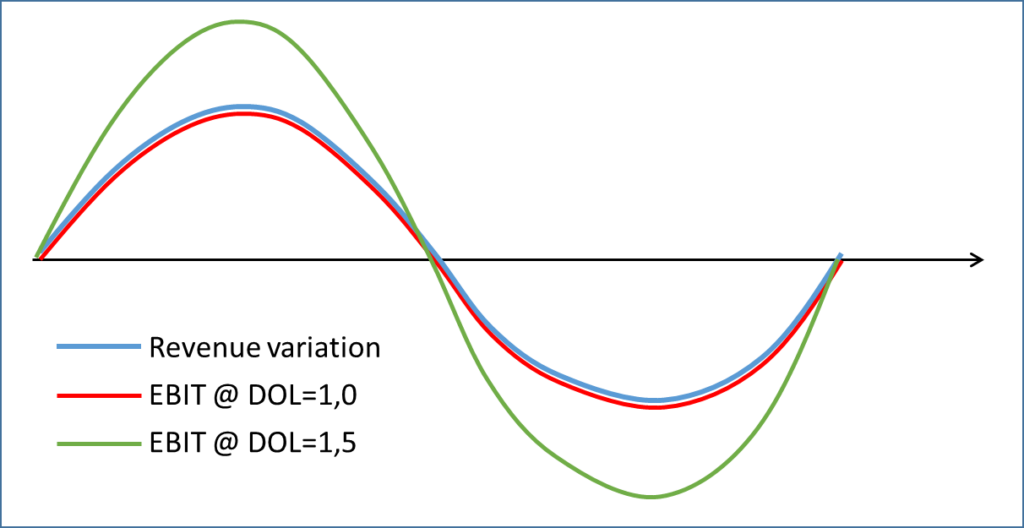

It is not a big secret that fixed costs are the real ugly thing for companies in crisis. While leading to rather good effects in times of growing revenues it turns to the bad once revenues decline: The higher the fixed cost exposure the stronger earnings react to a given decline in output. We usually measure this fixed cost exposure by the degree of operating leverage (DOL):

In this graph you can see how a company with no fixed costs (DOL=1,0) shows a similar percentage variation for revenues and EBIT but how a company with fixed costs (DOL>1,0) show a much stronger EBIT sensitivity – simply because fixed costs are here anyway, independently of any sales generation.

The degree of operating leverage (DOL) is technically determined as follows:

Typical fixed cost categories are salaries (at least to a certain degree), rent payments, other long-term contract duties, etc. Depreciation is often seen as a fixed cost but this only applies in normal times (then depreciation can serve as a rough proxy for maintenance capex) but in times of crisis there is often some possibility for companies to reduce periodical capex spending, at least temporarily. But still, some capex will need to be spent anyway in order to keep the business alive. The same applies to marketing expenses or research & development (the more R&D is done inhouse the more it has a hard fixed cost character).

You see, the determination of fixed cost exposure in practice is already quite challenging and for proper results a lot of analytical fine-tuning is necessary. Furthermore, fixed costs might be fixed in the short term but get more and more variable in the mid- to long-term as companies now have possibilities to gradually adjust to a new setting. This time-horizon dependency usually makes the analysis even more complex.

And if all that were not enough, there is another important point to consider: Some costs become fixed costs which you even haven’t spotted as those so far because in a normal setting they clearly had the character of variable costs. And this is the topic of today’s blog post.

One of these effects has already been discussed in a former blog post (HERE) and hence we only want to adress them quickly: Some companies have a minimum take or minimum purchase agreement in their supplier contract, meaning that they have to buy a certain amount of products no matter what their concrete demand is. The costs for supplier products are highly variable in normal times as they directly lead to finished products and hence directly flow into future revenues. But if there are no revenues and companies have to buy the supplier products anyway then these costs get fixed – in particular if it is about perishable products or other products with a short shelf-life. E.g. in many countries with lock-down mechanisms or distancing restrictions, restaurants and bars have seen such effects from their beverages and sometimes also food suppliers. But there are also other business models which suffer from such minimum take agreements currently.

The second interesting effect is particularly relevant for manufacturing companies (and here particularly for those which have a material manufactoring depth). And while from an economic point of view one would clearly understand that production also carries some fixed costs such as administration, rents, etc. investors usually cannot really spot the full extent of these fixed costs in the financial statements. The reason for this is that IFRS accounting requires to treat certain fixed manufacturing costs as part of the produced goods and hence allows them to become part of (capitalized) inventory – i.e. unfinished or finished products. Concretely, IAS 2.10 states that cost of inventory should include all:

- costs of purchase (including taxes, transport, and handling) net of trade discounts received

- costs of conversion (including variable and fixed manufacturing overheads) and

- other costs incurred in bringing the inventories to their present location and condition

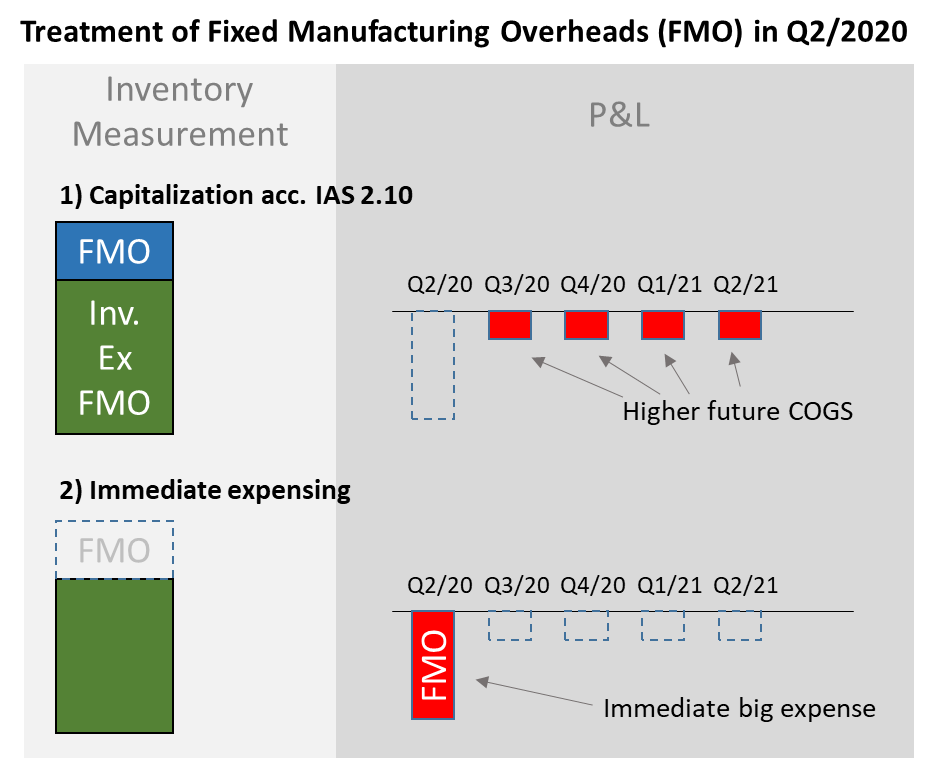

Of course, this makes perfectly sense in a normal business environment. Value is added to the input products to generate a finished product, and hence the inventory valuation covers all related costs. In technical terms these fixed manufacturing costs are capitalized and later (at times of sale of the product) find their way through the P&L as costs of goods sold (COGS). So, you never see these fixed costs as a separate cost category.

However, in times of crisis things are no longer that straightforward. Like for all fixed costs, the per-unit weighting of these fixed manufactoring overheads increases when output decreases. And now the question is for many companies during this coronavirus crisis – in particular with a view on upcoming Q2/2020 reporting – whether it is still appropriate to push-through these costs to the inventory capitalization. If they do, this might lead to a strong increase in inventory costs (on a per-unit basis), leading to potential depreciations sooner or later (due to the lower-of-cost-or-market principle) or at least to depressed margins in the future. If they don’t, then they have to expense them anyway – immediately and directly through the P&L. In any case, these fixed costs will show up in the P&L as an inforcement of the DOL – either now or in the future we will see a reduction of earnings.

As seen from a behavioural accounting point of view, we expect most companies to expense these costs immediately in Q2/2020. This allows to blame it all to Coronavirus crisis and keep a more competitive inventory balance once the economic situation normalises. And this is even not a bad behaviour. It makes sense from a pure economic point of view. For companies in a real material crisis, however, we do not want to rule out that they will continue to capitalize fixed manufacturing overheads because this would allow them to keep the P&L performance relatively better in the short-term (and hence camouflaging a bit the real economic problems at least for now).

Below we have listed some indications for finding companies which might potentially be affected from this phenomenon during the upcoming Q2/2020 reporting.

- Watch-out for industrial companies that have a high degree of vertical integration and/or manufactoring depth.

- With regard to the financials of companies, watch-out for manufactoring companies that have a relatively high porportion of production salary costs and a relatively low proportion of cost of material.

- Finally, watch-out for companies which have a relatively high operating leverage anyway.

Industrial companies that fullfill the above listed requirements usually put a lot of production efforts into the development of finished goods, and hence have presumably also a higher portion of fixed manufacturing overheads to be included into their inventory cost measurement. These are the companies which now have to deal with this effect.

Summary: Fixed costs matter! But sometimes it is really difficult to spot them based on corporate reporting. In particular for manufacturing companies with a deep vertical integration we expect to see effects in Q2/2020 from the above discussed inventory-hidden fixed costs. These effects could be a) immediate expensing of these fixed costs. This, however, should lead to gross margins in future quarters/years staying in the normal territory (as immediate expenses will keep inventory valuation at normal cost levels). Or these effects could be b) potentially depressed margins in the future (or even write-downs of inventory) if these fixed costs are not immediately expensed. Two extensions/limitations to this: (1) If coronavirus crisis takes longer such one-time effects might also pop-up in the coming quarters. (2) some of these fixed cost effects (though certainly not all) might be alleviated by state support measures such as short time work regulations.