On 16 October 2019, short seller Shadowfall issued a report on Eurofins, a Luxembourg-based laboratory services provider, raising several concerns regarding – amongst others – opaque intragroup and related party transactions (see LINK). So far, we cannot state whether the allegations are true. And it is also not the goal of this blog post to detect this. We rather want to shed some light here on how to deal with the general problem of related party transactions from an analyst’s point of view.

Hence, this post is not at all an investment recommendation in whatsoever direction. It is just a general piece of background information on a particular financial analysis topic. Further, we hold no economic interest in Eurofins. The fact that we are not a super-fan of some of the other ways of disclosure of Eurofins (see LINK) does not play a role here.

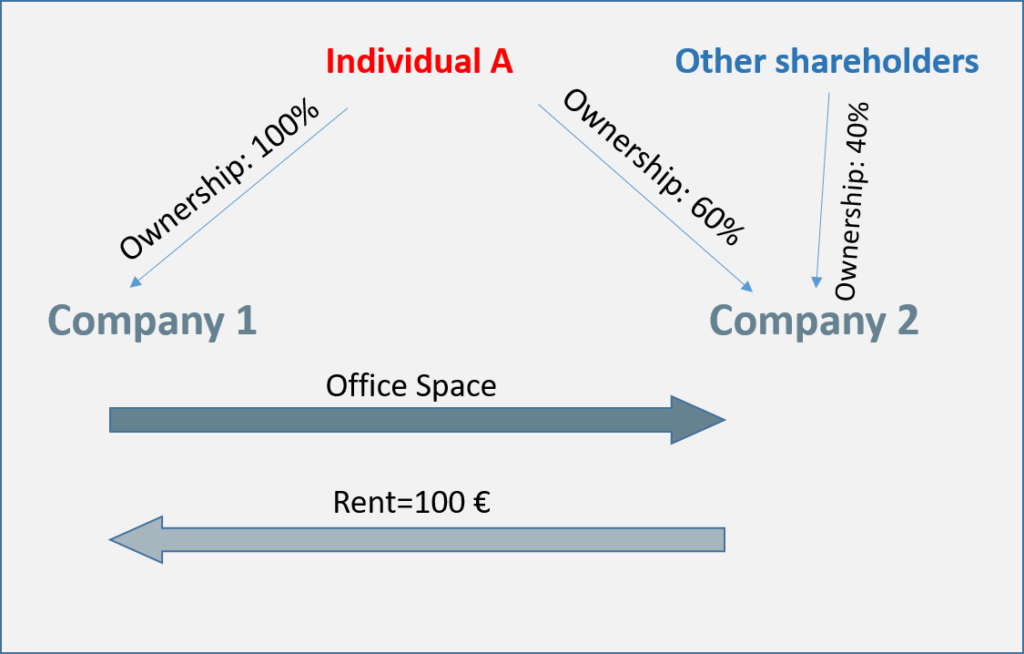

Related party transactions is the general term of transactions (on the revenue or on the cost side) with non-company third-parties which however have some informal or personal ties to the company. E.g. if two companies do business that are legally separate but have the same owner. A typical example is the case of company 1 (owned by individual A) renting office space to another company 2 (partly owned by individual A).

As long as this is a fair transaction (i.e. the rent is at arms’ length) there is nothing wrong with such a situation. Company 1 gives away office space and gets a fair price (the rent) for it. Nobody is losing or winning in this case.

However, imagine that company 1 now charges a too high rent for providing the office space. Let’s say for illustration reasons that the fair rent in the above depicted case is 50 Euros (but company 2 has to pay 100 Euros). In this case, as seen from the view point of Individual A, she gets via company 1 and has to pay via company 2. This is a plus of 40€. These 40€ are indirectly paid by the outside shareholders in company 2.

But don’t forget that he only holds 60% in company 2 and hence we cannot yet draw conclusions on whether there is something wrong. So let’s compare it to the situation of a fair pricing of the rent (i.e. if the payment is set at 50€). In this case, A gets via company 1 and has to pay via company 2. This is a plus of 20€. Now the outside shareholders in company 2 only pay (indirectly) 20€ for this contract. We can see now that in the case of an exaggerated rent, A gets more as a net number than in the case of a fair rent payment. Similarly, the outside shareholders have to pay 20€ more on a net basis. This effect is due to the different ownership structures in company 1 and company 2.

And this is the tricky point with related party transactions. If contracts are not priced fairly then someone is losing and another one is winning in such transactions. Of course, this can also go the other way (if the rent is too low from an economic point of view). Then it is A who suffers and the outside shareholders win. But in the above situation the risk is rather to the first version (but not always, see below). As A controls both companies (here >50% ownership, but this is not always necessary in reality) she can more easily set the terms of the contracts and hence there might be rather the incentive to go the first way and not the second way. The losers are then the outside shareholders of company 2 who do not have enough influence to change (or even monitor) contracts. It goes without saying that the risk of unfairly priced related party transactions is usually very high in family-controlled companies because only then we see similar ownership structures as in the graph above.

For good reasons, related party transactions are under special scrutiny of regulators and auditors, but as always in such cases these control mechanisms might not be tough enough or might be circumvented or at least offer the possibility of a slight position shift which is still within the range of what monitoring bodies would see as “fair”. Anyway, our reporting systems require companies to report on related party transactions in order to allow investors to better analyse this topic. And not a big surprise, related party transactions are also a highly relevant Corporate Governance topic.

By the way, renting office space is perhaps a typical example but there are many other contracts that fall into the related party transaction problem. It could be a consulting contract with another company or directly with the individual, it could be the supply of goods from a company and it can, of course, also be a customer relationship. So, related party transactions can touch the revenue as well as the expense (or generally speaking: the cost) side of companies.

And here is what we think you have to know as a financial analyst about how to deal with related party transactions:

- The strategy to expropriate wealth of outstanding (minority) shareholders the way we explained it above is called “Tunnelling”. The best way to detect tunnelling is by comparing contracts to an independent benchmark. However, this is not always very easy. Sometimes analysts are better able to do this (comparing rents with the usual local rents) but sometimes less so (what is the real value of highly individual, specialised supplier goods?). Rarely, we can see such a clear mismatch as in the case of Subsea 7, an off-shore energy servicing and construction company. The company acquired in 2018 Siem Offshore Contractors (which was partly owned by the largest Subsea 7 shareholder and chairman Kristian Siem) at a price which entailed a significantly higher premium than recent comparable deals in the sector.

- Another aspect to watch closely when you want to detect tunnelling is if the related party transactions make up a huge part of the expenses or revenues of the company. Even if you do not detect anything suspicious here there is a huge risk of getting expropriated as a minority shareholder because at high volumes even small deviations in the contract terms can make a difference. Take this risk effect into account when valuing the company. The Italian coffee company Massimo Zanetti Beverage Group (runs amongst others the well-known Segafredo brand) basically buys a big chunk of its coffee ingredients from a company controlled by Massimo Zanetti himself. This related to more than 30% of the company’s whole expenses for “raw, ancillary, and consumable materials and goods” in 2018.

- Sometimes it is also single transactions which should raise your awareness. When German outdoor advertising company Ströer Media once bought FreeXmedia, they did it via an intermediate transaction over a company controlled by two major Ströer Media shareholders, Dirk Ströer and Udo Müller, and then sold it forward to Ströer Media. The strangeness of the transaction (and the risk of something getting lost on the way to the benefit of the two main shareholders) gave them an ugly short-seller report by hedge fund Muddy Waters (also relating to other related party transactions) which pushed down the company for quite a while.

- There is another strategy with regard to related party transactions, the “Propping Up”, i.e. the case of making the company seem to be more successful than it really is (similar to the case above where the rent is understated as compared to fair market rates). This is sometimes seen for companies which are close to insolvency. And often such companies are again subject to tunnelling once they are saved from this critical situation. So watch out for family-controlled companies in crisis and their related party deals. Very often the end is just prolonged by generous contract terms, etc.

- Furthermore, related party transactions are sometimes used simply for earnings management – in both directions. This is something you can usually spot easily in most cases. Watch out for changes in contract terms. Temporary changes are often a sign of pushing the company’s earnings just above the guided earnings.

- There is also a positive aspect to several related party transactions. They ensure the long-term viability of the business model (a much lower risk of contracts being cancelled as the related party might have an interest in keeping these contracts alive). This is certainly a point. But watch out closely for it. Poland-based Dino Polska, a supermarket chain, has basically outsourced most of the new-sites construction process to a company which is closely related to Dino’s main shareholder and chairman Tomasz Biernacki. The company commented on this as a positive because of the higher efficiency and safe access to construction services for Dino. We are, however, a bit more sceptical on this.

- Family-controlled firms are often seen as superior investment alternatives because of the inherent rather long-term focus of the business model (and we agree: this really often a big plus of these firms). But the flip side of such businesses is often the blurring borders between the company itself and other related companies or activities. Always check the related party issue when analysing family-controlled companies. It might be that it is negligible but it also might be that related party transactions raise serious concerns sometimes.

- And as an additional comment on family-controlled firms: A serious word on Corporate Governance here: Don’t fall for the trap that a) this is a great company and b) there are some related party issues, and hence c) you simply automatically deduct the related party issue from the great company impression and still get to a great (but perhaps a bit less great) company. This view is dangerous. Behind a strange related party understanding of management/owners is often a more serious misunderstanding of Corporate Governance. As long as things go well there is no problem. But a bad Corporate Governance firm often shows its ugly face exactly if things no longer go into the right direction. In such companies you often have to live with the fact that in case of crisis more horrible things happen. And as you do not have a crystal ball (we neither) and hence never know what problems might show up in the future, take this risk into account of your valuations.

With regard to the current Shadowfall / Eurofins issue, we just wanted to keep you awake with this post. Make up your mind yourself. One thing is true: Eurofins has always engaged in related party transactions. The Martin family owns roughly 36% of Eurofins and Gilles Martin is the chairman of the company. There are/were lots of property transactions between the Martin family or related companies and Eurofins in place. But recently the company also stepped a bit back from these transactions (at least from the obvious ones). There will be no new buildings leased to Eurofins anymore in the future. However, with regard to existing property transactions, there are quite a couple of investors that didn’t feel comfortable with some terms of the leasing terms.

But this is only one aspect of Eurofins’ related party transactions. The Shadowfall report focusses on many other (not so obvious) related party transactions. Tricky to analyse. Let’s see how this issue develops.