In 2019, the IASB issued an Exposure Draft: General Presentation and Disclosures in which the board laid out its proposals for a reorganisation particularly of the profit & loss statement (P&L), but also of the cash flow statement. The main idea is to present financial performance in a more economic way, i.e. splitting down the P&L into operating, investing and financial sections – similar to the cash flow statement. While we do not want to go down into every detail here, we rather shed light on one of the main disclosure ideas: the newly introduced, separate line for the “Operating profit or loss from income and expenses from integral joint ventures and associates”.

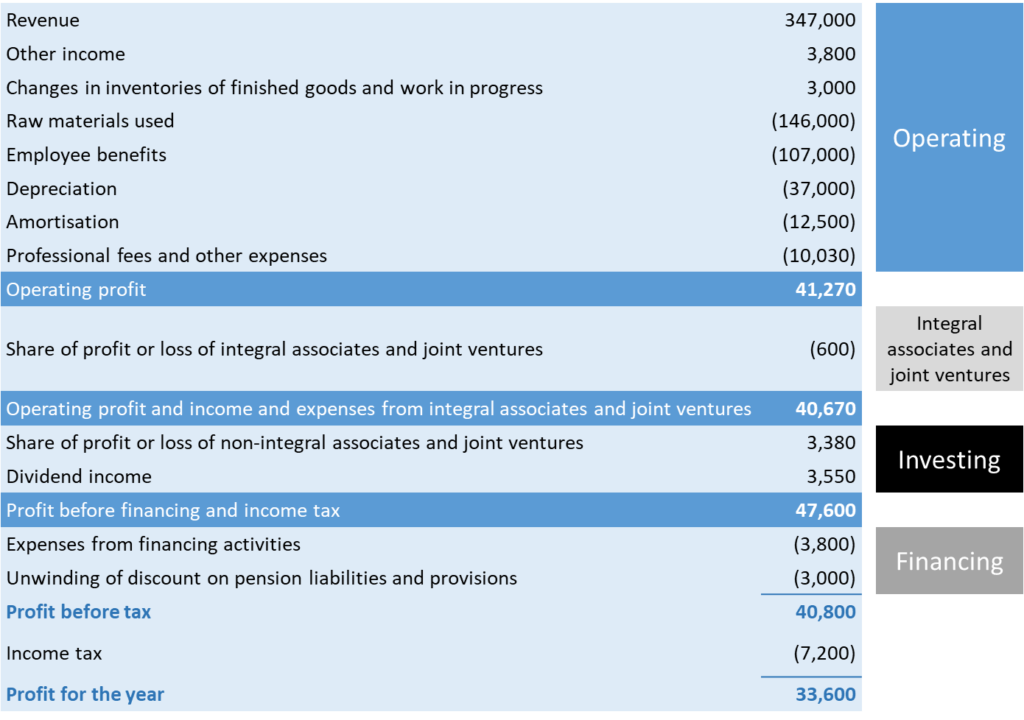

In short, the new presentation of the P&L mainly should look as follows:

Source for presentation and numbers: IASB 2020, comment: this is just a simplified version of the new P&L with a focus on the main changes, i.e. other disclosure requirements according to e.g. IFRS 5: Discontinued Operations still remain as they are and will not get lost in the new structure.

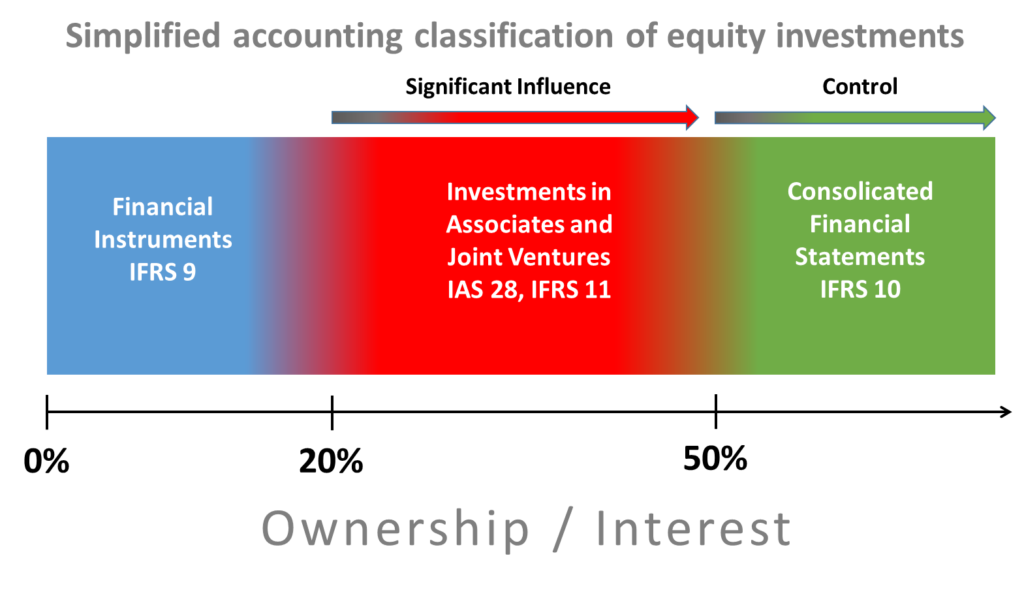

The idea of separately disclosing the contribution of “integral associates” clearly follows an economic perspective. It has always been investors’ perspective to understand the real core operating business of the company and to value this business accordingly. And associates (or at-equity investments) resp. joint ventures (JVs) have always been a big issue of analysis. Associates are – in simplified terms – investments on which the company can excert a ‘significant influence’ (assumed to be for a shareholding of between 20% and 50%) – more than just a pure financial investment (share < 20%) but not enough to control the investment (> 50% as a default assumption). And joint ventures are investments where parties have a joint control of the investment. Clearly, some of these investments – associates as well as JVs – are just running along the normal operating business of the company, but some of them might be an integral part of the core operations. To bring these integral – but not fully consolidated – investments closer to the core business is the background of the IASB proposal of separate disclosure of the contribution of these investments and the new “Operating profit or loss from income and expenses from integral joint ventures and associates” line.

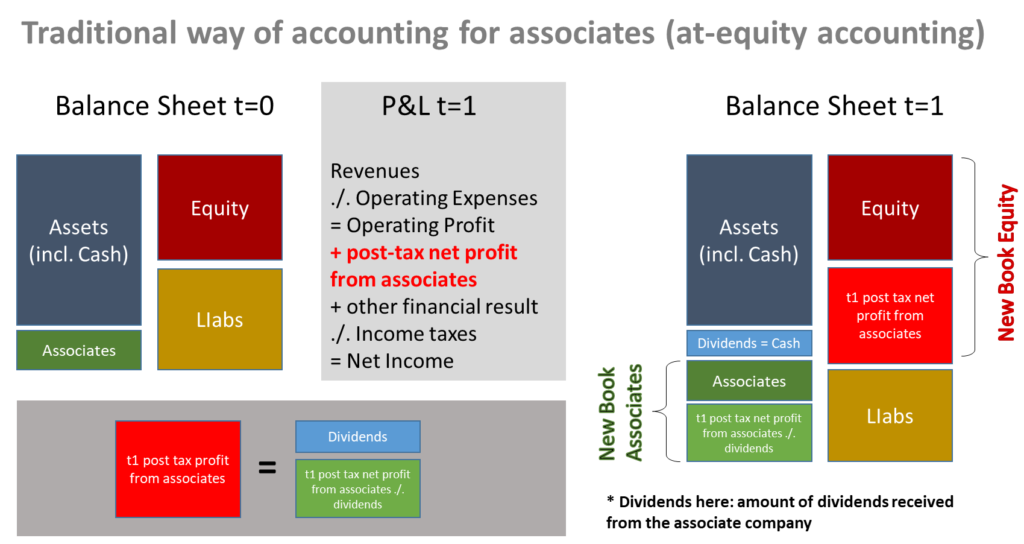

However, economics is one thing, technicalities of accounting are another thing. If integral associates should be brought closer to the performance of the consolidated business one should not forget that the accounting performance measurement of associates is totally different from the accounting performance measurement of the consolidated business. The first ones are reported on a net-basis, i.e. AFTER financing expenses and AFTER taxes (asscociates are also said to be accounted “at-equity”; this is where the term comes from), the latter ones are reported before all those expenses in the operating profit line. Or putting it differently: Associates performances: Net Income basis; Consolidated Performance in Operating Profit: Operating profit basis.

As a result, the new line “Operating profit or loss and income and expenses from integral associates and joint ventures” basically mixes two different dimensions. For the consolidated business no interests and taxes are deducted but for the integral associates there is. This blendig has a lot of negative consequences:

- It is not possible to calculate proper margins in the sense of profit divided by revenues. In the revenue line of the company we will not find the revenue contribution of the associates and hence a dirtily calculated margin must remain a distorted one (and in most cases an inflated one)

- Even more problematic: The “Operating profit or loss and income and expenses from integral associates and joint ventures” cannot be used for a proper valuation using multiples. When we mix numbers on an EBIT-basis (calls for an EV-multiple) and numbers on a Net Income-basis (calls for a Equity Value-multiple) we struggle to find a proper value-dimension for the mixed performance number.

In particular the second point requires some deeper analysis. For this, we just apply a simplified valuation using multiples.

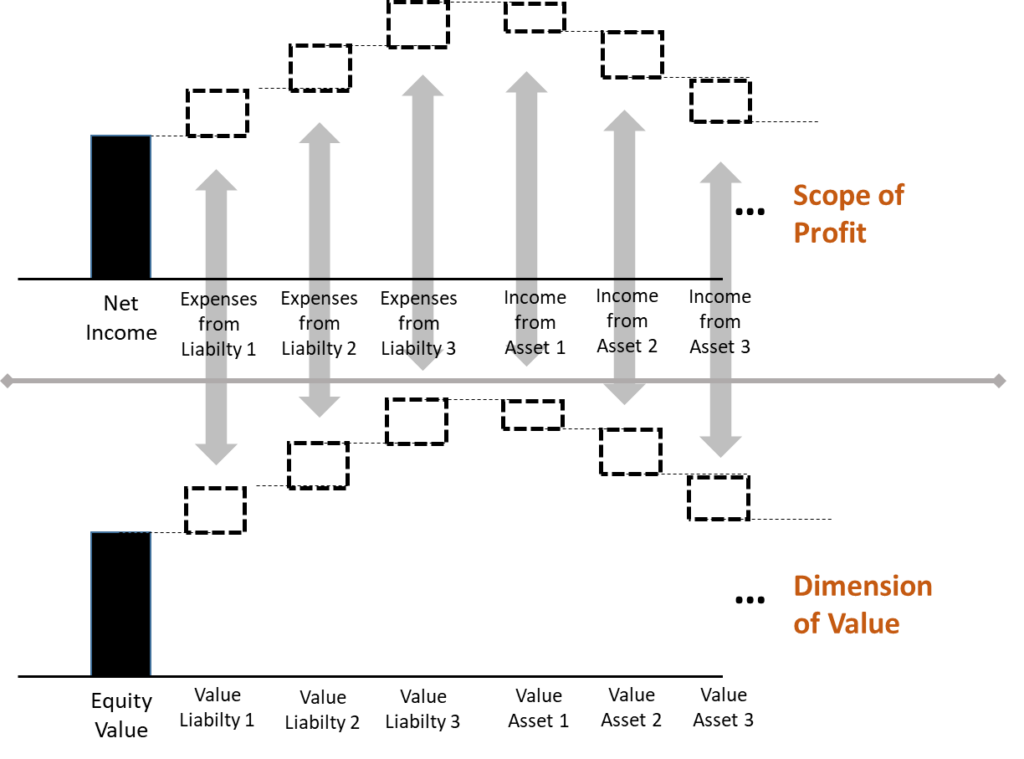

The proper way of such a valuation approach is to ensure that the two numbers – the denominator (performance measure) and the numerator (value dimension) – relate to the same scope of business. I.e. when income or expenses of an asset/liability are included in the performance measure then the value of this asset/liability also has to be included in the value dimension. If not, then not.

Comment: Profit and Value have different scale, the same in the graphs below.

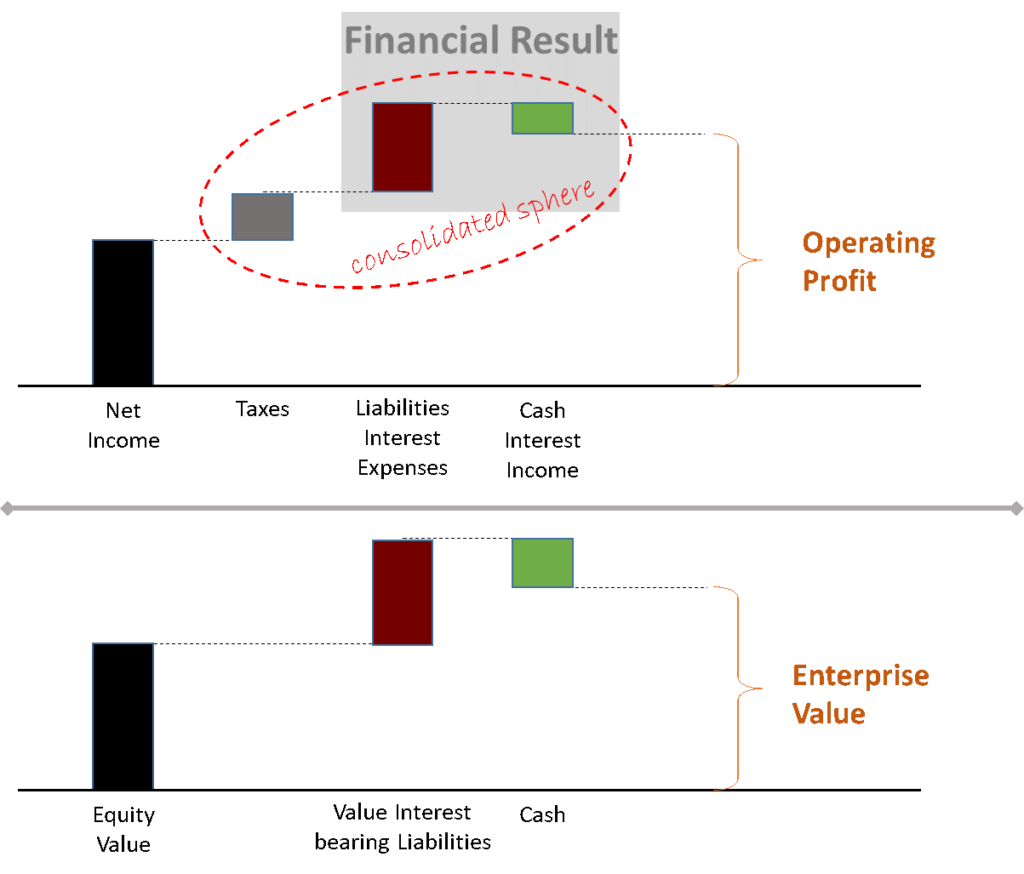

Applying this to a typical “Enterprise Value / Operating Profit” (dirtily speaking: EV/EBIT) multiple of a company without any other financial instruments, associates or joint ventures (and no minorities) we can see that the operating profit (which is stated before interest expenses from liabilities and interest income from cash) has to relate to the enterprise value defined as equity value plus value of interest bearing liabilities minus value of cash. Taxes are not a differentiator here, the full amount is simply added back because operating profit is stated before taxes in our accounts (one could also use NOPLAT in the denominator but this would require additional adjustments and is not a typical proceeding in practice).

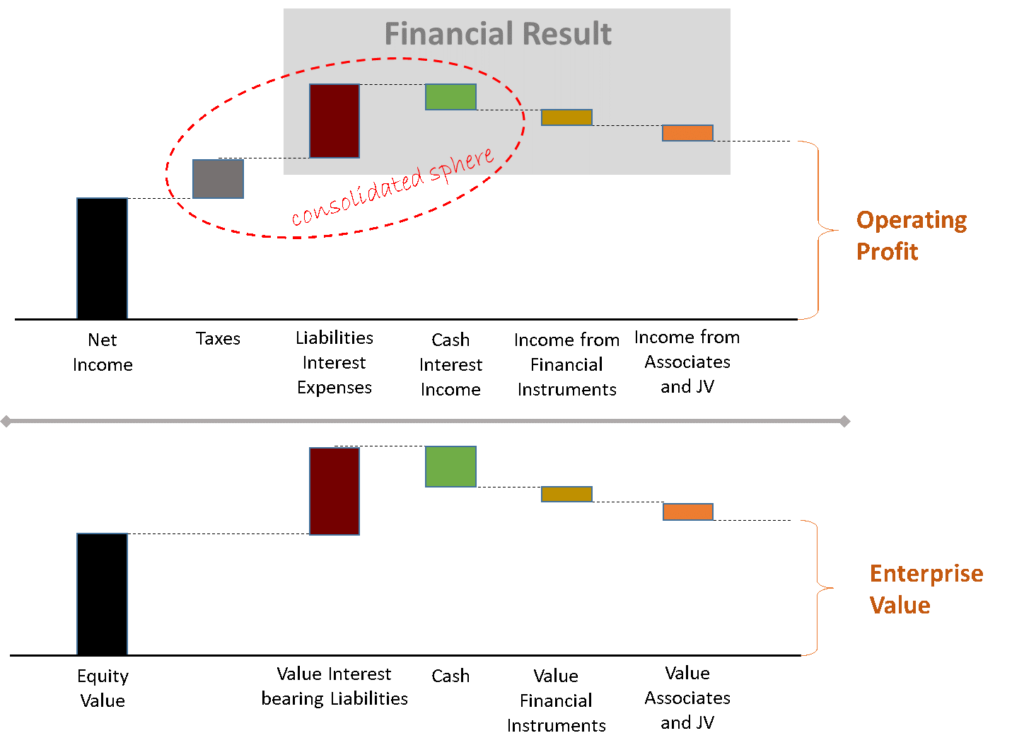

What is important here is that so far every adjustment takes place within the consolidated sphere of the company. This however changes if we calculate a proper EV / Operating Profit multiple for a company with equity participations treated as financial instruments plus some associates / joint ventures.

Now we have left the consolidates sphere. However, we can still properly apply our multiples approach by deducting the respective (equity) values of equity financial intstruments and associates / JVs (this is admittedly also not a very simple task in many cases as book values have to be translated into market values but let’s abstract from this problem here).

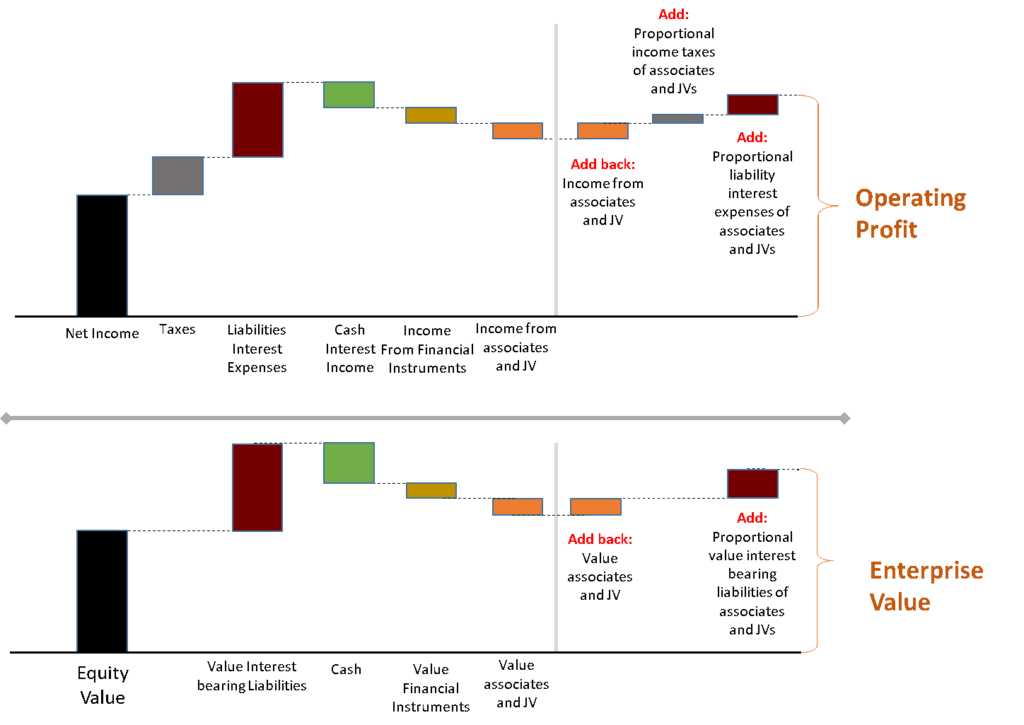

However, if we want to re-include the value of integral associates and JVs in our operating profit measure – and let’s say for reasons of simplicity that all associates and JVs are seen as ‘integral’ in our example – it gets tricky. We now have to bring back the performance measure (value dimension) of these investments on an operating profit (enterprise value) level. This approach is necessary as only then we can ensure consistency a) within the operating profit lline and b) between operating profit and enterprise value.

The big problem here is that we usually do not have the information of tax and interest expenses as well as debt positions of associates and JVs readily at hand.

Can you already see where we are going here? If a proper multiples valuation should be possible based on the new performance line, the best way would be if the IASB goes back to the good old “proportionate consolidation”, something that was possible for JV-accounting until 2014 but has been eliminated as a policy choice by the IASB in the course of the issuance of IFRS 11 ‘Joint Arrangements’. In short, proportionate consolidation is simply a way of consolidation which takes the proportionate (i.e. ownership-related) share of all positions from the P&L, balance sheet and cash flow statement of the investment into the group accounts of the mother company. And this would be exactly the information that we need in order to allow for a proper multiples valuation using the new “Operating profit or loss and income and expenses from integral associates and joint ventures”-line as a starting point of performance measurement. However, we think that it is highly unlikely that the IASB reopens the topic of proportionate consolidation again. Hence, this will not be the solution to our valuation dilema.

Another possibility would be to force companies to disclose the relevant information in the notes. Already now, companies have to disclose some of this information for ‘material’ associates positions. But for our valuation approach more would be needed: all relevant information of all ‘integral’ associates even if they are not material per se. As compared to the proportionate consolidation we would still have the problem that inter-company transactions are not properly considered in the numbers but at least we would be able to roughly recalculate the proper valuation inputs – on a homemade basis. We think that this is the minimum requirement that should be fulfilled to make the “Operating profit or loss and income and expenses from integral associates and joint ventures” line applicable for investment decision making.

But then still the question remains: If we need a lot of homework first to bring the new performance line to a meaningful basis for valuations, isn’t there a big risk that investors do not want to go the long way but try to make some short cuts?

We experimented a lot with possible shortcuts for this valuation approach but we couldn’t find a proper one or at least one which brings us roughly into the right ballpark. Sometimes we were closer to the correct results – but this was purely by luck – but mostly we were quite far away from the proper numbers. Using the “Operating profit or loss and income and expenses from integral associates and joint ventures” as a basis of reference and NOT deducting the value of integral associates and joint ventures from the Enterprise value (or: only adding back the value of integral associates and joint ventures – but not the value of proportionate liabilities – in the sense of our example above) is perhaps the best one but it still is highly problematic.

Below we provide a real world examples to highlight these problems: In 2018, Finish utility company Fortum Oyi acquired 49.99 percent of German utility company Uniper SE and was not allowed to go higher because of restrictions of the Russian regulator as Uniper runs some operations in Russia. Hence, Fortum accounted for the Uniper stake in its 2018 and 2019 as an associate (at-equity).

It is worth noting that in the meantime the Russian regulator has lifted its takeover ban and in spring 2020 Fortum has secured the majority and will fully consolidate the Uniper activities in its 2020 annual report. Hence, this is just a didactical example with no future meaning. We simply think back into the situation of the annual report 2019 here. In order not to mix up any analyst estimates with and without the consolidation effects we apply trailing multiples (i.e. multiples based on the reported 2019 numbers) here for reasons of simplicity. The didactical nature of the example is also emphasized by the fact that multiples (at least alone) are not very meaningful tool to value utilities.

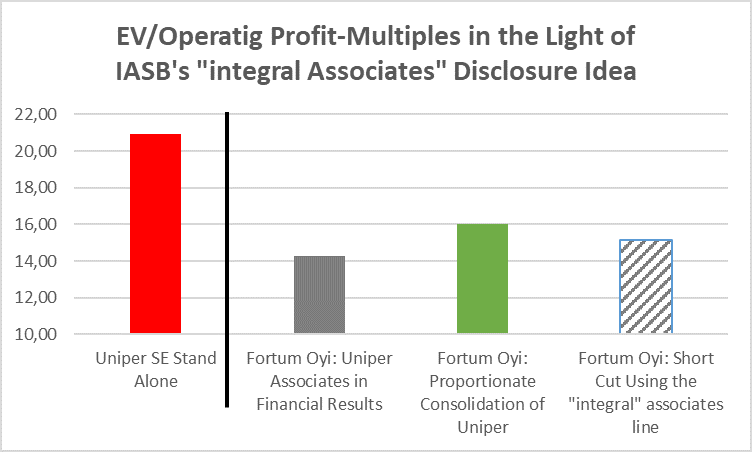

In 2019, Fortum accounted for the Uniper stake below the Operating Profit line. If we calculate the EV / Operating Profit-multiples for both companies we get values of 20.91x for Uniper and 14.28x for Fortum. Here the Operating Profit is a clean (i.e. as reported) number and the Enterprise Value is calculated as:

![]()

If we now assume that Uniper is an integral associate to Fortum, the proper way for the Fortum EV / Operating-Profit-including-integral-associates-mutliple would be to treat Uniper as a proportionately consolidated investment, i.e. to include its share of EBIT into the Fortum EBIT, to exclude the deduction of (or add back) the fair value of associates from the EV calculation and to add the proportionate share of net debt (including all components above) to the EV. If we go this way (and assuming that there are no major intercompany transactions) we get a Fortum EV / Operating-Profit-including-integral-associates-mutliple of 16.04x. It is not a big surprise that the new multiple lies somewhere between the former single company multiples.

Using proportionately consolidated numbers is the proper way of calculating the multiple for the ‘integral’ business of Fortum. However, we had to do home-made adjustments by using additional information than just the numbers from the P&L. This is possible here in two ways: first, as Uniper is material to Fortum some of the necessary – though not all relevant – information can be found in the notes to the Fortum annual report. And second, as Uniper is still a listed company the information can also be taken from the reporting of Uniper. But again: Doing such adjustments requires additional efforts and time.

And now let’s go to the new IASB line “Operating profit or loss and income and expenses from integral associates and joint ventures”? Whatever we try, we do not get to a meaningful multiple using this line in the denominator. The best proxy is, as already stated above, If we simply exclude (or add back) the fair value of associates from the EV calculation and simultaneously using the new IASB line as a basis of reference in the denominator. Doing this we get a new As-if-EV/“Operating profit or loss and income and expenses from integral associates and joint ventures” multiple of 15.13x.

However, this is just a random amount of difference to the proper multiple. In other cases, it could be higher or lower – there is no clear mechanistic relationship. Moreover, our short-cut has no real economic foundation. But if the IASB will provide such a new performance line in the P&L, we see the risk that it will be used in practice for some not-so-smart multiples exercises and might lead to misvaluations in several cases.

This brings us finally back to an important issue of standard setting in general. In our eyes, the job of standard setters is not only to open doors for better understanding of accounting (something that the IASB has been really trying hard and has also been quite successful in in recent years) but also to close doors for misunderstanding of accounting (something the board is not always successful in). Leaving the reliability issue aside, relevance of accounting is always a double-edged sword. Standard setters should not only make sure that financial statement experts can take more out of the information provided, they also should make sure that analysts and investors with average accounting know-how (the most part of capital market participants) can use this information properly without any requirements for bigger adjustments, deeper understanding or higher time efforts. And standard setters also should make sure that prepares (i.e. companies) do not get a lot of possibilities to steer the interpretation of numbers in the direction of their preference. We are unfortunately not living in a perfect world of all rational individuals.

Summary

The separate disclosure of integral associates and joint ventures gives fresh insight into how management runs the company. This will be a helpful information for investors although the risk of companies trying to interprete integral=well-performing and non-integral=poorly-performing should not be underestimated.

The presentation and disclosure of integral associates in the P&L, however, requires some adjustments. For making this line decision-useful for investors, additional information on associates (interet payments, taxes, leverage) is necessary. Additionally – although we do not think that this recommendation will be heard – the board should rethink whether proportionate consolidation for everything that is integral wouldn’t be a better way of emphasizing the contribution of these integral parts of the business: If you say A: highlighting the contribution of integral associates, you also have to say B: doing it properly and in a consistent way.

Disclaimer

The example of Fortum Oyi and Uniper SE is only a didactical one. It is not at all a basis for making investment decisions.