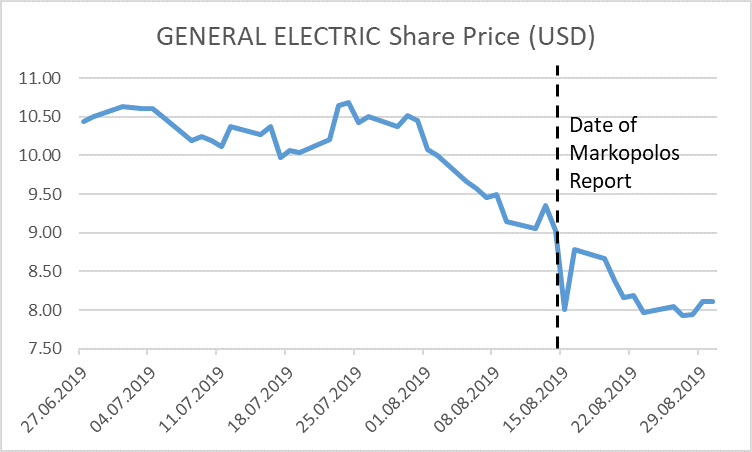

On 15 August 2019, General Electric (GE) has been hit by a research report written by former Bernie-Madoff-whistleblower Harry Markopolos which claimed that GE hides roughly 38 bn USD of accounting losses in its numbers. “In fact, GE’s 38 bn USD in accounting fraud amounts to over 40% of GE’s market capitalization, making it far more serious than either the Enron or WorldCom accounting frauds,” Markopolos wrote in this report. You can find the whole report here: https://gallery.mailchimp.com/199a11600490e42b3dcf6d2ee/files/fa29f469-c222-4a94-a324-ccf2cfea50ef/2019_08_15_GE_Whistleblower_Report.pdf).

In this report, Markopolos also made clear that he holds economic interest in a GE stock price decline via certain agreements with hedge funds. Furthermore, we informally heard that the Markopolos report (or parts of it) have been circulated among a group of selected hedge funds already before its publications (but couldn’t verify this). This would explain the stock price pressure that is observable already in the days before 15 August.

In the days following the issuance of this report, GE strongly rejected the allegations of Harry Markopolos. GE management supported this rebuttal by public insider stock purchases. E.g. GE’s CEO Larry Culp alone acquired more than 250,000 shares for roughly 2 mio USD on 15 August – just after buying for about 3 mio USD on 12 August, in total nearly doubling his total holdings within just a couple of days. Additionally, already at the day of disclosure of the report, GE’s Independent Board Director Leslie Seidman (a former Chairman of the Financial Accounting Standards Board (FASB)), defended live on tv-channel CNBC the integrity and economic soundness of GE’s financial reporting.

But still today many capital market participants are not sure how much of the report’s allegations are true, how much is an opinion and how much is simply wrong. So, it is time to shed some more light on this issue! Today we want to dig deep into the allegations about GE’s Baker Hughes accounting. Important: As this is an ongoing issue, please see the disclaimer at the end of this blog post!

What does the Markopolos report say with regard to Baker Hughes Accounting?

The report claims that GE has falsely consolidated its stake in the Baker Hughes assets which it acquired in 2017. According to the report this leads to GE not recognising a loss of roughly 9.1 bn USD due to market price movements of Baker Hughes shares which would have been recognised if the stake is accounted for as a financial investment.

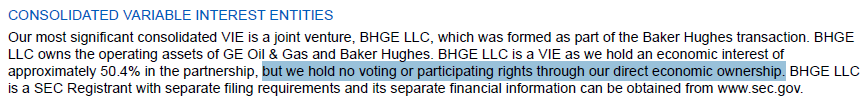

The report mainly argues by a comment in the GE 2018 annual report where the company states that they do not hold “voting rights or participating rights through”…the….”direct economic ownership”. The arguing of the report is that GE does not control these assets and hence consolidation is not appropriate here. Additionally, the plan to sell these assets should have immediately triggered a remeasurement down to current market prices. Finally, the report goes, the stock listed Baker Hughes itself consolidates the operating assets, and double consolidation is not allowed.

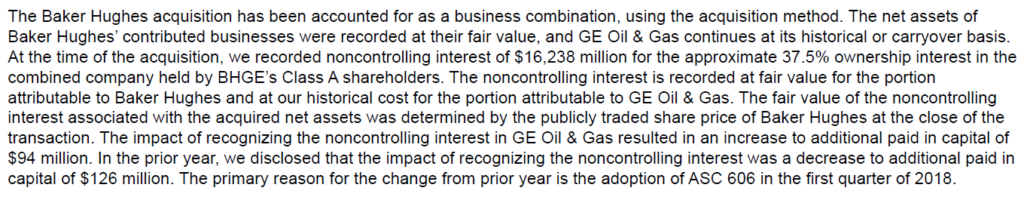

Source: GE AR (Form 10-K) 2018, p. 149, also cited by the Markopolos report.

How to tackle this issue?

For understanding whether the reporting of GE with regard to the Baker Hughes assets is wrong, we have to check two things: 1) is GE controlling this stake? and 2) did the announcement of divestment plans trigger any valuation adjustments that would have otherwise not been necessary. Plus 3) a nice entertaining twist for those who read through this post (don’t scroll J) and 4) a summary.

1. Is GE controlling the assets?

What we know

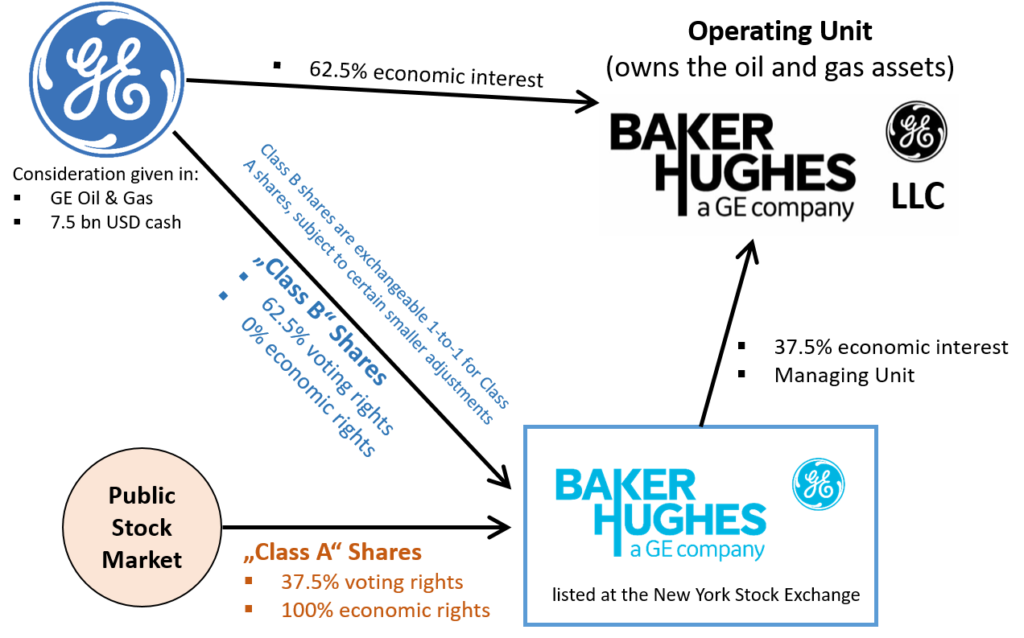

The original transaction is not a straightforward one in the sense that one company holds another company and that’s it. However, it is also not super-complicated to understand. Using GE reportings and SEC filings we are able to map the structure immediately after the closing in 2017 as follows.

Source: Own depiction, based on SEC filings and GE reporting; we have provided the 2017 GE reporting on this transaction in the appendix to this post.

Without explaining every relationship of this graph in detail (we think it is possible to read the relevant aspects from the graph), one can see that there are different paths of economic ownership and voting power in place. The main deal aspect from an economic point of view is that GE brought in its own GE Oil & Gas assets plus roughly 7.5 bn USD into the transaction to get its ownership and voting positions in return. The voting rights of GE go to the stock listed “Baker Hughes–a GE company” vehicle (BHGE hereafter). BHGE in turn is managing the Operating Company Baker Hughes GE LLC (BHGE LLC hereafter). There are also outside shareholders, which hold stakes in BHGE.

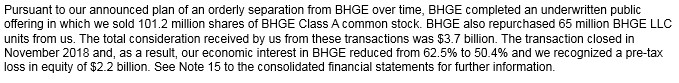

Then, in its 2018 Annual Report, GE reported some changes to this structure:

Source: GE AR (Form 10-K) 2018, p. 9

Hence, at the end of 2018 the structure of the participation looks as follows:

Source: Own depiction, based on SEC filings and GE reporting.

Now we can analyse the control position in the different parts of this structure. And without saying too much here, the crucial path is the relationship between GE and the stock listed BHGE. This is the case since if we find that GE controls BHGE then GE controls everything (also the OpCo BHGE LLC that holds the hard assets).

First, from the graph we can see that GE holds 50.4% of the voting power in BHGE at the end of 2018. This majority stake clearly sets GE into the default position of “control”. But there might be some aspects that prevent it from controlling BHGE. In particular it is necessary to have a closer look at the real decision making bodies of BHGE, i.e. the board (it is an old saying: Controlling the board means controlling the fate!). So let’s do this.

Upon time of closing of the original deal on 3 July 2017, the BHGE board consisted of the following key members:

| Name | Function in BHGE | Background |

| Jeff Immelt | Chairman of the Board of Directors | Chairman and CEO of GE |

| Lorenzo Simonelli | President and CEO | President and CEO of GE Oil & Gas |

| Martin Craighead | Vice Chairman of the Board | Chairman, President and Chief Executive Officer, Baker Hughes Incorporated |

On 2 October 2017, GE announced that Lorenzo Simonelli substituted Jeff Immelt (after the announcement of the latter that he plans to step down soon from all his GE management and board positions). Since then the key members of the BHGE board are:

| Name | Function in BHGE | Background |

| Lorenzo Simonelli | Chairman of the Board of Directors | President and CEO of GE Oil & Gas |

| Lorenzo Simonelli | President and CEO | President and CEO of GE Oil & Gas |

| Martin Craighead | Vice Chairman of the Board | Chairman, President and Chief Executive Officer, Baker Hughes Incorporated |

Furthermore, the BHGE board consists of lower positioned members – most of them with a GE background, only a few with a Baker Hughes background.

So, obviously it is clearly participants with a GE background which control the board. GE also obviously has the power to substitute exiting key members with own new members. Not a big surprise given the voting rights structure of the participation – but a necessary analysis to remove remaining doubts.

What we do not know

There might be any strange side-agreements that we are not aware of. But it is highly improbable that this is the case.

What we think

The concept of “control” is an economic one (substance over form). Here the Markoplos report is right. But the economics clearly tell us that it is GE which is controlling BHGE and hence also BHGE LLC. In fact, GE is everywhere in the driver seat. We can see no reasons why this should be different.

What is the problem with the Markoplos report?

A lot! The report did not make a lot of efforts to trying to understand the structure of the deal. The comment in the GE AR 2018: “…but we hold no voting or participating rights through our direct economic ownership” (see above) is perfectly understandable from the structure of the deal (it simply describes the upper path from GE to BHGE LLC, not more) and not at all an indication that GE does not control anything. The Markopolos report also did not look at board composition at all.

The comment that there might be a fraudulent double consolidation (at GE and at BHGE) is also wrong. In a consolidated group there might be many subsidiaries which also have to report on a consolidated basis. Nothing wrong with this, normal business. It would only be problematic if two unrelated companies consolidate the same assets at the same time, but this is obviously not the case here.

2. Did the announcement of divestment plans trigger any valuation adjustments that would have otherwise not been necessary?

If certain assets are classified as “held for sale” they have to be impaired to the lower market value (SFAS 144). Let’s check if this is the case here.

What we know

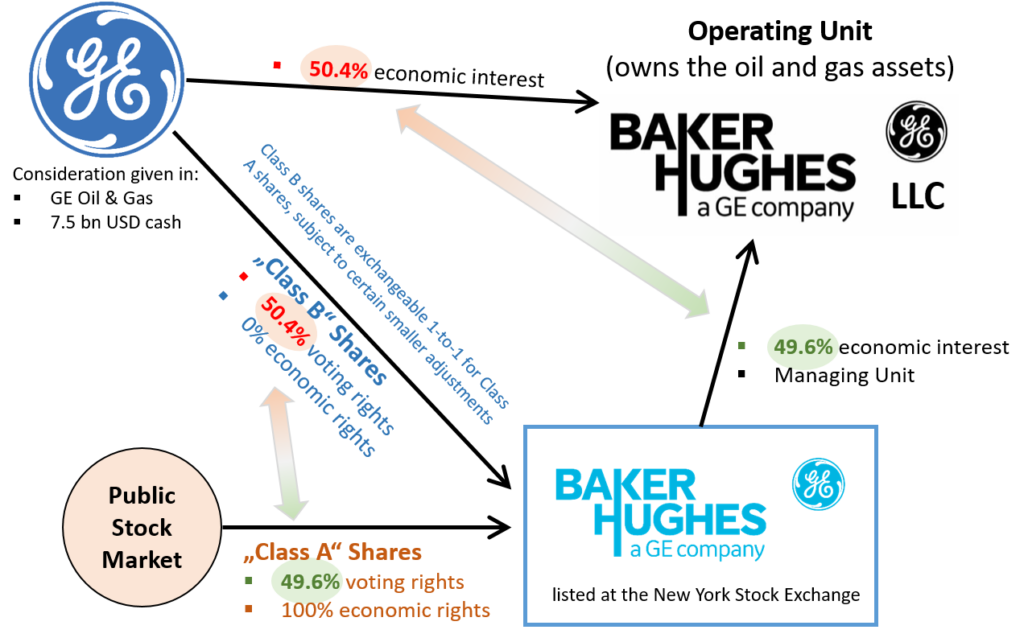

In fact, GE has plans to get rid of its BHGE interest. They have publicly announced this. However, in the 2018 Annual Report GE writes:

![]()

Source: GE AR (Form 10-K) 2018, note 2: Businesses held for sale and Discontinued Operations, p. 111.

Of course, it might be that GE has made a reporting mistake here. So it is worth to look deeper into it. First, the relevant standard SFAS 144 (Accounting for the Impairment or Disposal of Long-Lived Assets) that regulates the accounting for assets that are up for sale is quite similar to IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations). In these standards we can find the criteria for putting assets up for sale – and they are quite strict.

Without going into all the details, it is necessary (on a cumulative basis) that the assets must be available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets, that the sale of the asset must be probable, and its transfer expected to qualify for recognition as a completed sale, within one year, with certain exceptions. They must be actively marketed at a price that is reasonable in relation to it fair value. And actions required to complete the divestment plan must indicate that there are no significant changes to the divestment plan. And so on.

Here is a bit of background on why there are so strict requirements: Usually, the standard setters want to make it difficult for companies to put assets up for sale when in fact the companies do not want to do this with a sufficient degree of seriousness. Because otherwise there might be the incentive for CFOs to exclude some underperforming assets from the core numbers, giving investors the false impression that on an ongoing basis the company is still in very good shape. This set of rules is a negative demarcation.

As a consequence, it is very easy for companies to NOT put assets up for sale. Companies simply have to state that they do not want to sell it today but perhaps in the future (or similar with any of the other requirements), and that’s it already.

What we do not know

Perhaps GE really checked boxes for all the requirements cited above. But then the management would be very stupid and in fact performed a misreporting. Assessment: Highly improbable!

What we think

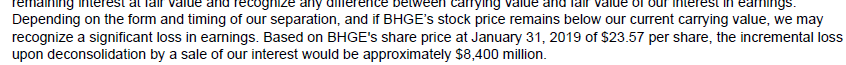

Quite simple: At least one of the criteria has not been met. No accounting for assets up for sale! Not a fraud at all. However, it might be that investors are not super-happy with this way of disclosure as there is in fact a market price decrease as compared to the carrying value – but to be honest, GE management didn’t hide a lot with regard to the economic consequences. In fact, they write:

Source: GE AR (Form 10-K) 2018, note 15, p. 139, also cited by the Markopolos report.

So, it is also not possible to accuse GE of not emphasising of what might happen in case of a divestment in economic terms. There are negative economics to this planned deal, but they are disclosed.

What is the Problem with the Markopolos Report?

Again, quite a lot. It always talks about financial instrument whereas it is only about assets up for sale (admittedly with similar economic consequences). It doesn’t check any criteria for putting assets up for sale – and hence it cannot really draw conclusions of whether it is a fraudulent proceeding or not.

3. What else?

There is a funny side-aspect to our analysis which we do not want to hide here.

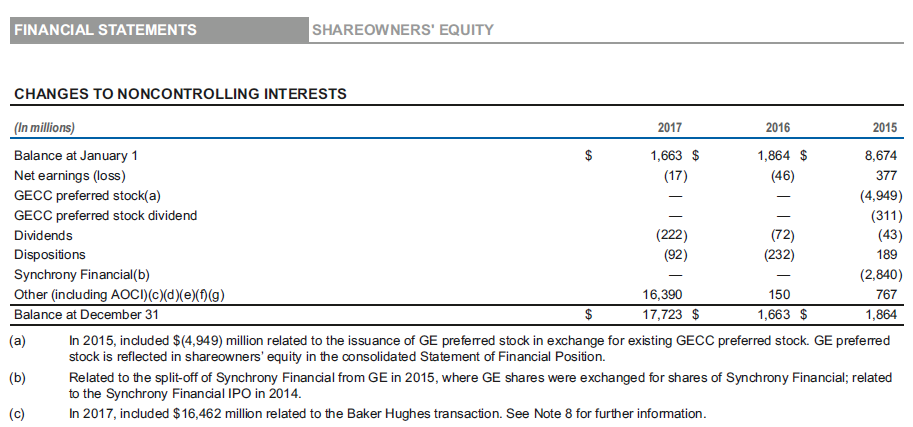

As GE only controls only 62.5% (and later only 50.4%) of BHGE, there are some non-controlling interests (the outstanding shareholders, minorities) to be accounted for in shareholders’ equity in the consolidated statements. A quite familiar thingy. The valuation of these minorities is split into two parts because GE originally brought in a) the GE Oil & Gas assets and b) some cash for buying a participation in BHGE. As a consequence they performed this two-way valuation of the non-controlling interest position, described below:

Source: GE AR (Form 10-K) 2018, p. 117. We also provide the relevant part of the shareholders’ equity table in the appendix.

So, when we started reading the Markopolos report, we stumbled upon the following comments:

“GE accounted for its holdings in BHGE as a Non-Controlling Interest, which was entirely consistent with the substance of the transaction…” and “GE improperly continued to account for its shares in BHGE as a Non-Controlling Interest in 2018…” (Source for all: Markopolos report, Summary, page iv.)

As we are rather the IFRS guys, we really (no joke!) had to check whether we missed something in the US-GAAP nomenclature: Is in US-GAAP perhaps another (new) meaning of non-controlling interests than in IFRS? But we quickly found out: It is not! It is just a misunderstanding of the Markopolos report which obviously mistakenly understood that non-controlling interests means something like non-consolidated entities (associates, financial instruments). In fact, GE never accounted for this transaction on a non-consolidated basis. It is only that the Markopolos report thought that the mentioning of non-controlling interests in the GE Annual reports means that they do not consolidate. Well, that is also a way of tackling accounting.

4. Summary

Admittedly, GE has never been at the forefront of conservative accounting application. Looking into the history of the company we can find a couple of examples of quite aggressive representations of its economic situation. One of them has recently highlighted in the VALUESQUE blog (https://valuesque.com/2019/03/21/ges-23-bn-usd-goodwill-impairment-the-non-soft-hard-cash-financial-analysis-problem/).

But with regard to the Baker Hughes accounting we cannot find anything wrong (but of course, it could be that we missed something). Moreover, the Markopolos report does not come even close of what is necessary to assess the accounting treatment here. We do not want to judge to harshly on the report (with regard to the Baker Hughes accounting) because at least the economics are correct – but also disclosed by GE – but all in all the Markopolos report really seems to be a bit light in accounting from our subjective point of view.

Disclaimer

We are no experts of US-GAAP accounting in general or of US-GAAP insurance accounting in particular. This comment is purely a subjective one based on information that we could publicly collect. By nature it suffers from a lack of information. And hence, it is certainly no advise to take investment decisions! Furthermore, we do not hold any economic interest at all – in whatsoever direction – in a stock price movement of GE. We also want to disclose here that we have already reviewed GE’s accounting in a different case (see: https://valuesque.com/2019/03/21/ges-23-bn-usd-goodwill-impairment-the-non-soft-hard-cash-financial-analysis-problem/)

Appendix

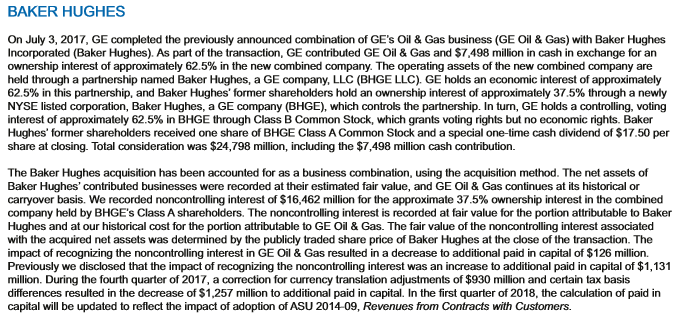

This is how GE reports on the Baker Hughes Transaction in its 2017 Annual Report

Source: GE AR (Form 10-K) 2017, p. 143.

Valuation of non-controlling interest in GE’s shareholders’ equity

Source: GE AR (Form 10-K) 2017, p. 168.