Equinox Gold Corp (EQX) is a Vancouver, Canada, -based mid-tier gold producing company with operations in the US, Mexico and Brazil. In its modern shape, EQX is the result of a major recapitalisation and a December 2017 merger with the three companies Trek Mining, Newcastle Gold and Anfield Gold. Furthermore, EQX performed major growth steps in 2018 (acquisition of the huge California-located Mesquite mine) and in March 2020 (acquisition of Leagold Mining Corp.).

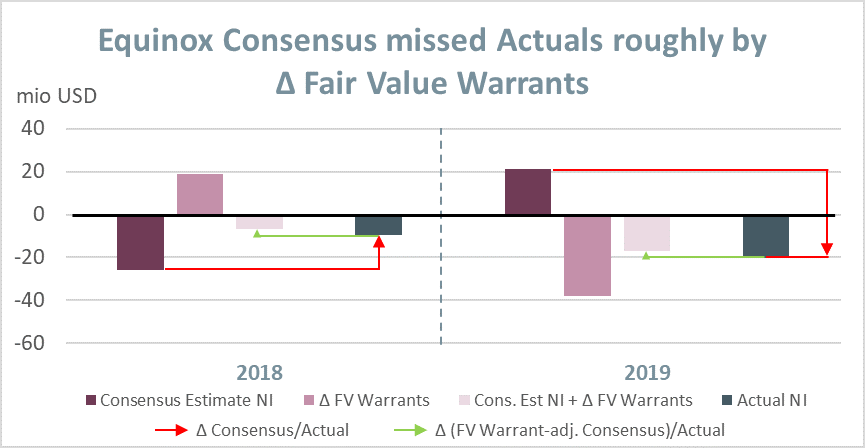

In its H1/2020 reporting the company surprised investors negatively on the earnings level. It was not the first such surprise, though. Already in FY 2019 earning came in much lower than expected. And in FY 2018 EQX surprised the capital market – now in the other direction – with a huge earnings outperformance. The main reason in all cases: the accounting treatment of share purchase warrants. So let’s go deeper into this issue.

EQX, which is reporting following IFRS, has share purchase warrants outstanding that – as of 30 June 2020 – are exercisable into roughly 19 mio shares of the company. Most of these warrants expire in October 2021 (a small part expires later). The exercise currency is the CAD. So far, this is all per se not at all abnormal. However, looking closer at the warrants two special characteristics show up.

First, while in most real-world cases such instruments relate to some form of compensation (mainly for employees’ work but sometimes also to third-party services), this is not the case for the EQX warrants. In fact, these warrants relate to former financing activities. They have been given away as part of a package in which investors got e.g. for each share of the company one warrant on top. It is worth mentioning here that this proceeding is not an uncommon feature of M&A transactions in the mining sector.

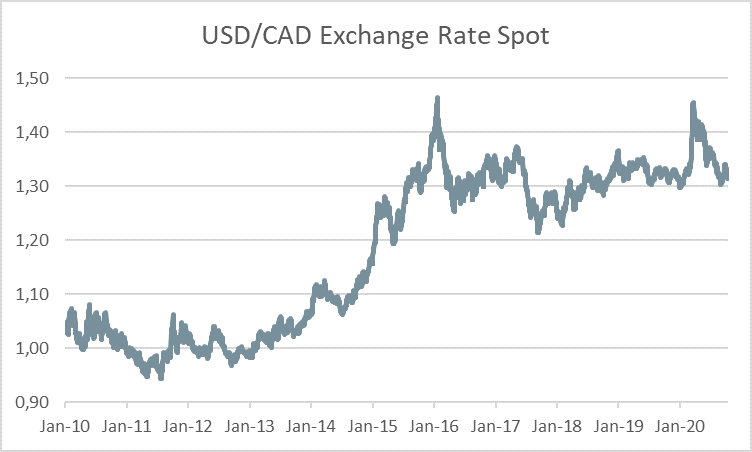

And second, the warrants are exercisable in CAD while the functional currency of EQX is USD (if you ask why the company has warrants outstanding that are exercisable in CAD while the functional currency is the USD: these warrants have not been issued by EQX but rather by its predecessor companies before the 2017 merger and are carried by EQX since the merger), i.e. there is some sort of a currency mismatch. Now these two characteristics perhaps do not look like important characteristics from an economic point of view but for accounting treatment they are highly relevant as we will see below.

But before we talk about these special characteristics a bit of general background is necessary. The basic idea of the accounting treatment of such share-based instruments follows a quite clear economic logic. If such compensation agreements are expected to be cash-settled then they are treated like a liability. This makes sense as a company has to pay a certain amount in the future without any changes in equity. In contrast, if such agreements are to be equity-settled – i.e. if shares are issued to the beneficiary in the future – then they are treated like equity. This also makes sense as there is a foreseeable increase in shareholders’ equity in the future. We know this treatment very well from typical such contracts like employee participation programs where these basic ideas are regulated under IFRS 2 Share-based compensation. As far as we understand, the EQX warrants can be equity-settled.

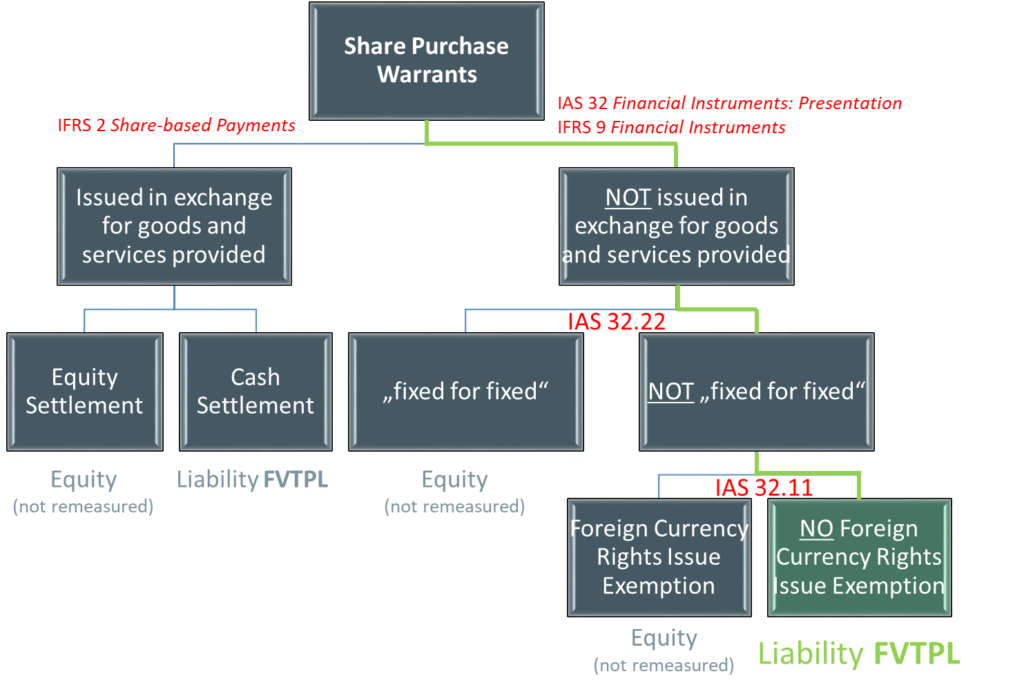

But now let’s discuss the two points mentioned above. The first special characteristic already takes accounting from one ballpark to another. The standard IFRS 2 only covers transactions that relate to goods and services provided to the issuing company. And as in the case of EQX no such goods or services stand against the issuance but rather a financing transaction the EQX-warrants cannot be covered by IFRS 2. Instead, IAS 32 Financial Instruments: Presentation and IFRS 9 Financial Instruments become striking.

And within IAS 32/IFRS 9 now the second special characteristic becomes relevant. The question of equity- or cash-settlement gets out of focus here. In contrast, according to IAS 32 the variability of the contract now stands at the core of deciding how to treat the warrants. IAS 32.22 states that such instruments are equity-like only if they are “a contract that will be settled by the entity (receiving or) delivering a fixed number of its own equity instruments in exchange for a fixed amount of cash or another financial asset is an equity instrument.” Hence, only if there is a clear and fixed relationship between the consideration given and the amount of share received (from the viewpoint of the beneficiary), then the contract is seen as an equity instrument. This requirement is widely labelled as the “fixed-for-fixed” condition. As a consequence, if this relationship does not hold then the contract has to be treated as a liability. There is however, one important exception to this rule, the so called ‘Foreign Currency Rights Issue’ exception according to IAS 32.11: “… rights, options or warrants to acquire a fixed number of the entity’s own equity instruments for a fixed amount of any currency are equity instruments if the entity offers the rights, options or warrants pro rata to all of its existing owners…” (at least for now, see the Appendix for more on this). If this foreign currency rights issue exception is given, then instruments that do not fulfil the fixed-for-fixed condition are still treated as equity.

Important to know that there is no grey zone: Such contracts are either equity or a liability. The following graph highlights the decision making process for share-based instruments according to IFRS (the green path already highlights the EQX path, more on this below).

From this graph it also becomes clear that not only the question of equity vs. debt on the balance sheet becomes an issue. It also makes a big difference in terms of subsequent measurement of the economic positions. If such contracts are equity they are valued fairly at the beginning and that’s it, no subsequent remeasurement takes place. If, however, they are treated as liabilities than they are constantly remeasured and value differences flow directly through the P&L (Fair Value through Profit and Loss, FVTPL).

For EQX, auditors decided that the fixed-for-fixed criterion is not fulfilled. As the exercisable currency (CAD) is different from the functional currency of the company (USD) there is a mismatch. And this is even the case against the background that CAD and USD are in a relatively stable relationship (though certainly not perfectly stable). The ‘foreign currency rights issue’ exception also does not apply as the warrants only relate to a fraction of the EQX shareholders base, not to all of them.

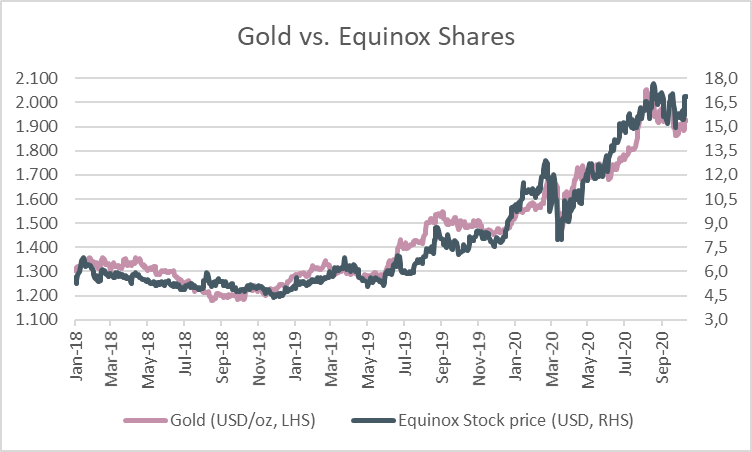

As a consequence, EQX had to report its share purchase warrants as a liability, and as a liability FVTPL. Looking at the stock price performance during 2019 it is not a big surprise that due to the increase of the share price the warrants have become relatively expensive, i.e. the liability has increased.

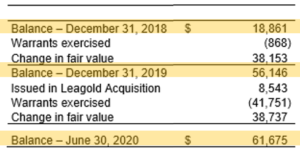

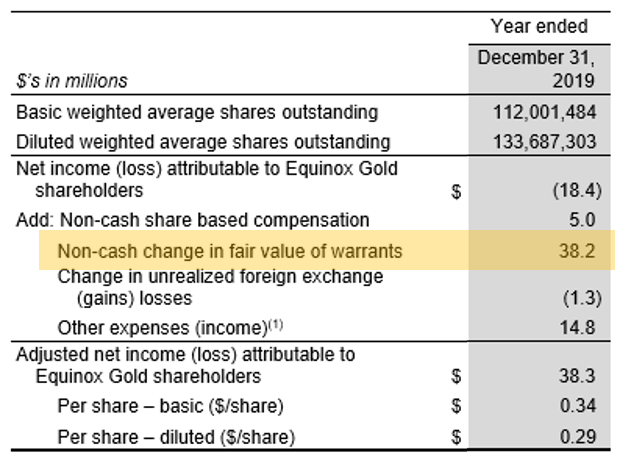

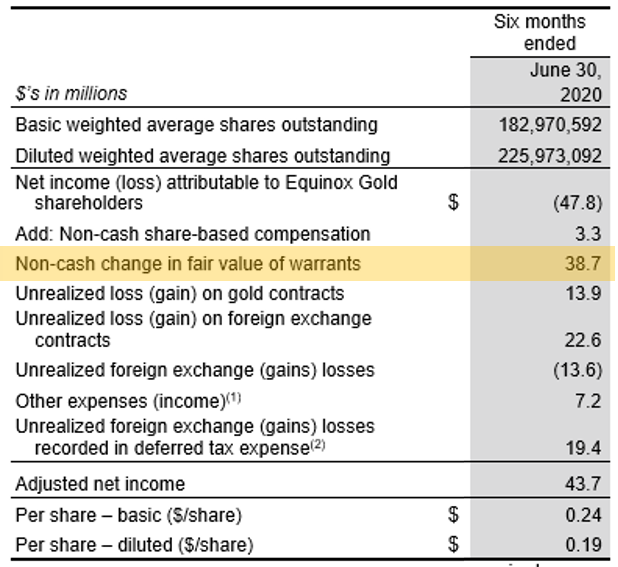

And as a result of this classification the increase in the warrants-liability has found itself as a relatively big negative contribution to the earnings of the company: -38,153 mio USD in FY 2019 and ‑38,737 mio USD in H1/2020 (recorded as part of ‘other income’). EQX, however, excludes these effects from its ‘underlying earnings’ definition as shown in its MD&A.

Source: Equinox, Consolidated Interim Financial Statements H1/2020, p. 15.

Source: Equinox, Management’s Discussion & Analysis 2019, p. 22.

Source: Equinox, Management’s Discussion & Analysis 2019, p. 37.

Now let’s hypothesize a bit (by looking at the decision tree presented above): If EQX had issued these warrants to employees or external service providers as some form of compensation (and not to investors as part of a transaction) then the warrants would be classified as equity, fairly valued at issuance and not remeasured thereafter. And if EQX had issued them to investors (as they did) but the exercise price would be set in USD, and not in CAD, then they would also be treated as equity, fairly valued at issuance and not remeasured thereafter (because then the fixed-for-fixed condition would have been met). This is also highlighted by CEO Christian Milau: “…if these were denominated in U.S. dollars under the IFRS rules, there would be no change.” (Source: Thomson Reuters Streetevents, Q4 2019 Equinox Gold Corp Earnings Call, 2 March 2020). You can see what a difference here the issuing motivation and the currency make: small economic changes would have led to a totally different balance sheet! This is a Black-or-White problem in perfection, and it is not really a satisfying situation for analysts and investors.

With all these technical discussions still the question remains what would be a sound presentation in economic terms? Some thoughts on this: First, what happened at EQX is that there are some claims on equity, which become relevant at some point in the future and that have been strongly increased in value recently because the stock price of EQX over time that has outpaced the stock price at time of issuance of the warrants. In the future, EQX will have to issue equity to cover these warrants and will – if stock prices stay at current levels – not get a fair price for this (but rather the lower strike price of the warrants).

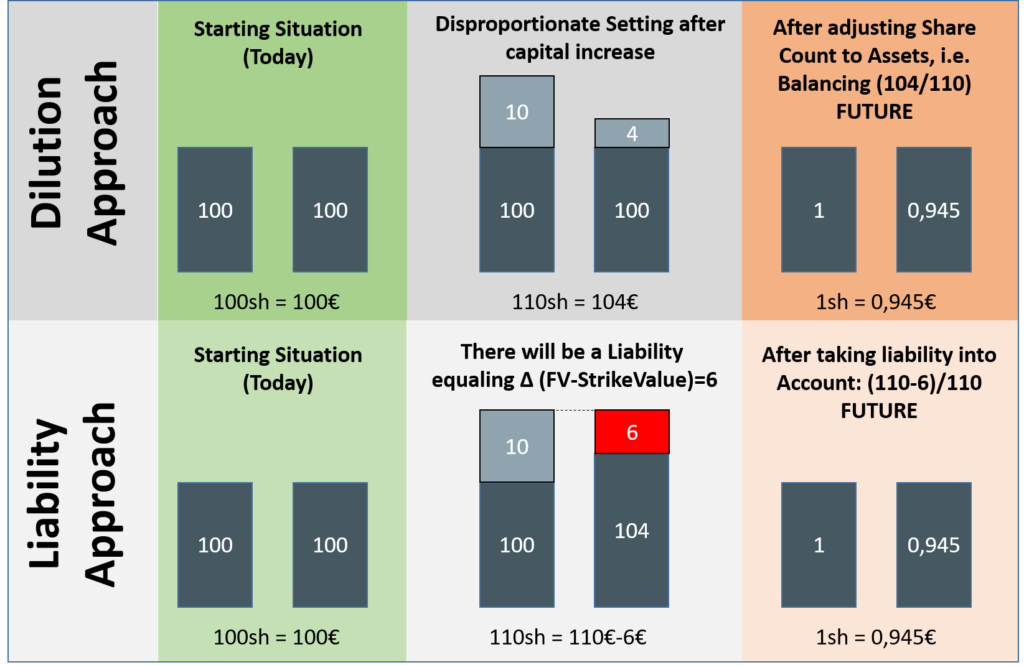

As a consequence, and at least from the perspective of existing shareholders, these warrants – similar to normal employee stock option programs – have both characteristics: Equity to the amount as they will strengthen equity in the future, and debt to the amount that the company has to close the gap between the fair stock price at time of exercise and the strike price. The latter aspect becomes clear when thinking of an existing shareholder who will get diluted later without getting the appropriate amount of money for this dilution at time of exercise. The following hypothetical example of a company without debt highlights this. Here, a company has warrants outstanding which are exercisable for one share each (each share has a pre-exercise value of 1€) and which have a strike price of 0.40€. We can now do the calculation of the effects after exercise a) via a pure dilution approach – in which after exercise 110 shares relate to 104€ (100€ pre exercise + 10*0,40 Euros cash), or b) via a liability approach where we assume the shares to not suffer from a dilution effect in a first step (i.e. 110 shares relate to 110€) but then deduct the difference as a liability. Both approaches yield the same results for existing shareholders.

Of course, this is a simplified example in which we look specifically at the exercise day (and shortly before and after). In reality, as is also the case for EQX we have to take the fact into account that exercise takes place some day in the future and hence we have to apply option pricing models to properly value the positions. But this does not change the overall effect of dilution and / or liability to existing shareholders.

But admittedly, in the case of EQX, existing shareholders can greatly tolerate this dilution effect as their own stock price increase over time (the trigger for the higher dilution effect) clearly overcompensates the dilution effect. We leave it here with this rather qualitative assessment and come back to a more technical and more quantitative assessment of equity-claim instruments in one of our next blog posts.

A couple of concluding comments are still necessary here:

- First, for instruments which have both equity and debt characteristics, it is really unsatisfying if IFRS only provides a Black-or-White decision. This does not mirror economic reality. Anyway, investors have to deal with it and adjusting this information for their decision making. It is worth noting that Black-or-White problems are a common theme of IFRS. For another such topic, see HERE.

- Second, we perfectly understand that EQX is stripping out the revaluation effects of the warrants-liability from its ‘underlying earnings’ definition. These effects are not really indicative for its ongoing performance. However, it should not be forgotten that these effects are real and will lead to – depending on your perspective – either dilution or payment duties (the difference between fair market value equity raising and the cheap, strike-price based equity raising in the future). Hence they are not meaningless. The quick comment of CEO Christian Milau “So it’s noncash” (Source: Thomson Reuters Streetevents, Q4 2019 Equinox Gold Corp Earnings Call, 2 March 2020) is not entirely correct. These effects are non-cash today, this is true, but they will become cash-relevant at expiration for every investor.

- Third, EQX’ share price development follows closely the gold price development. This is normal for a gold-mining company. In other words, clearly the main driver of the beginning 2019 to mid-2020 share price development was the gold price. Against this background, the explanation of CEO Christian Milau that “…as a result of having a very substantial increase of our share price since the announcement of the merger, we end up recording a loss for a fair value adjustment on these warrants in our P&L.” (Source: Thomson Reuters Streetevents, Q4 2019 Equinox Gold Corp Earnings Call, 2 March 2020, comment: he talks about the merger with Leagold Mining Corp.) is not really an adequate description of realities – in particular as the merger announcement took place at 16 December 2019 and the whole year gold price appreciation clearly overcompensated any effects (there was a +3-4% reaction of capital markets immediately after the announcement) from the merger news.

Disclaimer: We hold no economic stake in the company involved in this blog post – in whatsoever direction. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all!

Appendix

Currently, there is a project ongoing at IASB on ‘Financial Instruments with Characteristics of Equity (FICE)’. The idea is to make amendments to IAS 32 Financial Instruments: Presentation, mainly to address common accounting challenges that arise in practice when applying this standard. A discussion paper Financial Instruments with Characteristics of Equity has been issued in June 2018. For comments on this discussion paper as well as for an update and the current stage of the project, see HERE. In the context of this project also the ‘Foreign Currency Rights Issue’ exception has been scrutinized and has been called into question.

From our perspective, an elimination of the ‘Foreign Currency Rights Issue’ makes sense. It is a very special case that destroys the general logic of IAS 32. Although we understand from our experience that this exception relates to an in some jurisdictions and industries not uncommon case of paying dividends in shares and hence an equity transaction with owners, we could – with the example of EQX – define some more of exceptions like this. And exceptions always make accounting difficult. The particular Foreign Currency Rights Issue’ exception does not help us to make the general problem of equity-claim instruments more understandable.