There is an old saying in financial statement analysis: A good balance sheet is mostly even better, and a bad balance sheet is mostly even worse in reality. The reason for this observation is that accounting rules keep preparers of financial statements within a certain range but also that preparers have some incentive to mean revert in their reporting. While not so well-known in practice, the same observation (positive -> even better, negative -> even worse) also relates to most professional expertises. A reader of these expertises often has to identify the little nuances in order to understand what is really behind. In particular if it is about opinions. In the case of expertises the reason for this phenomenon is that preparers often fear that their work would not be seen as ‘professional’ enough if opinions are clearly (and without any major disclaimers) articulated. Bearing this in mind, we should have a closer look at the report that German auditing company KPMG has handed over to the supervisory board of Wirecard after finishing their investigations, and which was published at 27 April 2020. The original German version can be found HERE, and the English version (translated by Wirecard) can be found HERE .

The idea is not to recapitulate all the findings of the KPMG report but rather to highlight some of the – as we think – rather weak points of the report. This is important as it gives us a better feeling of what we could have known (and what we could not have known) earlier in this process.

Important: We comment on the KPMG report here without taking into account the new information since 18 June 2020. It is not about bashing KPMG with our hindsight know-how but rather to look at the report from the viewpoint of when it was published.

What was the idea and the general tone of the report?

In October 2019, Wirecard (represented by the supervisory board) mandated KPMG to conclude an independent special investigation. KPMG’s assignment was to adress several problematic areas and to answer questions on accounting and business performance that arose mainly in the context of former press reports in the Financial Times but also from other sources over the last months/years.

In this report, KPMG could disprove some of the accusations against Wirecard. But overall, many questions stayed unanswered. KPMG relates this (amongst others) repeatedly to problems in getting required information and data from Wirecard, but also to not getting answers from necessary third parties. The overall tone of the report was downbeat. The report does not draw a very bright picture of the compliance and governance of Wirecard.

The published report covers all major findings, as far as we understand. There are appendices to the report but as far as we know they mainly relate to “personal information and confidential business secrets” (section 1.3), so not to any relevant information from the investigation.

While helpful in general, in our eyes the report also contains several shortcomings. These problems should be adressed in today’s blog post. We go through them one after the other:

Why has KPMG investigated the substitute list?

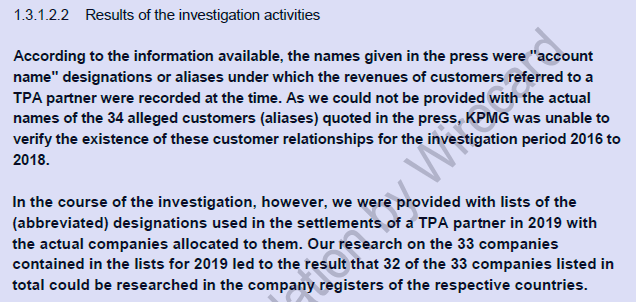

In section 1.3.1.2 KPMG analyses the existence of certain customer relationships. In particular, a list of Wirecard-customers (or customer groups) of 34 names from 2017 is in the focus of this investigation. However, KPMG concluded that they were not provided with the lists and hence could not verify the existence of the customer relationships.

Then, however, KPMG states that after they have given up on the 34-names-list, a list from 2019 was handed over to them (as we read it: a different list than the target one), this time covering 33 names. And KPMG could then verify most of the customer relationships of this substitute list.

For us it is quite unclear what this proceeding should tell readers (if we read it correctly). The original list could not be analysed, and then KPMG just takes another one that has been actively given (presumably by Wirecard) to them and analyses this one? This proceeding cannot answer the original question and for us it is not a big surprise that the substitute list is mainly ok.

Source: KPMG, Report concerning the independent special investigation, Wirecard translation, section 1.3.1.2.2

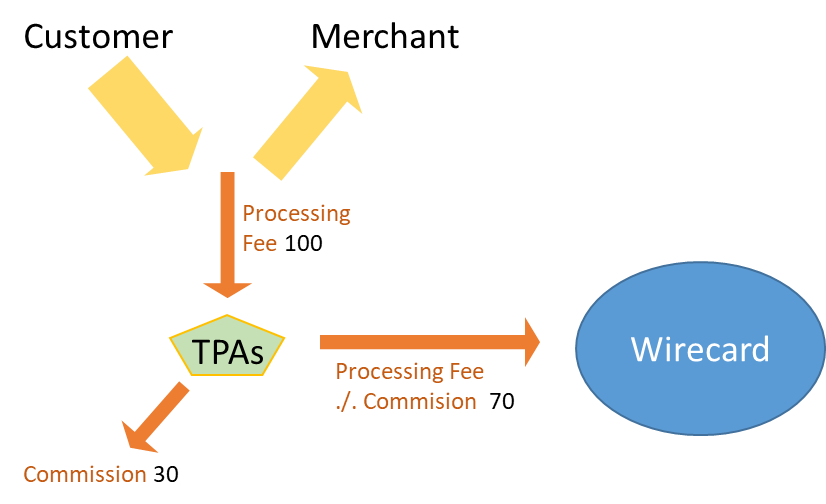

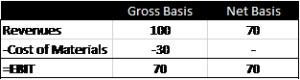

Why does KPMG react so softly on the accounting treatment of revenues from Third Party Acquiring (TPA) business (section 1.3.1.4.2)?

Wirecard accounts for revenues from the TPA business on a gross basis, i.e. it records the full processing fee of the transaction (100 in the example below) as revenues and then deducts the commissions (30 in the example below) to be paid to the TPA for providing this service as ‘cost of materials’. The following graph (simplified cash flow depiction) and table (accounting treatment) higlights this proceeding and shows the differences to a revenue accounting on a net basis where only the difference between processing fee and commission is recorded as revenues (for an overview of the Wirecard business model, see HERE).

As can be seen, on an earnings level both approaches lead to the same result. But differences exist in the amount of revenues and margins.

KPMG states that the question is here whether Wirecard has “control of customer relations” (then gross accounting is appropriate) or not (then net accounting is appropriate). To give you a bit of accounting background here, this touches IFRS 15 revenue recognition, and particularly the topic “Principal vs. Agent considerations” which is discussed in IASB, Clarifications to IFRS 15, 2015, B34-B38, which in turn can be found HERE.

KPMG correctly states that from their research they were “…not in a position to fully understand Wirecard’s own classification as a principal and thus the ‘gross accounting’ of revenues…”. We agree with this finding but we would even go one step further: From the findings (only in exceptional cases Wirecard knows who the customer is, in most cases they have no clue) this clearly shows that Wirecard is an agent in this business and net accounting is mandatory here – something that EY as the regular auditor of Wirecard should have also realised before at our opinion.

How can the escrow accounts be ‘cash’ if you even do not get a bank confirmation or account statement (section 1.3.1.4.3)?

Wirecard treats the escrow accounts as “cash or cash equivalents” on its consolidated balance sheet. KPMG correctly states that this classification should be questioned. KPMG refers to the problem that because of the nature of these accounts “availability at all times without penalty” might not be met and then these accounts should be other financial assets. But they also state “With regard to the aspects described above, there is room for interpretation and discretion, which Wirecard uses according to an expert opinion.”

This KPMG-assessment seems to be quite soft. Just to put things into perspective: Neither Wirecard nor KPMG were able to get a proper bank confirmation or account statement over the whole period of the investigation. Information access is a very low version of “availability at all times”. If getting proper and timely information is not possible then these accounts cannot qualify as cash.

We even think that one could go one step further – to the question whether one can recognise an asset anyway if no access to information is available. The Conceptual Framework for Financial Reporting 2018 states in F 4.4 (a): “An asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.“ If one understands lack of information access already as a lack of control, then it could be that even a non-recognition would have been appropriate (important: even without the knowledge we have today). It would have been very helpful if KPMG had at least enlarged the discussion about this problem and put some more flesh to the bone.

Was the acquisition price for the payment business of ‘company 9’ too high?

Wirecard has paid a price of roughly 336 mio Euros (inluding earn out) for the payment business of ‘company 9’ in India. However, the fund from which it bought this business has only one year earlier bought this business for a price of only roughly 37 mio Euros. While the process also raised some questions which are discussed in the KPMG report, we rather want to focus here on the particular answering of the question of whether Wirecard payed an excessive purchase price for this object.

The tools for determination of whether an excessive purchase price is paid are manifold. Only focussing on the economic perspective (the fraud perspective would come on top), one could e.g. perform business valuations and do some sort of a “fairness opinion”. However, KPMG has done nothing in this regard. KPMG has just checked some comments from Wirecard regarding the ideas behind this acquisition. Based on this analysis, KPMG writes: “The accusation made… [of an excessive purchase price] … cannot be confirmed on the basis of the information available.” (section 1.3.4.1.2) This proceeding does not seem to be very helpful for getting an answer to the questions raised in the context of this acquisition.

What efforts has KPMG made to get to their results in general?

As it gets clear from the report that KPMG operated in a very difficult research environment and often wasn’t provided with necessary information during this process (from total different parties), it is not a big surprise that many of the questions to be adressed could not be answered by KPMG. This is not at all a problem of the report.

However, in many cases it is not clear what efforts KPMG has made to get to the desired information. Or putting it differently: How hard they have fought to answer the questions. Knowing this is however of utmost relevance for a reader (and particularly for the supervisory board of Wirecard). Not being able to answer can e.g. mean anything between a probability of 5% and 95% (taking here the 5% at the limits as being still a clear yes or no). And while we understand that KPMG cannot give probability assessments here we think they should have given all the information on their efforts in order to allow a reader to get to at least a rough probability assessment.

Some Questions (but not all) that we have:

- How hard has KPMG tried to get the bank certification? Why should coronavirus be such a big obstacle in getting this certification (“In view of the spread of the coronavirus, it has not yet been possible to provide KPMG with corresponding direct bank confirmations in a timely manner.” (section 1.3.1.1.2) “Corresponding direct bank confirmations to KPMG … could not be provided in a timely manner to date due to the spread of the coronavirus.” (section 1.3.1.1.5))? Why did KPMG only talk to branch employees (“In the course of our on-site visit to the banks, on March 4, 2020, we were orally informed by an employee of a branch of Bank 2 that the corresponding account balances were being held for the account of Wirecard.”)?

- Did KPMG stop with the background check of the 34-name-list when they were not “provided” with the actual names? Couldn’t KPMG confront Wirecard with the names as researched by others, e.g. FT?

- Which steps has KPMG taken to find out the real size of the merchat cash advances (MCA) business? How much over and above the pure numbers from the management presentation has been found out?

By adressing these questions – and some more – KPMG would have greatly contributed by telling a bit more of what they have tried during this whole process.

Has KPMG left one of the main sources of information untapped?

On top of the former point, we want to particularly highlight one additional aspect. One of the main sources of information for this whole case – and basically the main trigger for the special investigation – is the Financial Times. And it is not only the lead analyst and reporter in this case, Dan McCrum, but the whole network of information that FT has gained access to from external parties and whistleblowers over the years.

However, as far as we understand the report, KPMG has not proactively approached FT. In section 1.2.1.6 the report mentions that KPMG was provided with information from third parties but the wording sounds like KPMG has been approached by these third parties – not the other way round. And it is unclear whether FT is part of this group.

Not to be misunderstood: this point is not about taking the position of the FT, not at all. It is only about using all available information in this process. And if KPMG had found out that the information from FT is useless, then it would be also ok. Furthermore, for the KPMG report the whole framework of assignments is described in sections 1.1 and 1.2. Additionally, KPMG gives the statement: “KPMG determined the scope and nature of the relevant investigation activities independently and at our own discretion in accordance with our engagement.” (section 1.2.) We couldn’t find any information that contacting FT would be prohibited. We also don’t think that there are side-agreements to the investigation assignment which are publicly unknown.

So, the least we can say here is that it is unclear whether KPMG has talked to FT, but we have the subjective impression that they have not – at least not in a structured way.

Summary:

- Admittedly, the KPMG report helps a lot in understanding the Wirecard story. And we also understand that the research environment was very difficult for Wirecard. However, there are several aspects in this report which give rise to a quality critique.

- The main points from our side are: the switch to the substitute account name list, the unclear accounting positioning regarding revenue recognition and escrow accounts, the short way of checking excessiveness of the purchase price for the acquisition in India, and the unclearness of the amount of efforts that KPMG has put into the single steps (including the question why they seemingly have not actively approached Financial Times).

- Certainly we will get more answers on some of the underlying questions in the coming weeks which will shed fresh light at many aspects. However, we think a bit of more evidence would have also been possible with the KPMG report at the time of issuance.

- It is important to note that this report is not written with hindsight but rather with a focus on the state of information at the time of issuance of the report.

Disclaimer: We hold no direct economic stake in Wirecard – in whatsoever direction. And we have no major business relations to KPMG (only that we train staff in business valuation issues from time to time). We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all.