While Tongaat Hulett LTD was standing close to the top of our accounting watch-list for a long time (and we were scratching our heads about a lot of things), recent developments led us to give an answer to the question raised in the headline now very clearly: No, they can’t! And they can’t turn land into gold, neither. How do we know? Just a couple of weeks ago it became public that Tongaat Hulett LTD, a South-African agricultural conglomerate mainly focussing on sugar production and property business, is accused of severe misstatements of accounting numbers over many years. Bad news for investors in the company, good news for the short-sellers!

And there are obviously a couple of different accounting irregularities with Tongaat Hulett: The biggest one was certainly the overstatement of revenues from land sales, but the company was also downplaying and misunderstanding the negative aspects of cash being trapped in Zimbabwe (see the article on the different natures of cash here: https://valuesque.com/telias-net-debt-ebitda-communication-the-restricted-cash-financial-analysis-problem/) and – the point of interest in this article today – it presumably misstated the value of its main assets: the cane roots and the standing cane. The latter directly resulted in an earnings overstatement as these fair value changes have been flowing through the profit & loss statement over the years. To be fair: This aspect is not publicly confirmed yet, so we still stay in a state of analysis – and of course we might be wrong with our analysis – but looking at the numbers there are strong indications from an analytical point of view. And it is a quite interesting and delicate aspect of IFRS-accounting that is touched here. So this is worth having a closer look at.

Let’s start with some technical background first: IAS 41 Agriculture covers the accounting of so called biological assets. These are assets that are somehow in a living state and are to be sold at a later point in time. This could be animals (like salmons in a salmon farm) or living plant (like typical agricultural assets). The standard generally requires such assets to be measured at fair value less costs to sell. Obviously the fair value of these assets changes over time – with the planned growth of animals or plants – but of course also related to some other aspects such as weather accidents or diseases or similar. The very interesting point is now: the periodical changes of these fair values flow directly through the profit & loss account [IAS 41.26].

While from a theoretical point of view largely sound (because the usual lower-of-cost-or-market principle for “inventories” does not make a lot of sense for naturally growing assets) this rule is a very fragile one as it obviously allows companies to recognise revenues long before they are earned in a market, i.e. before products are sold to customers (so called paper profits). But as long as the fair value can be determined with a reasonably high degree of confidence – e.g. when there is a market price for it – the proximity of fair value to an hypothetical selling price seems to be quite high. But what if the accounting “fair value” cannot be estimated with high reliability? What if there is no market price? These questions now leads us to IFRS 13 Fair Value Measurement – and it has the potential to turn the fragile standard IAS 41 into a quite explosive one.

Very shortly here: IFRS 13 sees different levels of fair value measurement depending on the nature of the information available: Level 1 measurement uses quoted prices in active markets for identical assets as an input and is a quite reliable version of measurement – so quite a good benchmark. Level 2 measurement is standing on a weaker basis and uses “observable” information, either directly or indirectly, other than for identical assets. A typical case is here quoted prices for similar or comparable assets. But if all this is not available, level 3 now turns away from a “market” (because there is none) and uses all other information which allows to – often by use of a model – determine a value. Obviously level 3 is by far the weakest one and entails also some subjective elements. This might (but not necessarily has to) be tolerable in certain situations where we need fair values in accounting, but it obviously opens a big door for management, perhaps even a gate, if this fair value measurement is directly linked to a core periodical performance driver of the company, the revenue generation.

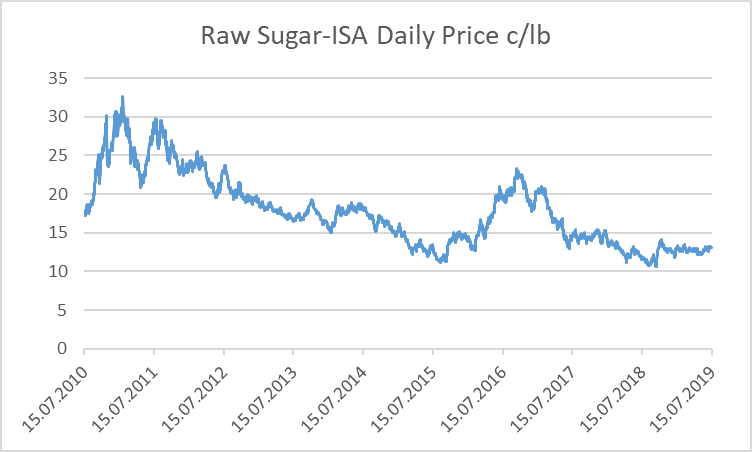

And here we are back at Tongaat Hulett’s situation, which is not an uncommon one for companies growing agricultural or animal assets. In the annual report the company explains: “Growing crops, comprising standing cane, is measured at fair value which is determined using unobservable inputs and is categorised as Level 3 under the fair value hierarchy.” and “The fair value of standing cane is determined by estimating the growth of the cane, the yield, sucrose content, selling prices (including specifics such as European Union exports), less costs to harvest and transport, over-the-weighbridge costs and costs into the market”. The company also comments that it is valuing “roots at current replacement cost of planting and establishment, amortised over the period of their productive life” (which is 6 to 12 years). And this all makes sense from a theoretical point of view. But what about the practical application, in particular the one related to the valuation of standing cane? To check the calculations provided by the company, we below re-performed the Tongaat Hulett analysis by taking into account the amount of land available for growing cane sugar, the cane yield, i.e the harvesting potential per hectare (information given by Tongaat Hulett in every annual report), and the price development for raw sugar (this is a market price). These variables seem to us to be the main variables for the fair value development of the relevant positions. Interestingly here, the sugar notations are in a deep downswing since 2011.

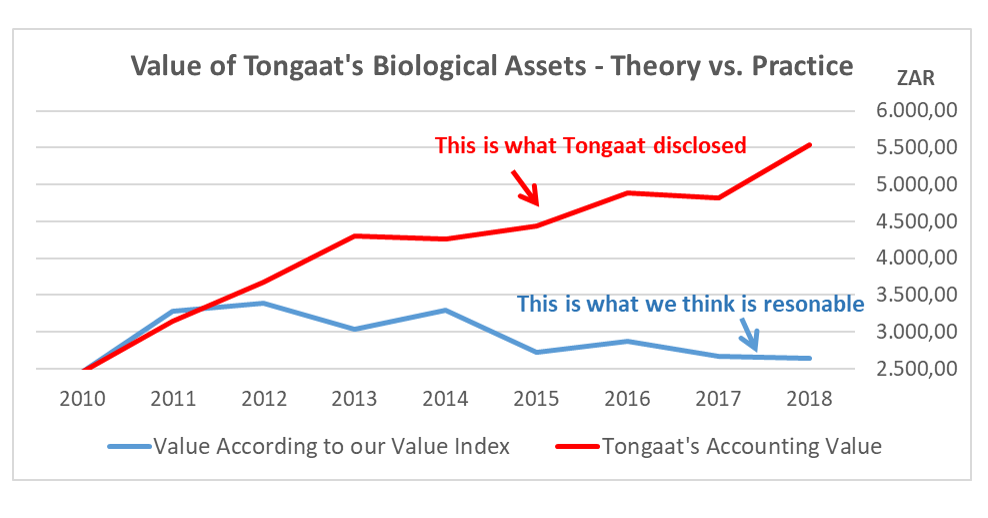

We start with our analysis in year 2010 and we run through the numbers. We follow the valuation as stated by Tongaat Hulett , i.e we exclude the sugar price development for cane roots valuation to stay close to the replacement value, but we include the sugar price into the standing crane valuation because the latter is reasonably close to the sugar market. We also excluded all exchange rate effects. And this leads us to the following analytically estimated “fair value” development of the biological assets.

In the graph the actual accounting valuation of Tongaat Hulett’s biological assets is contrasted to our valuation. What a big difference this is! Just as an explanation: The main negative to our analytical path here is the sugar price development for the standing canes. And we can see: Base on our assumptions it is impossible for us to retrace what drives the company to the valuation disclosed in the annual reports. It is also not the case that we are particularly conservative in our calculations here. It is just a fair rebuilding of the valuation approach of Tongaat Hulett from our information point of view.

It is worth to remember here: it is all profit-&-loss-relevant what Tongaat Hulett provided in its accounts! As we can see, our analysis indicates that over the years there is an accumulated profit-&-loss-relevant difference of almost 3 bn ZAR between our estimates and the company-stated ones. Not an insignificant number for a company with an annual stated pre-tax income of on average about 1 to 1.5 bn ZAR.

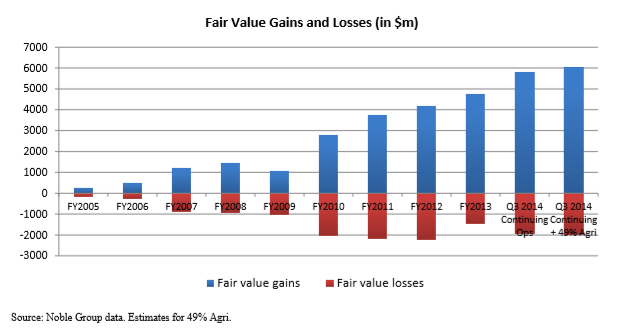

This picture – again: here only based on subjective analytical insight and not confirmed – is not a new one. We have seen a lot of companies in the past which presumably took the chance of making use of the weak IFRS 13 / IAS 41 accounting-hole to dress up their numbers. A quite serious example from Germany was the once-listed, now insolvent company Asian Bamboo AG, which mainly produced bamboo wood and realised huge earnings until 2013 based on IAS 41 paper revenues (of course not supported by cash flows). Once it became clear that these expected price increases will not materialise the company suffered from massive impairments and finally had to go bankrupt in 2015.

Another famous example – this time not directly related to IAS 41 but rather to the fair value accounting and the associated P&L-relevant gains and losses of similar transactions– is Noble Group which have been the victim of short-seller research house Iceberg Research in 2015 who uncovered their accounting practice with regard to certain metals and minerals. As a matter of course, many of these gains later never realised. Today the company is technically insolvent and in the middle of a court-overseen restructuring process.

Without stating the obvious, there are a lot of companies out there where we have some headaches when we look at the numbers, even if they are far from being a bankruptcy candidate. In these cases it is simply a question of reliability. How much can you trust the numbers if there is so much leeway and discretion for management to recognise revenues?

For investors there are a couple of important points to consider when dealing with companies that have a material IAS 41 exposure:

- By nature, the earnings generated via IAS 41 accounting are much less reliable than earnings that are the result of a finished transaction. This is not a bad signal per se, it could also turn out to be better in the end. Even a super-honest CFO can only provide you with his best guess on what might later turn out in a transaction. But the signal from IAS 41 accounting (paper profits) is much more blurred, and not as clear and conclusive as the one from a usual cashflow-backed revenue generation process.

- Be particularly wary if the combination of IAS 41 and level 3 measurement of IFRS 13 is in place (you should find information on this in the notes). This is a very dangerous situation in terms of information quality of earnings. Take this high uncertainty into account in your valuations!

- Always try to retrace the proceeding of companies applying IAS 41. You are not able to check every parameter? Does not matter. Try to bring in your best guess. Are there any breaks that you do not understand? Confront the management with it. And: Have a model ready which allows you to calculate some sensitivities. Are there some driving parameters where you have a strong opinion on (such as e.g. the sugar price in the Tongaat Hulett case)? IAS 41 business models usually have a lagged cash generation process (cash inflows follow earnings with some periods time because cash only flows once products are sold). So, your parameter projection has an immediate impact on the expected cash generation – and hence on the business valuation.

Caveat to this analysis: Again, this is just a subjective analytical view based on partially imperfect information. Things might be different in reality. We hold no economic interest in Tongaat Hulett.