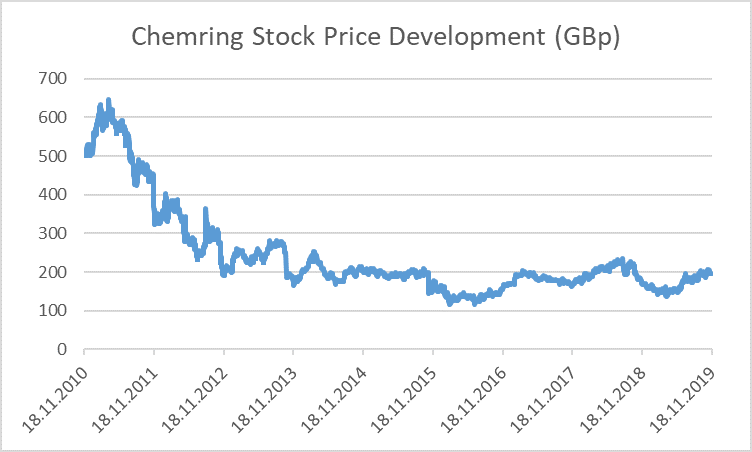

We know a couple of investors who once scratched their heads about the Chemring Group Plc. 2011 annual report (reporting date 31 October) and then decided to set a reminder alert for the next time when the general economic environment will show some signs of weakness. This should make sure that they do not miss out when companies start to go for some sort of Chemring’s “Weak-but-Strong” game again. Now, already with the publication of the 2017 and 2018 annual reports we could hear a soft chiming of this reminder alert. But – promised – we will see some louder ringing of the bells after the 2019 results are disclosed.

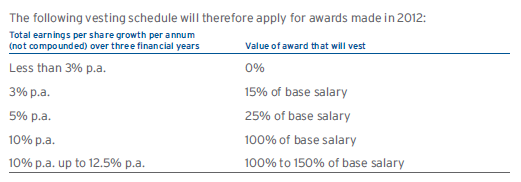

But one by one: what was the problem with the Chemring 2011 report? The UK-technology company that focuses on the aerospace and defence sector commented in its report about a worsening business environment. In particular the government spending cuts in Europe and the USA seemed to be a real challenge for the company as we could read in different parts of the report. Consequently, the company reacts by downward adjusting the targets for its management bonus plan.

Source: Chemring AR 2011, p. 43.

On the same page one could read: “The Committee is satisfied that, although lower than for previous awards, this target range is still highly challenging given the current prospects for the Group and for the sector.

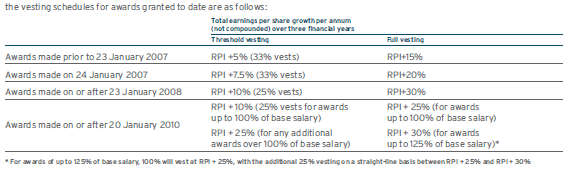

To understand what exactly “lower than for previous awards” means, a glance at Chemring’s former remuneration target is necessary. Here it is:

Source: Chemring AR 2010, p. 40.

If you look at the change, you can see quite a heavy reduction of hurdle growth rates! But ok, one could say: It is consequent. If it is so troubling to do business in this environment and these factors are rather out of the control radius of management: why not reducing the targets that way (although even this stand-alone decision led to some eyebrow raising amongst investors).

So, a fully consequent decision? Stop, there is at least one other bigger decision to be made in the annual report where the future economic conditions play a major role: The goodwill impairment testing! And here Chemring writes in its 2011 annual report:

“The calculation has used the Group’s forecast figures for the next five years. At the end of five years, it assumes the performance of the Group companies will grow at a nominal annual rate of 0.5% in perpetuity thereafter. The growth rates are based on management’s view of industry growth forecasts. Having considered the budget cuts in the US and UK, management are still forecasting growth similar to historic rates.”

Source: Chemring AR 2011, p. 72, (14) Goodwill.

So much about consequence! While Chemring considered its weak business environment clearly in its management remuneration targets (which makes life easier for management), not a lot of this could be seen in the impairment assumptions (which again makes life easier for management). This looks like cherry picking – a nice “Weak-but-Strong” presentation of the company.

Of course, there might be reasons for this proceeding. One argument was that the growth rates in impairment testing are still quite low as compared to the remuneration target rates. Another one was that in the mid- to long-run there will be a normalisation again. And a last one that the impairment test does not relate to the whole group but only to the part of the formerly acquired businesses which are not that much subject to the cuts.

Ok, we even have some understanding for this. But (a) a comparison of the absolute growth rates is not really appropriate as the targets have to be set naturally higher than the expected growth rates anyway to serve as an incentive – it is the the change (the ∆) that makes it a bit dirty, (b) the sheer amount of the remuneration target rates cuts together with the general tone in the annual report does not really suggest that everything is ok in the mid- to long-run (at least seen from that point in time), and (c) we would at least expect some overlap of whole group development and that of single cash-generating units in terms of business outlook.

So on balance, what was left is a not super-comfortable feeling with this proceeding, to say the least.

Obviously, the risk of such Weak-but-Strong presentation games is quite high at the turning points of business climate, i.e. if companies slide from a positive phase into a rather negative one. And this is what we can observe on a broader basis in our current business environment. It is not particularly about company-specific events (such as government spending cuts as in the case of Chemring) but rather about the economy as a whole.

We certainly know that we perhaps will not see such dramatic target rate changes again, nor will be able to get so much information about the reasons for the parameter settings as in the Chemring 2011 report. Companies should have learned in the meantime. But looking at e.g. the 2017 reporting of Merlin Entertainment Group we could already observe some first signs of the return of the “Weak-but-Strong” game. The UK-based theme park runner company reduced both its EPS and ROCE management remuneration target rates by on average ca. 30% for its long-term incentive plan – and kept the growth rate for impairment testing unchanged at 2.5%. For 2018 we even observed some more of such moves. But as we do not want to give any investment ideas or advice here (and because we are active in some engagement cases currently), you have to find out the latest changes yourself. But what we can say here already: By cursorily screening our universe for 2018, we can see a general tendency of remuneration targets getting easier and easier, i.e. less demanding – a typical preparation move on the eve of weakening economic conditions.

To summarize: What we think is important for investors in this context:

- This is a topic which is at the crossroads of accounting and corporate governance. And both sides are relevant! The read-across should be a holistic one. With all the big problems that we face with goodwill impairment testing and its low decision-value-relevance in the current capital market environment, investors should use information from the management remuneration scheme as an important indicator of economic consequences for the future impairment risk in particular and for the valuation of the market value of equity in general. Similarly, investors also have to take care that management stays properly incentivised and that companies do not take the first clouds out there at the horizon as a welcome occasion to ease the remuneration targets.

- We are still in a phase of a generally positive economic environment, although first bricks in the wall can be observed already in some industries. We expect that we will see a lot more of the “Weak-but-Strong” game in the near future. Hence, take care of excessive application of this technique in the next reporting seasons!

- Since June 2019, shareholders have much stronger influence on management remuneration schemes. Part of the implementation of the revised European Shareholder Rights Directive (“SRD II” – 2017/828/EU) is the so called “Say on Pay” rule where owners now can clearly cast their vote on the whole remuneration scheme structure. This is particularly relevant for smaller markets where this possibility did not exist before, but it is also of high importance for the rather bigger European markets where such influence was already in place before (Germany, UK, France and some others; governed by national law). The pressure on investment managers has increased by this legislation change anyway as their fiduciary duty is now much clearer defined when it comes to e.g. bonus programs of directors. This blog post should highlight an important consistency check of how the whole scheme is embedded in the general understanding of how to run the company and its accounting.

- We think that such “Weak-but-Strong” situations are a real acid test for the blossoming “engagement” activities of many asset managers in the non-anglo-american markets. While it is easy to remind the boards for some improvement possibilities, it is much more difficult to force the company into a holistically consistent behaviour which also includes the negatives (e.g. the potential necessity for impairments). Why? There is always the risk of losing out by putting the finger also on the parts of corporate behaviour which so far keep the positive capital market story alive. So, it is necessary to be quite sensitive here. While some long-only US investors go this way already quite smartly for some time (but not a lot, though) we want to await whether the rather younger engagement generation in continental Europe will find their way on how to do this properly.

And how did the Chemring story continue? The company later changed the structure of its management remuneration plan again, but rather purely from a structural point of view. Until today it never touched its long-term growth rate assumptions for the goodwill impairment tests. But due to detailed planning phase assumption changes it had to recognise some impairments over time. We couldn’t spot any conspicuous features in the remuneration vs. goodwill reporting again. But in recent years there was not such a dramatic environment change for Chemring, neither – at least as compared to the 2011 government budget cuts.