Preface: This is just an educational explanation based on public press reports. It does not mirror my own analytical views, positions and findings. Please read the disclaimer at the end.

First Act: Exposition

I am running a little beer pub in the middle of Nuernberg, a city in Germany. My speciality is the “Burg”-Beer (“Burg” is German for “castle”). Nuernberg has a beautiful castle which is located just above the old-town.

I am proud of my licence to sell beer in Nuernberg which I got from the local beer regulator. My business is going quite ok, but it could be better. Unfortunately, the growth possibilities in the Nuernberg market are limited. Recently a potential investor for my pub showed up (he wanted to buy a stake in my company) but in the end he didn’t find my beer pub business very interesting. Time for some change…

Second Act: First Success in Hamburg

I decided to grow my business by also offering Burg-beer in other markets, namely in Hamburg, another city in Germany. However, buying a real pub there ist too expensive and moreover you need the local licence to sell beer in Hamburg – which I do not have. So I partnered up with some local Hamburg pubs: they should sell my Burg-beer and get a fee for it. Unfortunately, it turned out, people in Hamburg do not like my Burg-beer because Hamburg, despite the name, does not even have a real “Burg” anymore, i.e. no castle. Nobody is interested in my Burg-beer.

Nevertheless, the potential investor showed up again in my Nuernberg pub. He likes my growth mode and wants to know more about it. Hamburg is far away from Nuernberg and so I decided to lie a bit. I told him about some first great success with my Burg-beer in Hamburg. He likes my story and buys a little stake in my pub business for a not so unattractive price.

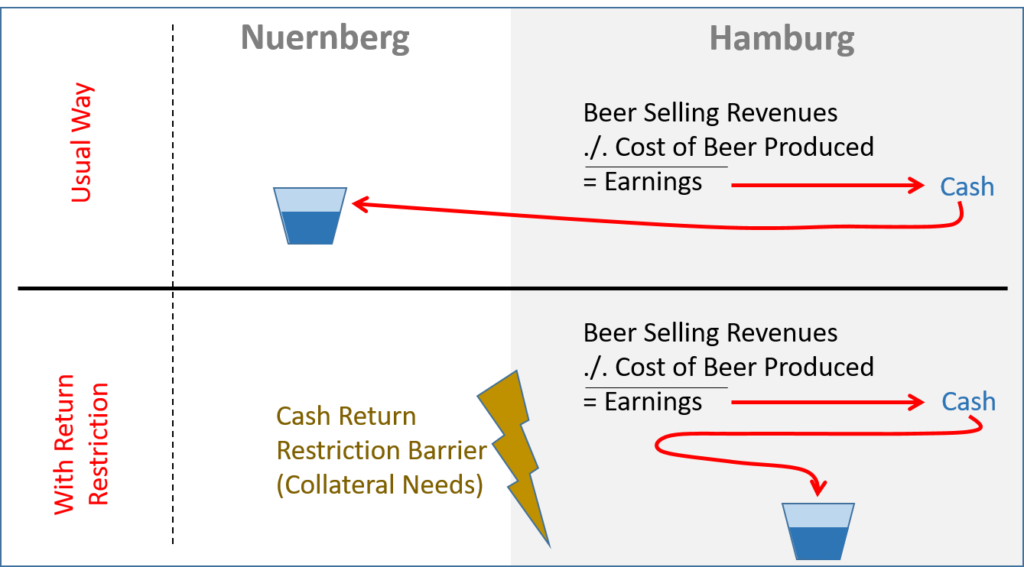

Third Act: Hiding non-existent Beer cash from my auditor

After this little success, I understood that making my story bigger could perhaps give me some more investments in my pub business at even higher prices. So I tell a story about strong beer selling growth rates in Hamburg, and this story gets bigger and bigger. Nearly all pubs in Hamburg, I told him, now sell my Burg-beer and people love it. The potential investor really gets triggered by this story. He wants to buy a bigger stake at a very attractive price, but…. he asks for some auditor confirmation for my Hamburg business (for him the way to Hamburg is too far to check). So I also tell the cooked-up story to my auditor. ‘Here the revenues, there the costs, nice earnings, super growth, that is my new great Hamburg business.’ The auditor believes it basically (for him the way to Hamburg is also too far, and I can show him some good looking, selfmade accounting records) but he asks: ‘If you are that successful, where is the cash from the Hamburg business?’ Hmm, good point he has! But here is what I told the auditor: ‘In my Hamburg business I have a charge back clause. If somebody gets a wrong beer-bill from my partner pubs, he or she gets reimbursed the triple drinking bill of the night.’ For this the beer regulator in Hamburg requires me (at least for the moment) to keep all the earned cash in a secure account in Hamburg – just in case somebody can prove he got cheated that way. ‘And this is the reaons I cannot bring the cash back to Nuernberg.’ This sounded plausible to the auditor. He checks with a Hamburg trustee who is supposed to oversee my accounts (a good friend of mine and even better in lying than me) and is fine with his answer. Great! This helps me to make the weak link to my story make disappear. Now the whole Hamburg business takes place in Hamburg – no possibilities for the auditor to find inconsistencies anymore. And my investor is also happy and buys a bigger stake in my company.

Fourth Act: No overpaying for a Beer Pub in Wolfsburg

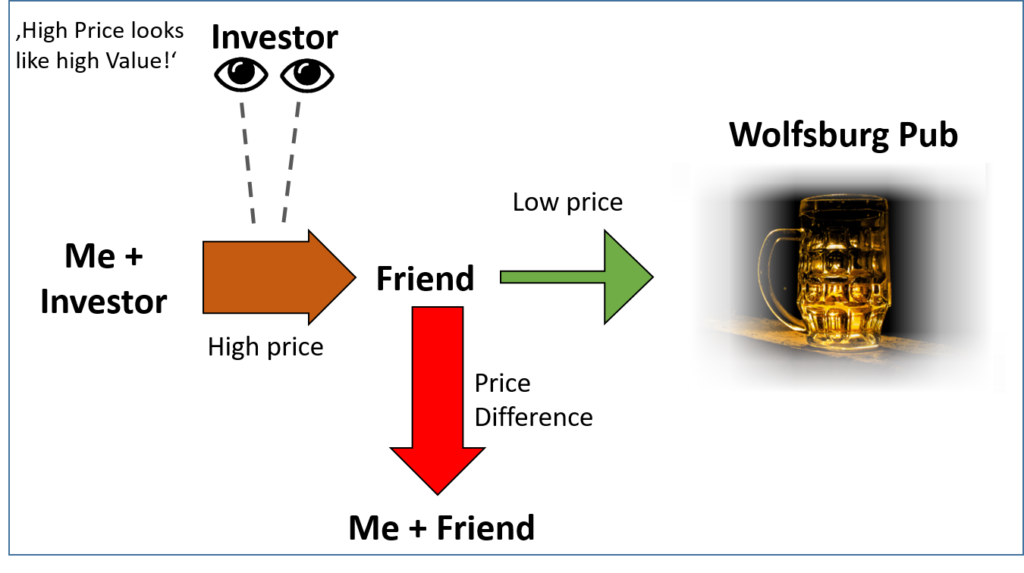

Now I have enough money to do some other businesses. I decided to buy a pub with a local beer selling license in Wolfsburg, a city also far away from Nuernberg. The pub I wanted to buy is admittedly a shabby one – but I do not have the money for a good one. My investor, however, asks me about this new move and expresses his hopes that I am going to perform a market leading acquisition. To satisfy my investor, I decided to make my acquisition a bit bigger than it actually is and so I paid a huge price for the shabby pub: Because high price sounds like great business, isn’t it? But to make it clear: I didn’t pay the huge price to the original owner (I cannot afford it). My good friend from Hamburg – the one who is overseeing my accounts – bought the shabby Wolfsburg pub before – privately and at the low price it deserves. And then my pub business – now a combined company of my investor and me – bought the Wolfsburg pub from my friend (but I didn’t tell my investor about this structure). And in the end I didn’t even lose any money. I even benefited from this transaction as the overpaying was done partly by me and partly by my investor. But my friend promised to return more than my part of the overpaying back to my pockets. What a nice transaction!

Fifth Act: Roundtripping Beer Bottles

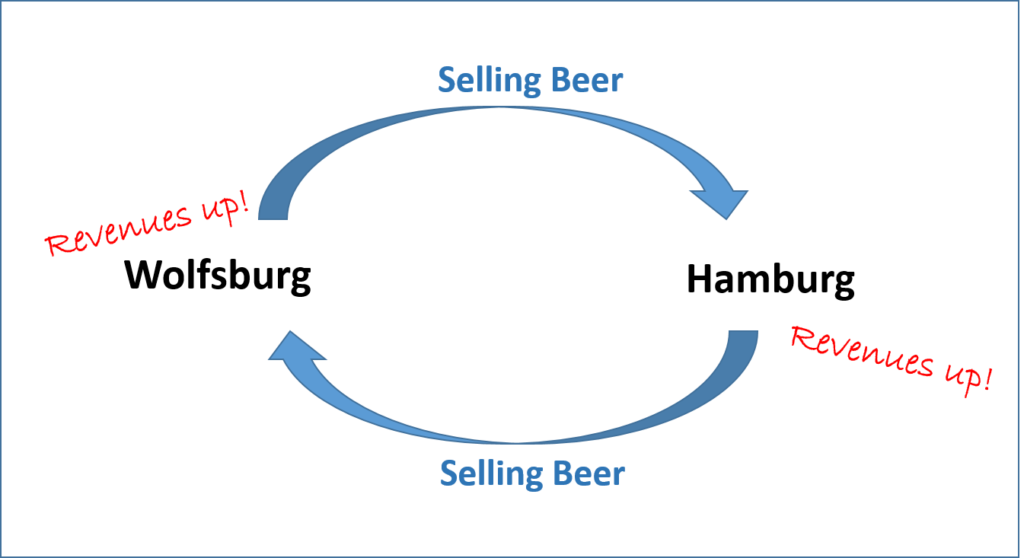

However, in Wolfsburg again it turned out that nobody likes my Burg-beer (Wolfsburg has a castle but not a very nice one). And my investor is awaiting success stories. I decided to help my Wolfsburg business a bit and so I put a structure in place where my fictious Hamburg pub-partners buy lots of Burg-beers from the Wolfsburg pub. As a return, the Wolfsburg pub also buys a lot of Burg-beer from my Hamburg pub partners – quid pro quo. We even did not have so much beer for all these transactions but this is not important: it all only happens on a piece of paper. No real transactions took place, it all netted out! But both of my pub affiliates, Wolfsburg and Hamburg, now look super successful, selling lots of beers. My investor bought another stake at an even higher price now.

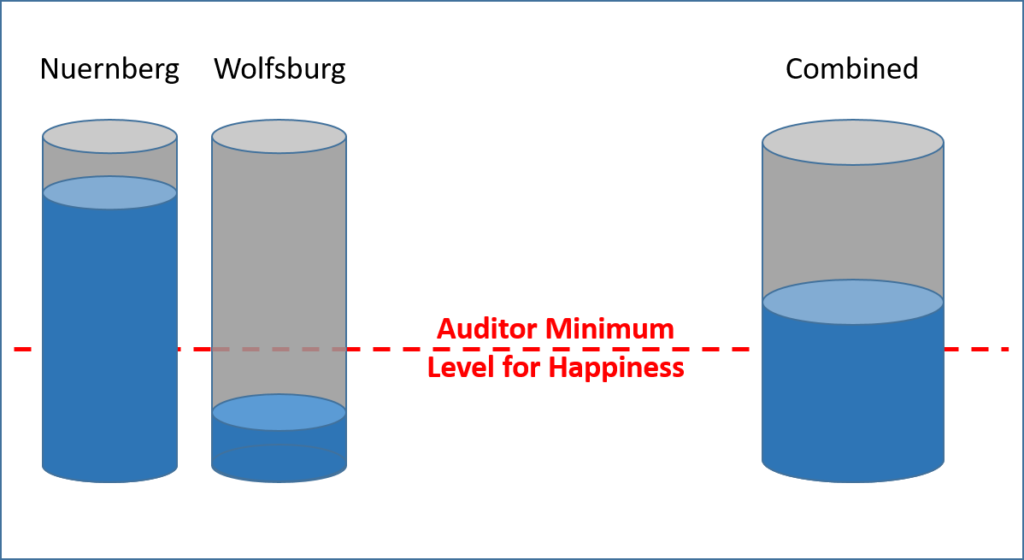

Sixth Act: Integrating my Wolfsburg activities for Performance Measurement

The auditor, however, wants to know more about my Wolfsburg business, which is by the way actually not selling Burg-beer at all. I told the auditor that it is only possible to look at the Wolfsburg pub business in connection with the original Nuernberg pub business: ‘It is one family, you understand?’ And as I am still a bit successful in my Nuernberg pub, grouping together the Wolfsburg pub with my Nuernberg pub shows at least some medicocre success on average. The auditor is happy with this. The investor, too. He buys another stake in my company at an even higher price.

Seventh Act: Overdoing it a bit?

The next steps is to hand out some loans to some “innovative” pubs in Hamburg which should create an even better Burg-beer with these funds. Of course, the pubs do not exist (but nobody knew this) and so the money – paid nicely split by me and my investor – flew at 100% into the pockets of my friend (who promised to pay the major part of it back to me soon). The investor keeps on buying stakes in my company at high prices. I am getting rich.

Eigth Act: Fin

I have to admit that it got more and more difficult to keep this story alive. Recently, the Nuernberg beer regulator also started to ask questions. But this regulator can only check my local Nuernberg business, not the Hamburg one and not the Wolfsburg one (puhh, good news for me…). And in Nuernberg everything still looks fine.

But finally – an old story – the newspaper which must have always had some information about my real business activities, and over a long time has written some critical stories about my business, managed to persuade my investor to look a bit deeper into my Wolfsburg and Hamburg business. So my investor hired a special investigator. And if that wasn’t already very bad news, I cannot reach my friend from Hamburg anymore. Where is he? I hope he is doing well and going to pay my share of our “deals” soon – he hasn’t done so far…

Disclaimer: This text is meant to provide a simplistic and entertaining introduction to the Wirecard case to non-experts. It is just based on recent press reports. It does not mirror my own serious analytical positions, in particular not with regard to the role of auditors and regulators. I use this explanation as a starting point for discussions with my undergraduate students. Of course, we discuss all the real economic and accounting circumstances (and also the shortcomings of the press reports) in depth. This article is also a tribute to Paul Krugman’s article “Flavors of Fraud”, 28 June 2002, New York Times, which helped me a lot to understand the functioning of accounting when I was a young Ph.D. student. More serious analyses of the Wirecard case can be found HERE, HERE, HERE, HERE and HERE.