In this blog we recently discussed some cases where the concept of control (HERE) or the existence of related-party transactions (HERE) played a major role. In fact, both topics share a common basic characteristic: they touch the very question on who is really in the driver seat when certain business decisions are made – with all the consequences for the valuation of the equity of this entity. Today we want to stretch this question further by combining these two topics in one single analysis: We want to find out what happens if “Control Questions” and “Related Parties” meet! But before going deeper into this: Don’t forget: Please see the disclaimer at the end of this blog post!

Today, for finding out more on the Related Party/Control topic we have a closer look at recent accounting manoeuvres of Grifols S.A., a world-leading Spanish blood-plasma-based solutions and products provider. In 2018, Grifols conducted two M&A transactions which the company describes in its 2018 annual report:

“On 1 August 2018, Grifols, through its subsidiary Grifols Shared Services North America, Inc. completed the acquisition of 100% of the shares in Biotest US Corporation for a price of US Dollars 286,454 thousand…”

and

“On 19 March 2018, Grifols has entered into an agreement with Aton GmbH for the purchase of 100% of the shares of the German based pharmaceutical company Haema AG, in exchange for a purchase price of Euros 220,191 thousand…”

Source for both: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, 3 (Business Combinations), p. 10 and 12.

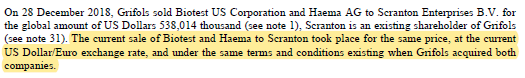

Grifols S.A., however, did not stop here. The company rather decided that there are some better places for the two subsidiaries. Again, in its 2018 annual report it is written:

“At the close of 2018, Grifols agreed to sell Haema AG and Biotest US Corporation to Scranton Enterprises, B.V. for USD 538 million to monetize earlier these investments and reinforce its financial structure. Grifols maintains operational control of the plasma centers and holds an exclusive and irrevocable call option for both companies.”

Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARY COMPANIES, Consolidated Directors’ Report, p. 6. Own comment: the transactions took place at 28 December 2018.

This latter statement certainly should raise eyebrows of readers (and a lot of questions, too). Bought and already sold within such a short time-frame? What exactly has Grifols done in 2018 and why? Let’s look deeper into this:

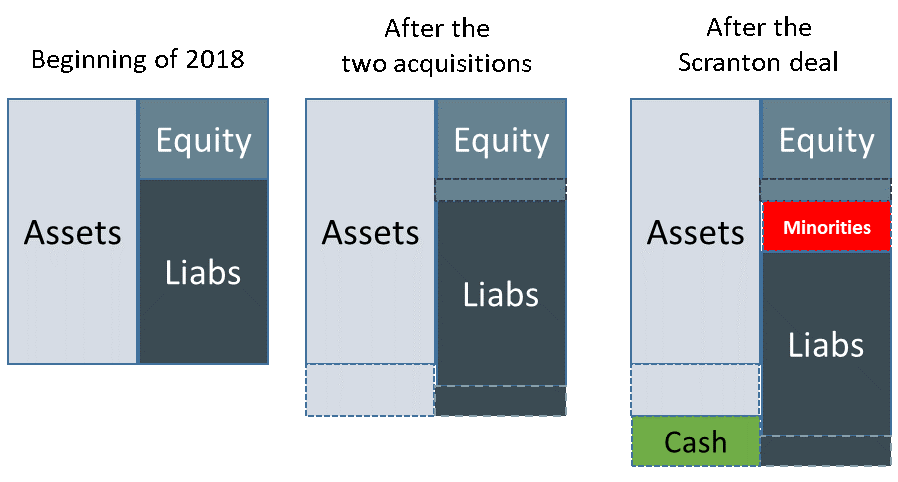

- Who is Scranton Enterprises B.V.?

Scranton is labelled “an existing shareholder of Grifols” at other places of the annual report (Source e.g.: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, p. 3.). In fact, Scranton holds ca. 8,7% in the equity of Grifols S.A. Scranton is owned and controlled by several directors of Grifols – amongst others also members of the Grifols family. Scranton is also the landlord of the Grifols Headquarter. The Grifols family, in turn, holds via different vehicles (and together with Scranton) roughly 36.4% in the equity of Grifols S.A. In short, Scranton is a super-related-party in this transaction.

- What does Grifols want to tell addressees with the comment “monetize earlier these investments”?

Not much, from an economic/value point of view this is not a very sophisticated transaction. Grifols gives more details on the deal:

Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, 3 (Business Combinations), p. 11.

According to the annual report, nothing really changed in value terms for the company over the year 2018 – bought and sold again at the same price (at least at first glance).

- What means “Grifols maintains operational control” (own emphasis of “operational”)?

Again, not much! Grifols runs the operations. So far this is just a service.

- What is meant by “reinforce its financial structure”?

We are going to look later at this point.

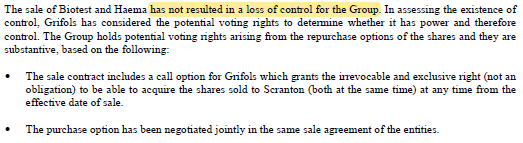

- What is the accounting impact of the comment that Grifols holds “…an exclusive and irrevocable call option for both companies”?

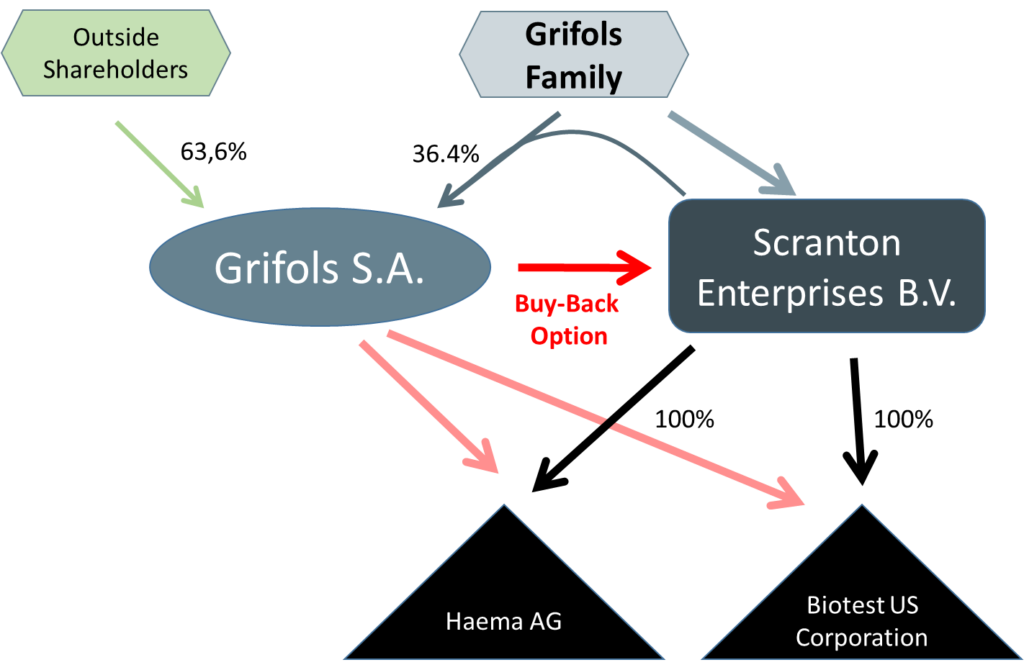

Now it is getting interesting! This goes far beyond only operational control. Grifols explains clearly what it thinks this means:

Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, 3 (Business Combinations), p. 11-12.

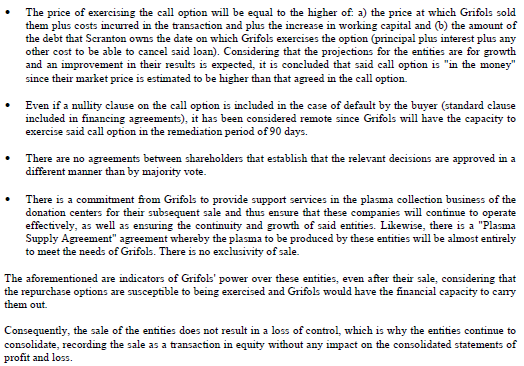

Obviously Grifols does not qualify these transactions as a real sale. The extensive rights to call the companies back to Grifols make it some sort of a “parking” transaction. Grifols understands that it is still the mother company Grifols S.A. which controls these entities (and hence it keeps them fully consolidated at the end of 2018 with a high non-controlling interests new counter-position, see also appendix). Below we have depicted the situation of Grifols at different points in time in 2018.

But is such proceeding really in line with IFRS? Answer: Probably yes (we give it this credit here), but not sure – and if yes: with some unlucky side effects!

IFRS 10 (Consolidated Financial Statements) explains in IFRS 10.B24 that the concept of control does not necessarily need a direct access but might also be assumed if one company does not hold a control position now (here obviously the case: the entities are sold to Scranton) but has exercisable substantive rights to change this situation in a reasonable short time-frame – usually shorter than a shareholder meeting can be convened. Some comments on this standard also demand the rights to be “in the money”, and hence giving the right exercise a certain level of positive probability. So let’s see how things are here:

- Grifols S.A. obviously has the stated right to call back these entities in a reasonable time frame (at least this is what we read from the annual report explanations). So no problem.

- Grifols states that because the projections for the entities are for growth, the right is “in the money”. They further explain this view on their finding by explaining that “their [the entities’] market price is estimated to be higher than that agreed in the call option.” (Sic!) This is an argument which we think Grifols should have covered by a fundamental valuation from third party appraisers as of the balance sheet date (but we do not know). Assuming that this valuation view is correct, the rights are in fact in the money and hence support the application of IFRS 10.B24 here.

So everything ok, isn’t it? Not yet. Financial analysis wouldn’t be complete if we do not take the whole picture into account – and now it goes down to the nature of the buyer: a related party! Two points are now worth a further analysis:

- The above comment “their [the entities’] market price is estimated to be higher than that agreed in the call option.” is quite an explosive one! The strike of the option is explained in the above statement as being the higher of the (slightly adjusted) transaction price (transaction took place 3 days before the balance sheet date) and some other value benchmark (not meaningful for our analysis here). With all the other Grifols’ comments which should make sure that the rights are “in the money” this unfortunately does tell us nothing else than: Grifols sold the entities to Scranton BELOW Grifols own estimate of market price! Check the comments above yourself! Here Grifols got caught at our opinion by the wish to explain the moneyness of the option but then didn’t see the implications. And these implications are: A sale to a related party at sub-market prices! Isn’t this tunnelling, i.e. expropriation of outside shareholders (see HERE to learn more about tunnelling)? Could be, but could also be that it is not – but then the moneyness comment is probably wrong. No easy way out for Grifols!

- Additionally, the answer to the question of whether Grifols S.A. (as a separate company) really has the stated right is not at all simple. In fact, the control, ownership and decision making relations for the whole construct of those parties which were involved in the 28 December 2018 deal are far away from independence. We have mapped them below:

Is it here really the case that Grifols S.A. as a separate unit can call back the entities at its own wish? It is obvious that there are conflicts of interest at the ownership level. The economic question is clearly rather: Can outside shareholders of Grifols S.A. really put through a decision in a short period of time to call back the entities (and this would be necessary if they need it)? They would require a general meeting if Grifols’ management doesn’t want to do so (important: Grifols S.A. Co-CEOs and the Chairman are from the Grifols family). Can outside shareholders really reach a Grifols general meeting decision faster than perhaps a general meeting decision is made at the level of the two sold entities? We have doubts here. And even if you think that this is possible: Can outside shareholders really mobilise a Grifols’ general meeting majority to act against the interests of the Grifols’ family members? Recent history of Grifols has never tested such a situation but at least we want to have some doubts here, too. Is Grifols S.A. really able to make an independent economic decision regarding the two entities? Puuuuhh….. tricky questions. But to address them is mandatory. It is the only way to understand whether the rights to call back the entities are in fact of value for Grifols S.A. or whether they simply do not have enough economic content to support ongoing control of the entities by Grifol S.A. This question is at the very core of determining whether the accounting treatment is correct (at least from an economic point of view). But of course, we also want to know whether the outside shareholders got tunnelled by this transaction.

We leave the hard answers open here. Think yourself! But as you can read, we do not want to hide that at our subjective opinion on the accounting treatment of Haema AG and Biotest US Corporation in the Grifols’ annual report is highly critical from an economic and corporate governance point of view – in many different dimensions. To be more clear: The impression of the Grifols annual report 2018 does not provide a proper economic picture of the company’s situation in our view. But we certainly do NOT want to state that it is an accounting misstatement. We are no auditors. It might well be that everything is in line with standards – but perhaps the standards do not always allow for a reasonable economic mapping.

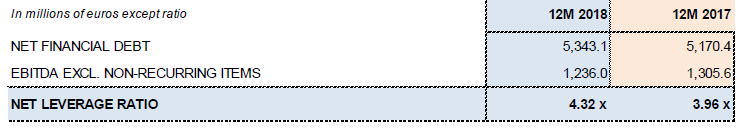

And: if you finally ask yourself why Grifols S.A. engages in such strange transactions anyway we have some explanations for you. We do not think that tunnelling is the goal. It is rather that Grifols S.A. wants to make its financing structure more conservative. The relatively heavily indebted company is facing some covenants from loan contracts which relate to the leverage ratio – debt/EBITDA – of the company (and which might potentially be calculated on a consolidated basis): “The issue of senior unsecured notes and senior secured debt is subject to compliance with a leverage ratio covenant. At 31 December 2018 the Group complies with this covenant.” Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, 20 (Financial Liabilities), p. 67.

The concrete leverage ratios look as follows:

Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARY COMPANIES, Consolidated Directors’ Report, p. 51.

The sale of the two entities to Scranton has helped Grifols to reach this 2018 leverage ratio as it did not touch the EBITDA but reduced the net financial debt (due to the cash-inflow from the sale). Without the Scranton transactions the 2018 net leverage ratio would have been at roughly 4.7x.

For 2019 there is again some pressure. Grifols’ management originally guided the market to reach a leverage ratio of 4.0x but during its capital market day in June 2019 Grifols had to admit that they will not manage to get to the desired level.

Source: Grifols CMD presentation, 5/6 June 2019, p. 383, own emphasis

This ongoing covenant-pressure might also explain another rather strange transaction that Grifols is planning to go for. Subject to certain approvals from authorities, Grifols will contribute 45% of the economic rights (and 40% voting rights) in its subsidiary Grifols Diagnostic Solutions (GDS) Group into a company called Shanghai RAAS. In exchange, Grifols will acquire 26.2% stake in Shanghai RAAS (voting and economic rights). Source: Grifols CMD presentation, 5/6 June 2019, p. 378.

The nice aspect of this deal for Grifols is a) that it is a cashless one (barter-transaction) and b) that Grifols will now additionally include 26.2% of Shanghai RAAS net profit at the Grifols EBITDA Level.

Source: Grifols CMD presentation, 5/6 June 2019, p. 380

Obviously, this transactions – if performed as planned – again improves the leverage ratio (net debt remains unchanged, EBITDA increases). However, so far we do not know how this inclusion of SRAAS performance at the EBITDA level should be possible (at least if we talk about GAAP-numbers). The focus on only net profit impact also rather sounds like at-equity accounting – but why then at the EBITDA-level? We know that Grifols will get some rights regarding appointment of directors, etc. but it is unclear for us currently to see what the accounting impact is. We simply have to wait here for some more clarity.

What is left from this whole analysis is again the perception that economics so very often tell us a totally different story than accounting does. But we will not solve this problem by more clear accounting standards. The real world is simply too complicated to get framed into some across-the-board accounting rules. It is always necessary to keep an open eye if you want to make sound investment decisions. Grifols – a company with an otherwise quite interesting business model – is certainly a case that requires investors’ full attentiveness when analysing its capital structure and when determining fair equity values.

Disclaimer: As always: We hold no economic interest in Grifols S.A. or any related instruments. And we base our findings in parts on subjective assessments, i.e. we might be wrong with our analysis. This whole comment is just our subjective opinion.

Appendix

In the 2018 annual report, Grifols kept Heama and Biotest fully consolidated despite having zero % ownership. The fact, that the two entities have been sold is mapped by a massively increasing non-controlling interest position.

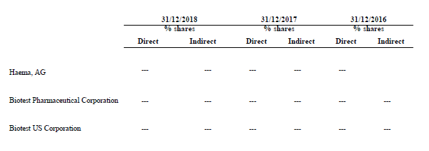

Disclosed holding Percentages in the respective companies at 31 Dezember 2018: zero

Source: Grifols AR 2018, APPENDIX I, GRIFOLS, S.A. AND SUBSIDIARIES, own depiction of an extract of the table.

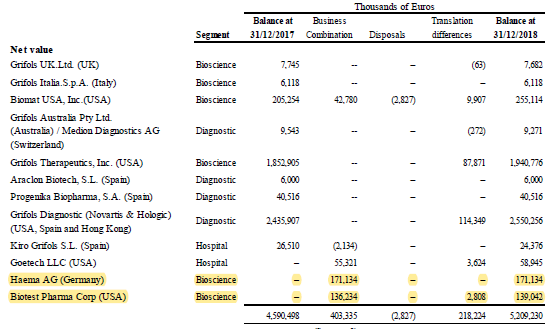

Goodwill:

Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, (7) Goodwill, p. 41.

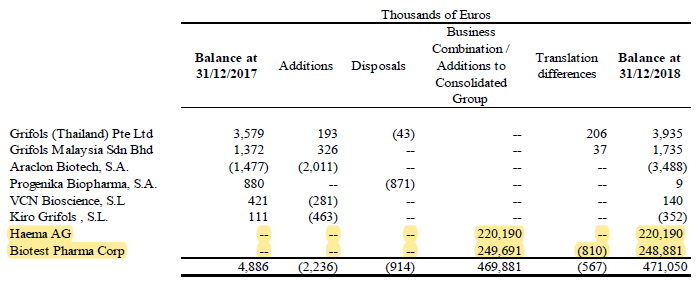

Non-Controlling Interests:

Source: Grifols AR 2018, GRIFOLS, S.A. AND SUBSIDIARIES, Notes to the Consolidated Annual Accounts, (17) Non-Controlling Interests, p. 59.