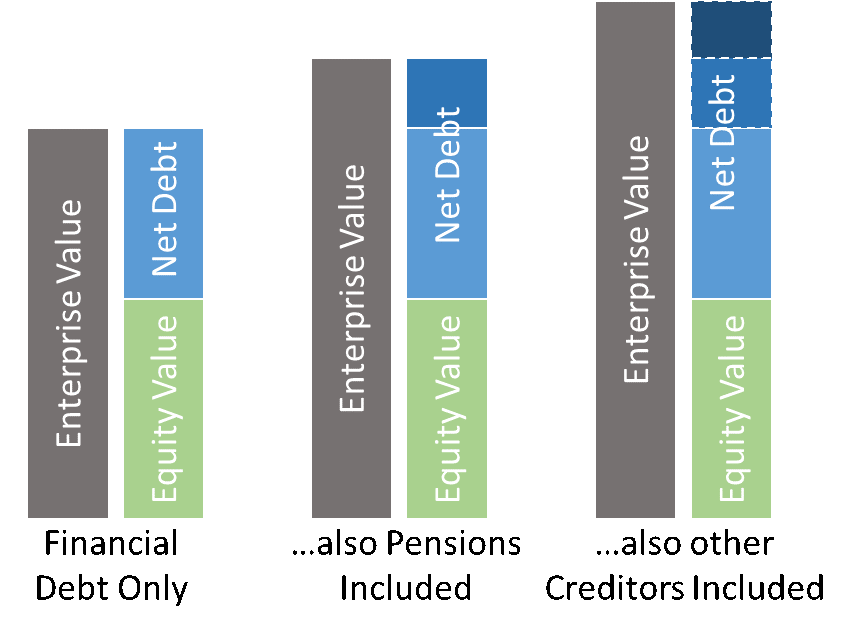

From a technical point of view you can treat each and every future expected cash payment as a liability, e.g. the payments to banks and bondholders (1), additionally the payments to pensioneers (2), additionally the payments to suppliers (3) and so one. We usually call the value dimension that covers both the equity value and the isolated liability as Enterprise Value.

What is important is, that if you apply these approaches consistently, you will end up at different enterprise values and different net debt numbers, but you will always end up at the same equity value (we do not want to go into the details of what is necessary for getting to the same equity value, but you can also see it in the graph above). All our different DCF models are just a tautology! This means, whatever you think is an “isolated liability” position: If you treat it consistently in your DCF approach you will always end up at the same equity value.

But from a practical point of view it sometimes makes more sense, and sometimes less sense to classify certain payment duties as “debt” if you perform an entity DCF. In particular it does not make a lot of sense to include payment duties which do not have their roots at the time of valuation (e.g. future salary payments, etc.). Because many of these payments relate heavily on the future performance (i.e. the future cash inflows) so that it is better to keep them as a future cash outflow in your net cash flow projections. Furthermore, Net Debt is mostly a financial measure (as we try to separate the business in operating [cash flows] and financial [Net Debt] with this split). Hence, operating liabilities are rather seen as part of the operating business and not as part of Net Debt.

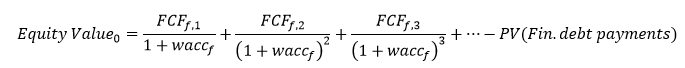

So it seems as if it is a good idea that from an analytical point of view it is a good way to classify as Net Debt what is a) financial in nature and b) has its roots in past events. This allows to project the operating part of the business as a result of a fundamental analysis and leaving the rest as non-operating and hence as debt which then is deducted at the present value from the result of the DCF model.

With FCFf: Free cash flow to the Firm, i.e. before considering payments from or to all financial liability categories, wacc: weighted average cost of capital which uses all financial liability categories as a debt component in the calculation, PV(.): present value.

So far, so good. But there are some transactions which are somehow in the twilight zone of what is financial or operating. Certainly, leases are a good example for this. We do not want to go into the details of leasing contracts here, you can find more information about this HERE .

For an analyst who applies a DCF approach things are quite simple from a technical point of view: You have to decide, then stay consistent and you will end up at the same equity value in both ways (see also HERE on how this works in practice). Again, it does not matter really (except for the fact that some analysts feel more comfortable with one or the other approach in their practical life).

But if you want to reduce your analysis to a snapshot, or a ratio analysis, things are no longer that simple. E.g. what if you want to get a feeling of the debt repayment capacity of a company based on a static ratio, such as Net Debt / EBITDA? Again you now have to make a clear statement of what is part of Net debt and what is not. But unfortunately now: The results are no longer the same (as in the DCF-world)! Ratios here will differ for the different treatments, and so might the conclusions of addressees of these ratios. (Comment: We just picked the ND/EBITDA ratio here randomly, we could also have picked any other ratios including Net Debt).

Let’s stick to the IFRS 16 lease problem. We take a super steady-state company here for the start (no growth, super balanced lease portfolio). It has an EBITDA before lease payments of 150, periodical lease payments of 50, and net financial debt (ex-leasing) of 400. The present value of lease payments from existing contracts is assumed to be 350.

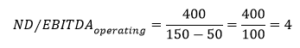

Now, the Net Debt / EBITDA ratio with treating leasing as operating-in-nature is calculated as:

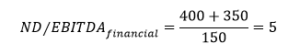

For leasing as financial-in-nature the result is:

Here we obviously get different results (acknowledging that this clearly depends on the parameter setting above, but in reality we do not get equal results much often, neither). Why is this the case? The answer is simple: Both ratios have totally different meanings!

ND / EBITDAoperating tells us (general meaning): How many years would it take, if we take EBITDA (after periodical lease payments) just for paying down financial debt (ex-leasing) – assumed that we do not use it for any other things, such as CapEx, tax payments, etc.! In contrast, ND / EBITDAfinancial says (general meaning): How many years would it take, if we use EBITDA (before periodical lease payments) for paying down financial AND lease debt – assumed that we do not use it for any other things, such as CapEx, tax payments, etc.!

So, which is now the better ratio for credit analysis? First of all: None of them is perfect! The assumptions behind both of these ratios are very simplistic as they do not take the asset-side into account at all. For ND / EBITDAoperating it is assumed that the company does not need to make any new investments (CapEx) within the pay-down-period. The existing assets assumedly simply suffice to generate this EBITDA over time. But what if the balance sheet asset life is very high already? Do we see this reinvestment needs here somewhere? No! New CapEx could make either the EBITDA a bad number as it then has to be reduced by investment pay-outs, or it might make Net Debt a bad number as then new debt issuance is necessary which is not mirrored in the Net Debt number of the ratio calculation. But at least here (i.e. for calculation of the ND / EBITDAoperating ratio) you can enter into new leasing contracts whenever they expire. This is no problem when calculating this ratio. With regard to ND / EBITDAfinancial we have the same assumptions behind the ND / EBITDAoperating ratio PLUS the assumption that the company does not need to enter into new leasing contracts. This means: The existing leasing contracts suffice to cover the pay-down period.

In short, ND / EBITDA is a simplified ratio anyway. It is a bit of an indication, but without looking at the substance of companies (which might trigger intertemporal effects such as future CapEx if rather mature) it does not make a lot of sense per se. Or putting it differently: a liability that is (even indirectly, perhaps because it was originally used for buying a machine) covered by a machine still working for several years is not a big problem usually as it will be serviced by the proceeds that the machine will generate over time. But a liability that is not covered by the original dedicated asset anymore, is a bigger problem. If the company needs some fresh covering assets, they have to get a new loan from a bank or similar financing.

This shows the big problem of static ratios anyway: the have to use some implicit intertemporal assumptions. But don’t get us wrong here! This does also not mean that ratios do not make sense at all. In fact, they make a lot of sense. They allow us to bring this highly complex DCF thinking down to a very short statement. If you know and understand the assumptions behind ratios (in terms of what they mean for value, debt, coverage, etc.) they are a great tool.

Irrespective of the weakness of the ND / EBITDA ratio anyway, with the different assumptions behind the ND / EBITDAoperating and the ND / EBITDAfinancial, ratio we cannot really make a clear statement here which is the relatively better ratio. It all depends on what you want to say. But as there is currently rather more critique than applause for the FitchRatings-approach we think that two supportive points for the FitchRatings-approach are worth mentioning here:

(1) In terms of coverage of liabilities by assets, lease liabilities are a quite (but not perfectly) safe position. There are mainly assets which clearly stand behind this liability. Of course, this might get tricky if the lease contracts are onerous. Furthermore, the vulnerability of contracts potentially getting onerous increases with the amount of lease contracts of the company. But at least with regard to the latter aspect (“highly lease dependent business models”), FitchRatings has understood the necessity to provide some additional metrics for lease-liability-as-Net-Debt. Because of the general coverage by assets, lease liabilities are usually not the most critical parts of net debt – don’t forget that for pure financial liabilities such as loans, bonds, etc. the question of coverage is not that clear-cut in most cases. So if you understand a ND / EBITDA as a measure of financial stress we certainly have some sympathy for the FitchRatings approach to NOT treat leasing liabilities as Net Debt.

(2) The second point, however, goes much deeper: We are all looking for simplified assumptions. We do not have a crystal ball, and hence we are weak in making projections (computers by the way are also weak). And we only have a limited capability to analyse the world as it is. We cannot understand everything that is going on (which restricts us a lot in our fundamental analysis). Hence, we have to use some heuristics for making decisions, and we have to build our fundamental analysis world by (simplified) models of the real world. Just take the Capital Asset Pricing Model (CAPM) as a tool for deriving discount rates. All is meant to simplify the complex overall picture.

But the worst that can happen is analytical uniformity. This means that everybody agrees on a certain heuristic. By definition of a heuristic, there are always cases where it does not work. And these cases should be open to be treated differently by investors! It is still the markets, with all their complexities which govern our investment success! In history of capital markets, where analytical democracy was in place we never got strong results. Be it the invention of the Black/Scholes formula which led to a unified valuation of option contracts in the early days, just until phenomena such as “smile” and “skew” became aware and also until traders understood that other processes than the Brownian motion are perhaps in some cases a better choice. This was also the case when in the 1990s the topic of real options (“best to be valued according to a Black/Scholes formula”) became the very hot in equity valuation. And this was also the case when consultancy Stern Stewart flooded the analytical world in the late 1990s with their statement that the “Economic Value Added” is the most meaningful approach to value equities. And – we have to say this here – this is also the case for many analytical paths of credit rating agencies – just reminding you to their ABS and MBS assessments in the eve of the 2008 financial crisis here…

Admittedly, the world of credit rating agencies is totally different today from what it was some years ago. The rating industry has evolved from a quite static analytical environment to a much more dynamic environment today. And to be honest: For us, it makes a lot of sense how they go for credit analysis today. However, as long as these credit rating agencies rely on ratios it is still up to the single investor to look at the assumptions behind it. But when we have analytical uniformity we often forget to do this. Why should we revisit the assumptions? All the others have done so already?

And hence, the current proceeding of FitchRatings serves as a great weak-up call for investors’ alertness: We have DIFFERENT opinions of credit rating agencies on a measure which is not at all a natural measure! On Net Debt! And this makes an analytical-uniformity-loving analyst think (hopefully): What does this mean for my particular investment case? I have to balance the different views and make my synthesis myself. I need to understand the different assumptions behind the ratios (measures) in order to make an assessment.

Again: We do not want to say that the FitchRatings-approach is superior to the Moody’s/S&P’s approach. But we were scared that now everybody follows the same approach which might lead investors into the analytical-uniformity-trap in the light of a phenomenon (leases) which still is a twilight zone of investing and financing. This now does not take place! We have thought-provoking different opinions. Analysts themselves have to make up their mind. They cannot hide behind a unanimous decision of rating agencies. They have to understand the economics behind the different approaches in order to make a decision! And this is a great contribution of FitchRatings.

Summary

- Which payment obligations are really part of Net Debt is a very subjective assessment. But in a dynamic analysis environment (e.g. DCF) we can always deal with this properly. Anyway: For a static view today we agree for most cases that we usually talk about financial debt in the sense of the IFRS standards (i.e. “present obligation as a result of past events”).

- As leasing is certainly somehow in the twilight zone: There is no easy answer on whether leasing is part of Net Debt or not. In fact, ratios including and excluding leasing from Net Debt have totally different meanings and totally different assumptions behind them. It is important for investors to know this.

- We have some sympathy for the FitchRatings approach (excluding leasing from Net Debt). Lease liabilities are usually (but not always) well covered by future revenues from the assets that relate to these lease liabilities. So, in most cases they are not the most dangerous part of the whole Net Debt position.

- For investors which look for single-ratio-statements – and which now complain about the different approaches of credit rating agencies – we finally have some bad news: You will not be able to draw a clear conclusion just by looking at Net Debt or by ratios such as Net Debt / EBITDA only. You cannot simply compare this number to other companies. You have to do some more analyses to set these numbers/ratios into perspective. The different analytical approach of FitchRatings is hence highly welcome in terms of that it makes these investors think – or that it breaks investors’ complacency in terms of how to look at credit ratios in general!