It is not a big secret that coronavirus has hit the airline industry massively. Flight traffic down to super-lows and even for those planes that fly load factors are at levels never seen in the past decades. Today we want to have a look at a special effect of coronavirus on the airline industry (and on the accounting of Ryanair): The „now-show“ effect!

„No shows“ is the general term for passengers that are not taking a booked flight but rather let the fare ticket expire without using it. In normal times no-show rates stand on average at about 1-1,5%, so not really a meaningful revenue driver (but an important factor for overbooking strategies of airlines, but this not the topic of today….)

Coronavirus, however, served as a catalyst for gigantic no-show rates in the airline industry. No-show rates rose to a record high of about 70% in March 2020 – here bookings took place before passengers were aware of the full severity of coronavirus – and still stand at about 15-20% today (i.e. at times where passengers know about the severity and impact of coronavirus). So now we are in the territory of materiality…

While we do understand that there are some challenges to correctly map no-show cases in management reporting systems in general (e.g. often questions about intentional no-showing in order to benefit from a cheap combination-ticket arise), most airlines have no problems of properly dealing with this in a very timely manner. Most, but not all airlines… let’s have a look at how Ryanair handles this topic.

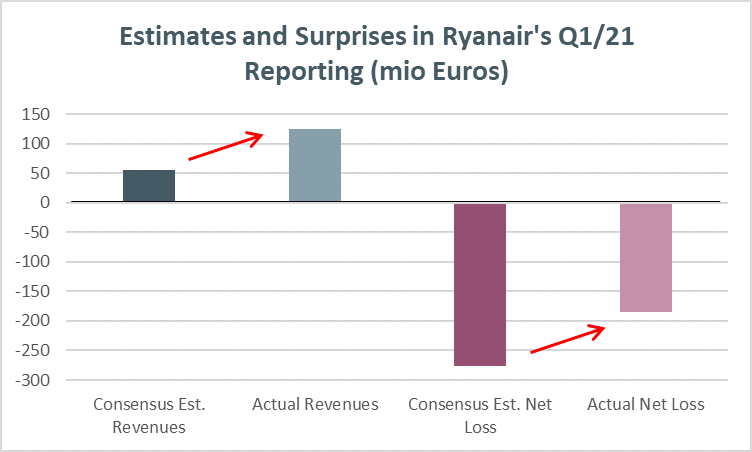

For the first quarter of Ryanair’s FY 2021 (Q1/2021), which ended in June 2020 (Ryanair has a FYE in March), analysts expected horrible numbers. In fact, in this quarter Ryanair’s general airline traffic was down ca. 99% year-on-year, and even if Ryanair engaged in some rescue and repatriation flights for different country governments during these months, consensus revenue estimates from analysts stood at only 56 mio Euros just before the quarterly earnings announcement date (as compared to an actual revenue of 2.312 bn Euros in Q1/2020). But when the actual numbers were reported at 27 July 2020, analysts and investors were quite surprised: revenues came in at 125 mio Euros – more than double the expected amount – and on a net basis Ryanair also outperformed analysts estimates clearly with an actual quarterly loss of 185 mio Euros as compared to 270 mio Euros expected.

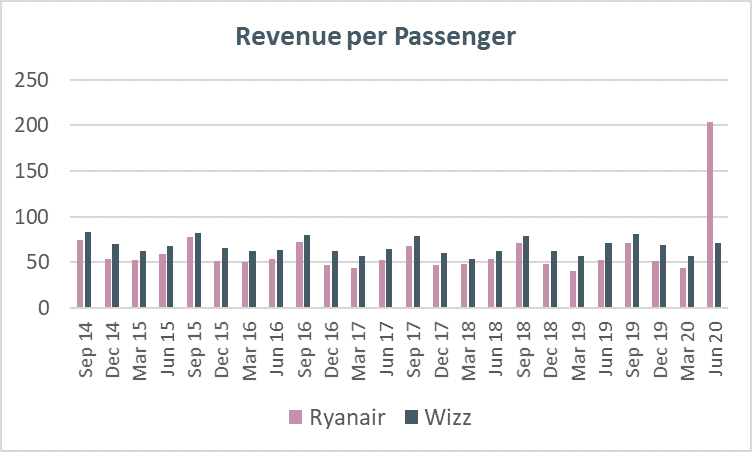

Moreover, the unit economics also surprised positively: Revenues per passenger skyrocketed in this quarter – out of the normal 50-80 Euro range up to more than 200 Euros. This was also totally different from number of competitors.

But the state of investors‘ happiness did not last very long. Quickly it became clear what the reason for this outperformance was. Part of this quarter’s revenues were some revenues which do not relate to this quarter but rather relate to a different quarter from an economic point of view, more precisely to Q4/2020 (the quarter ending in March 2020). Actually, basically all of coronavirus-motivated no-show revenues from the March-quarter only showed up in recognised revenues of the June-quarter. But why is this the case? Let’s dig a bit deeper into Ryanair’s reporting..

In its annual reports, Ryanair states: „Unused tickets are recognized as revenue on a systematic basis, such that twelve months of time expired revenues are recognized in revenue in each fiscal year.“ (Source: Ryanair AR 2020, p. 192/193). More concretely, on a systematic basis‘ effectively means in the case of Ryanair that there is a time lag of about 8 weeks between the scheduled flight (to which the passenger did not show up) and the recognition of revenue in the corporate accounts. To understand more about the background of this proceeding we have to go back a couple of years…

In 2012 Ryanair announced a change in accounting estimate „arising from enhancements to our Revenue Accounting Systems“ (Source: Ryanair AR 2012, p. 2). More concretely, the company stated: „Exceptional items in the year ended March 31, 2012 relates to a one-off release of ticket sales revenue of €57.8 million, net of tax, due to a change in accounting estimates relating to the timing of revenue recognition for unused passenger tickets which were made as a result of the availability of more accurate and timely data obtained through system enhancements.“ (Source: Ryanair AR 2012, p. 10). More details on this move were provided in the related analyst briefing, 21 May 2012. Here, former Ryanair CFO Howard Millar commented that this effect is „a catch-up of a number of years“ and „…some of it goes back four or five years.“ (Source: Thomson Reuters Streetevents, Edited Brief, Full Year 2012 Ryanair Holdings Earnings Analyst Briefing).

So, obviously until 2012 Ryanair had big problems to book no-show revenues at all. The clean-up in its AR 2012 comprised effects from the 4 to 5 years before. This was at a time where other airlines were far advanced and had no problems of booking these revenues in a timely way. The improvement in Ryanair’s „Revenue Accounting Systems“ in 2012 was certainly a big step for the company but it still was not enough to bring the systems up to competitive levels. They could not bring it down to less than 8 weeks. And this state is valid until today…

Anyway, the time-lag-accounting of no-show revenues at Ryanair resulted in the effect that all no-shows from February and March 2020 found their book entry only in the June 2020 quarter of Ryanair’s reporting (and not in the March quarter), As we already mentioned, no-show revenues of airlines are not really material in normal times. Additionally, they rather follow a more or less time stable path under normal circumstances. And hence, in the past results have not been meaningfully distorted by this accounting effect. But in the June 2020 quarter, were February/March no-show-rates were ultra-high and normal revenues were ultra-low it made a lot of a difference.

While this is all probably only a one-time effect, there is still a lot of read-across for investors here: The first question is how this whole proceeding is in-line with IFRS 15 Revenue Recognition. Usually, accounting system weakness is not an excuse for non-timely recognition of revenues… And the second question is: What can we read from such a system weakness for the whole control system and corporate governance of Ryanair?

Disclaimer: We hold no economic stake in the company involved in this blog post – in whatsoever direction. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all!