Cases & Stories

We get to the bottom of things and focus on what really matters

Business valuation is not just a mathematical exercise. In our assessments, we include what truly matters – corporate reputation, governance and management quality. We believe top-tier valuations are only possible with actively engaging in research and knowledge exchange as we show in our regular publications and speaking engagements. We live and breathe “Value Discovery.”

Cases

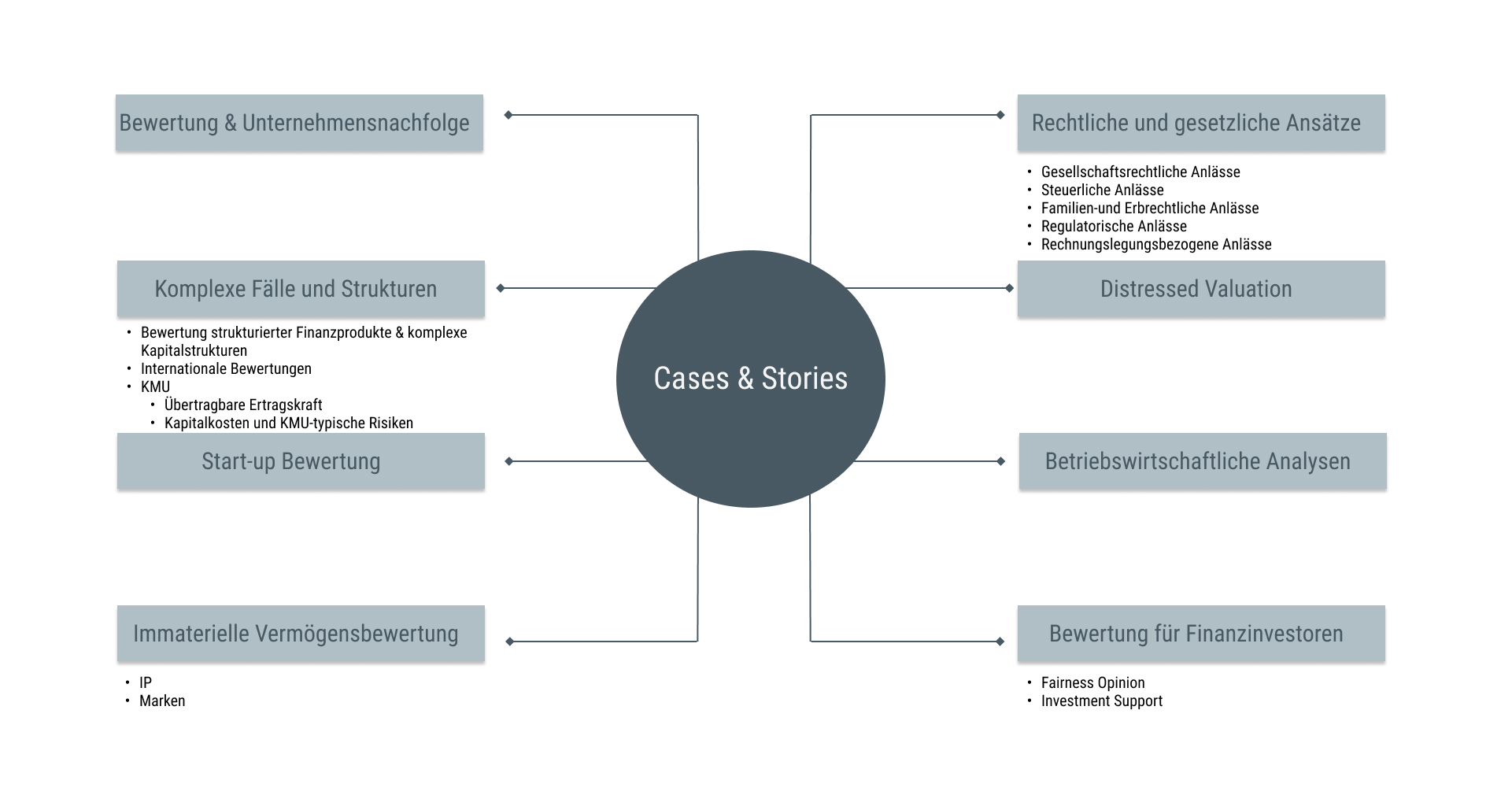

We offer a broad range of services related to business valuation. Here you can find a selection of cases from our various valuation areas:

Legal and statutory reasons

Corporate, tax, family, inheritance and accounting matters

Distressed Valuation

Valuation of companies in crisis or in crisis situations

Academic and business appraisals

Complex scientific appraisals and special business analyses

Valuation and analysis for financial investors

We offer all services in the area of fairness opinions and balance sheet analyses.

Valuation and succession

Business valuations in the context of succession planning

Complex structures and financial instruments

Valuation of structured financial products & capital structures

Valuation of start-ups and intangibles

Dedicated start-up valuation for investors and valuation of intangibles

Reporting

We provide support in the preparation of investor-orientated annual reports and other reports.

Stories

When Standard Setters are too slow: The Case for Tesla’s 1.5 bn USD Bitcoin Accounting

(Not only) in my opinion, the seminal and still most relevant paper about bitcoin…

SNP’s Profit Warning and its Order Book: Oh Revenue, where Art Thou?

Schneider-Neureither & Partner SE (SNP) is a German software company, mainly…

Understanding ESOPs (2): How Ocado magically palmed 63.6 mio GBP of Expenses

In one of our former blog posts we had a look at the accounting functioning of…

European Banks and the Q3/20 IFRS 9 Overlay – Fundamental vs. Technical Input to Accounting

As a consequence of the experiences made during the great financial crisis 2008/09…

SBM Offshore’s “Directional Accounting”: Read-Across to IASB’s Disclosure Project (and to IFRS 10/11)

In 2011, the International Accounting Standards Board (IASB) disclosed a whole…

Is Proximus Tackling IFRS too Hard? – The Belgian Football Broadcasting Rights Accounting Dispute

Belgian football is one of the most attractive in the world, even though the…

Understanding Stock Options – Basic Techniques

Dealing with stock options (employee stock options ESOs or employee stock option…

Equinox’ Share Purchase Warrants: What a Difference an Issuing Motivation (and a Currency) makes!

Equinox Gold Corp (EQX) is a Vancouver, Canada, -based mid-tier gold producing…

Babcock’s strange JV Reporting: Catch-Up Effects, omitted Revenues and overshooting Margins

London-based Babcock International Group Plc. is a multinational engineering support…

Coronavirus: Ryanair’s Unconventional “No Shows” Accounting

It is not a big secret that coronavirus has hit the airline industry massively.…