As an add-on to our first part of the Covid-10 Fundamental Company Analysis Manual (HERE) we today provide the second part of this manual with some more aspects to look at for an equity investor.

- Take care of Currency Effects

Along with international capital market distortions we could also see some rather material exchange rate movements (as seen from the Euro) in recent days. These movements are for many currencies even on a standalone basis out of the normal trading range. And for the whole currency portfolio of an average international company they are definitely out of normal.

Currency effects have to be taken into account over and above all the other effects. They might hit companies which usually hedge in certain trading ranges (which are now left) and certainly companies which leave some of their exposure deliberately unhedged. Also take into account the degree of natural hedge of companies (i.e. how foreign activity is backed by assets in the foreign country and also by same currency denominated debt).

- Government Support (and Restrictions)

General crises of the extent of the current Covid-19 crisis always involve monetary and political involvement. In particular the latter certainly has to be taken into account now in fundamental analysis (monetary effects have to be taken into account, too, but they rather touch the market as a whole). While acknowledging that it is very tricky to make a good analysis on political actions – everybody who has already analysed a political sector knows this – it nevertheless is a must in each fundamental analytical toolsets of investors these days.

In terms of restrictions we currently see a lot of different ones touching totally different sectors and regions. They often come over and above the already negative pure economic impacts on many business models. Certainly, they will be somehow temporary but how long they will last is highly unclear.

In terms of government support we also see currently lots of initiatives across all countries (short-time work allowance, tax moratoria, state guarantees, etc.). These support schemes often serve like a put option on financial performance to certain companies. So it is highly important to take such initiatives into account for a fundamental analysis these days. And don’t forget that there are some sectors in every country which might benefit more than others because of national prestige, too big to fail, exposure to the labour market, etc.

- More Insight into Operating Leverage Effects

We have already discussed the problems of a high level of fixed costs (high degree of operating leverage DOL) amid a crisis in our first blog post on this topic. And it is not a big surprise that the first business models that run into trouble during the Covid-19 crisis are exactly the ones with a high fixed cost basis.

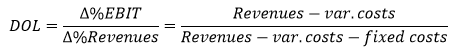

As this is such an important topic for fundamental equity analysis in the light of a crisis we want to go a bit deeper into the Operating Leverage issue here. In general, Operating Leverage or better: Degree of Operating Leverage (DOL) is a sensitivity measure that shows how much the operating profit changes for a given change in revenues:

As a matter of course, DOL=1 if the company only has variable costs, and DOL increases with the amount of fixed costs that the company is carrying.

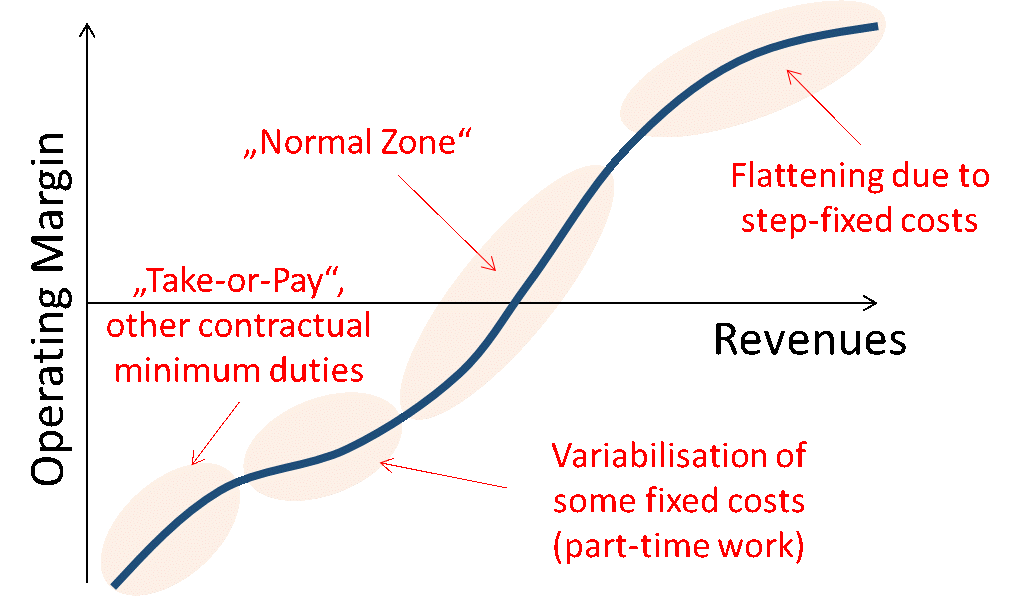

What is often overseen is that DOL is not a linear function across revenue changes. In most cases – if there are only small movements in revenues – we are in the “normal zone” where we can apply our DOL-formulas quite properly. If there are bigger revenue increases, the DOL usually decreases due to the necessity for more investments to support the higher revenue numbers (so called step-fixed costs). But this point is not of high relevance currently. We rather have to look into the other direction. Here we can see that for bigger revenue decreases there is usually also a flattening of the DOL as now some short-term-only fixed costs get more variable. This might be in particular due to part-time work of employees, but also due to other effects. However, there is also an aspect that might make the DOL steeper for bigger revenue decreases: Often companies have certain minimum purchase requirements in their supplier contracts. This might lead to the situation that companies have to take-up supplier goods that they cannot resell – at least in the current situation – or that they have to pay fines with all the consequences that this situation brings (margin pressure, cash flow pressure, destocking pressure, storage costs). This might be a problem in the current Covid-19 crisis if companies have revenue-side pressure but still working supply chains.

Hence, investors are well-advised to have a closer look at the contractual supply structures of companies and the corporate ability to variabilise some of the fixed-costs if they want to make forecasts on profitability measures.

- Contractual Time Shifts and Tipping Points

Similar to the DOL-steepening risk by minimum purchase requirements discussed in the bullet point above: Contractual effects can also have positive effects, at least temporarily, in particular if they exist on the revenue-side. E.g. container leasing company CAI international Inc. is clearly sitting in a sector which gets hit very hard by Covid-19. But still the company’s performance is shielded for some time because of longer-term contracts with customers. While such contractual shielding allows the company to buy some time (and sometimes also to bridge shorter shocks), it usually does not serve as a sustainable support. In fact, if crises take longer – as the Covid-19 crisis presumably will – there is often a point in time (a tipping point) where most of these contracts run out and the full economic impact on performance and cash-flows becomes real. So for analysts and investors revenue-side contracts have to be seen in two ways: First, don’t model such companies to negatively in the short-term. Second, take care of sudden performance drops in the mid-term once these contracts run out.

- More insight into Inventory Effects

We have already discussed inventory issues in our first post – with the sweet spot for companies that have a rather low level of finished products and a rather high level of raw materials on their balance sheet. Today we would like to add two aspects to this:

First, usually companies are better equipped if they rather have a slow inventory turnover – all other things being equal. Such a situation gives much more flexibility then a situation in which inventory is rather turned fast. This is particularly true if companies rely with their supply chains in parts on China but also – now after Covid-19 became pandemic – if they rely to other shut-down regions.

Second, also supply knows seasonality. And hence, some companies are hit harder so far than others. In terms of analysis, this becomes relevant if investors expect a normalisation (or at least a movement into this direction) over the course of the year. E.g. in the first months of the year, usually sporting retail products are sourced heavily from Asia while electronic hardware is rather sourced more heavily in the later months of the year.

- Fundamental Analysis still matters

So far, at least the stock market has not differentiated a lot for fundamental reasons. What we saw over the last weeks was more or less a beta-weighted sell-off – with some exceptions. Additionally, correlations of price movement within sectors are still quite high which also indicates that there is not much differentiation regarding specific business model characteristics.

We think this is a clear sign that with deeper fundamental analysis on single business models there is still a lot of room for added-value to investment decisions.