Thursday, 18 June 2020, marked the preliminary peak of the story of Wirecard, the German DAX-listed payment processing company. That day, auditing company Ernst & Young refused to sign-off the annual report as their hopes to find roughly two billion Euros that are missing on the balance sheet have vanished into the thin air of Manila/Philippines: The two banks BDO Unibank and Bank of the Philippine Islands where the funds should have been deposited declared in two indpendent statements that in fact they do not have any business relations at all to Wirecard.

For many years now, the story of Wirecard has been packed with discussions over its accounting proceeding and its business model. In particular the Financial Times has issued several analyses in this regard over the years (see HERE). Some of the Financial Times accusations lead to a special audit conducted by KPMG. The translated report (original is in German) on the results of their investigations has been published at 28 April 2020 and can be found HERE.

Below, we want to shed some light into the current situation, starting with a short explanation of the business model of Wirecard (necessary to understand the current issues) to then going on with a short explanation for what could be explanations for the missing money.

What is the business model of Wirecard?

Wirecard is a payment processing company that provides infrastructure and services for online payments. For relevance of the current issues in particularly three different aspects of the business model are to be discussed:

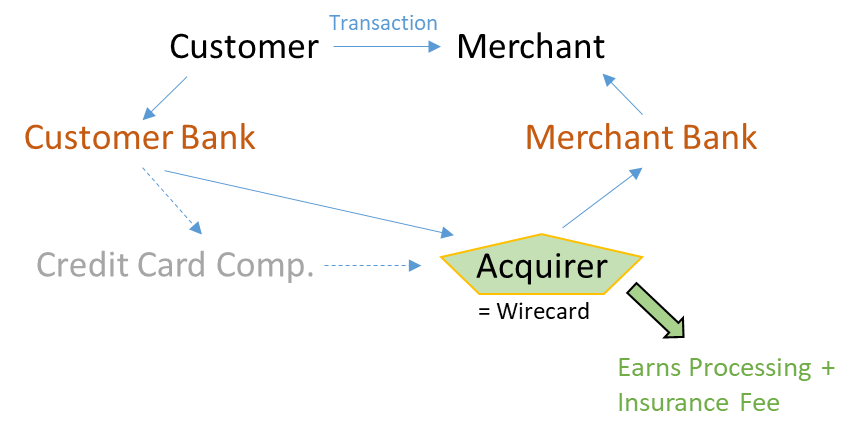

First, and this is the original business of Wirecard, the company places itself somewhere into the payment circle of online transactions. When a customer buys something from a merchant, its bank transfers the money (often via credit card companies) to the so called acquirer (this is Wirecard) which then transfers the money with a time lag to the merchant. The acting of an acquirer is necessary as it provides insurance for e.g. the credit card companies against the merchant not delivering the goods, or similar cases. The acquirer optimises its risk management by delayed payments (duration dependent on the merchants risk profile) and by staggered payments (keeping parts of the sum as collateral).

It is important to understand that this business is a negative-working-capital business, i.e. the receivables of acquiring business – expected payments from the customer bank or the credit card company – are cleared first by a cash-in to the acquirer and then it takes some time until the liability of acquiring business is settled at later time. Inventories do not play a major role here. Negative-working-capital businesses have the attraction of companies getting pre-financed. The deposits of acquiring businesses are called the merchant float.

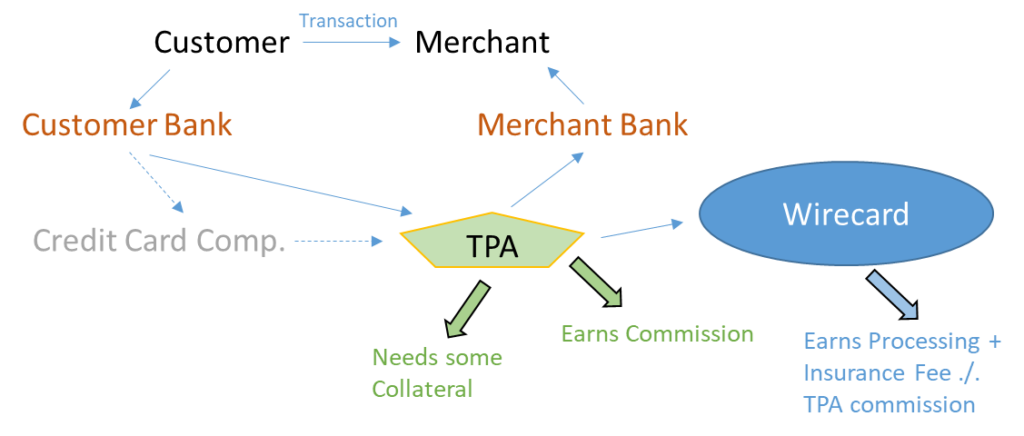

For doing such transactions, acquirers need a banking license which Wirecard has via its Wirecard Bank subsidiary. But for being a powerful player in the online payment business it is necessary to be able to offer services on a worldwide basis. However, Wirecard – similar to other payment processing companies – can certainly not hold banking licenses in all regions of the world. This gives rise to the second pillar of Wirecard’s business model: The Third-Party-Acquirer (TPA) business model. Here, Wirecard makes use of partners in the respective region (and which hold a banking license), pays a commission fee to them and provides security deposits so that the TPA is not running into danger to stand in for any problems that arise in the customer-merchant transaction.

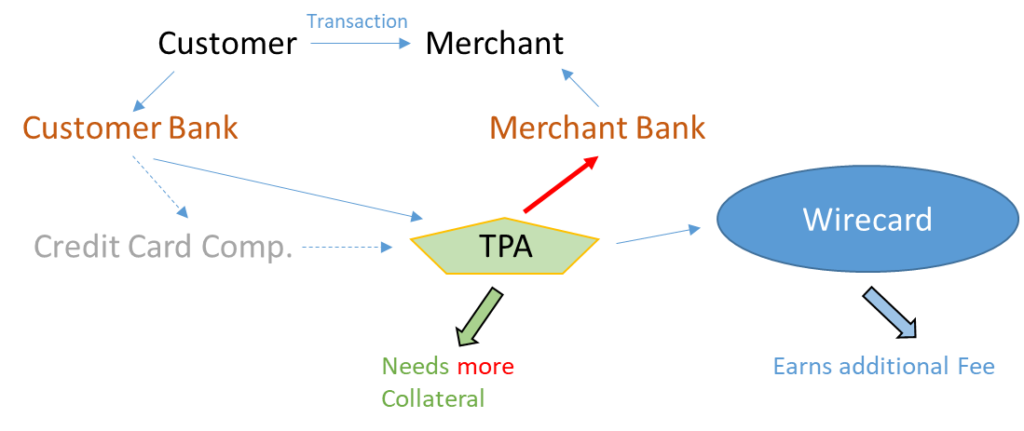

And finally, Wirecard also offers a so called merchant cash advances (MCA) or digital lending. This is not a business model per se but rather an additional value-adding service. Here Wirecard or TPAs offer some sort of early-settlement of the transaction to the merchant, i.e. they do not go for the delayed payments as explained abvoe. This service can be understood as some sort of working capital financing to the merchants. Of course, it needs a quite deep risk assessment of the merchants in order to optimise this business. And if it is performed by TPAs higher security deposit payments are necessary than in transactions without MCA as the financial impact of transactions problems is now bigger for the acquirer.

For the current events which led to the refusal of EY to sign the annual report in particular the latter two aspects of the business model are important. Obviously, Wirecard has to provide in these two transactions security deposits. It usually does so on escrow accounts and via trustees. But one consequence of this is that now this cash is sitting somewhere abroad.

How much cash (or other assets) is used as security deposits at third parties?

To be honest, we do not know! We have some indications but can only give a rough estimate here.

- Looking into the financial reports of Wirecard we can see that in basically most periods the receivables from acquiring business are higher than the liabilities from acquiring business, e.g. in Q3/2019 receivables 732.8 mio Euros vs. liabilities 578.6 mio Euros. However, because of the negative-working-capital charakter of this business we should expect the opposite relation. In earlier years, e.g. in 2016, Wirecard has commented that this is the case as parts of the receivables are not direct receivables in the payment circle but have the character of security deposits for TPAs. In recent times, e.g. 3Q/2019, the company explained this effect by the early settlement of the merchant receivables, i.e. by its MCA program. Nevertheless, we still think that some of the receivables in acquiring business have the character of a collateral in the TPA business.

- Some of the cash is that is shown on the balance sheet is used as a collateral in the TPA business. This is also what the KPMG report (section 1.3.1.4.3) discussed for the concrete amount of 1 bn Euros.

- The MCA balances of Wirecard were standing at 320 mio Euros according to the Q3/2019 investor presentation and the KPMG report (section 1.3.2.2.2).

- In the adhoc information about the delayed annual report, Wirecard wrote: … no sufficient audit evidence could be obtained so far of cash balances on trust accounts to be consolidated in the consolidated financial statements in the amount of EUR 1.9 billion.” (HERE) The company clearly speaks about “trust accounts”, but we are not sure whether this is a credible set of information here.

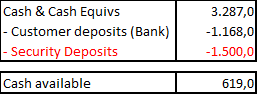

Summing this up we estimate that a minimum amount of 1.5 bn Euros is held in escrow accounts as a security deposit, if the adhoc comment is correct, then even more. Because of the development of the regional business split in recent years we also expect that most of these escrow accounts are somewhere in the Asia-Pacific region (but we do not know).

How much Cash has Wirecard?

Again, we have a look at the Q3/2019 numbers. If we include our minimum amount of 1.5 bn Euros as security deposits we can derive an expected number for the cash available.

Comment: We followed the understanding of Wirecard management that the part of customer deposits at Wirecard Bank which is directly invested in fixed-income securities (ca. 550 mio Euros) is not to be deducted from the balance sheet cash position.

In this calculation we see to which available cash number we get with our minimum estimate for security deposits. And again: The security deposits could also be higher. Taking the 1.9 bn Euros as a minimum amount we would come already quite close to the zero-number.

Comment 2: In the KPMG report a lot of discussion is about how to treat the security deposits in escrow accounts on the balance sheet for IFRS reasons: is it cash (as Wirecard says) or is it some other financial instruments as KPMG very softly suggested. We do not want to comment on this reporting problem here as it does not matter for our economic analysis (although we have a very clear opinion on it). In economic terms restricted cash is basically not available witout any loss of business for use of the company and that is the relevant point here. For more on restricted cash, read our blog post on Telia HERE.

Possible explanations for the missing 2 billion Euros

In the KPMG report, a big point of discussion was the question whether (at least some of) the TPA revenues in the Asia-Pacific region really exist. KPMG could not really evidence the existence or concrete amount of Wirecard revenues. The reason here is mainly access to data. However, they provided some indications (85 mio Euro payment from TPAs and verification of December 2019 transactions).

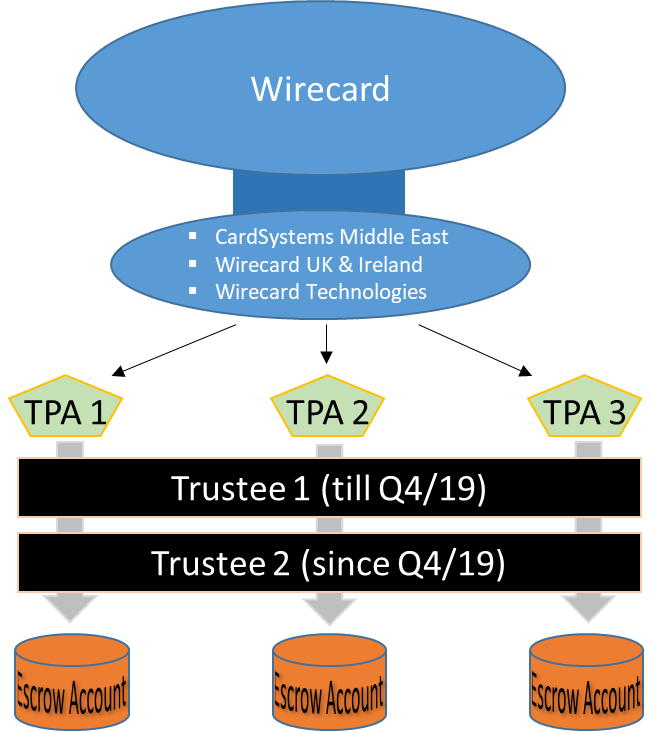

Having a closer look at the communicated structure of the TPA business, we can see that the TPA business mainly runs through the three Wirecard subsidiaries CardSystems Middle East, Wirecard UK & Ireland and Wirecard Technologies. There are three relevant TPAs for which a trustee manages the necessary escrow accounts (for the security deposits). In Q4/2019 the former trustee 1 ended the cooperation and handed over to to trustee 2 (Source: KPMG report).

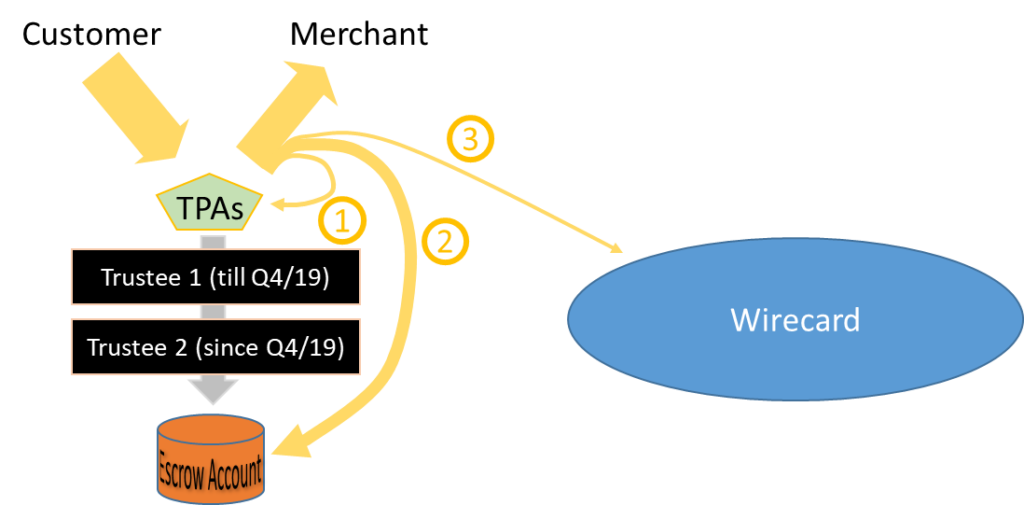

The business flows in the TPA business are mainly as follows: Cash comes in from the customer (or the credit card company), a part of it is kept as a commission fee (1), a part is used to feed the escrow accounts (2) – these amounts were quite material as the growing business required a growing deposit (see also KPMG report, section 1.3.1.1.3). And some parts flow to Wirecard (3). The remaining amount is then forwarded to the merchant.

And now we can finally come to the question where the missing 1.9 bn Euros could be. From what we wrote above we think (but are not sure) that at least most of the money is money in escrow accounts from TPAs. As it can not simply disappear there are basically two plausible possibilities for how it left the company-sphere:

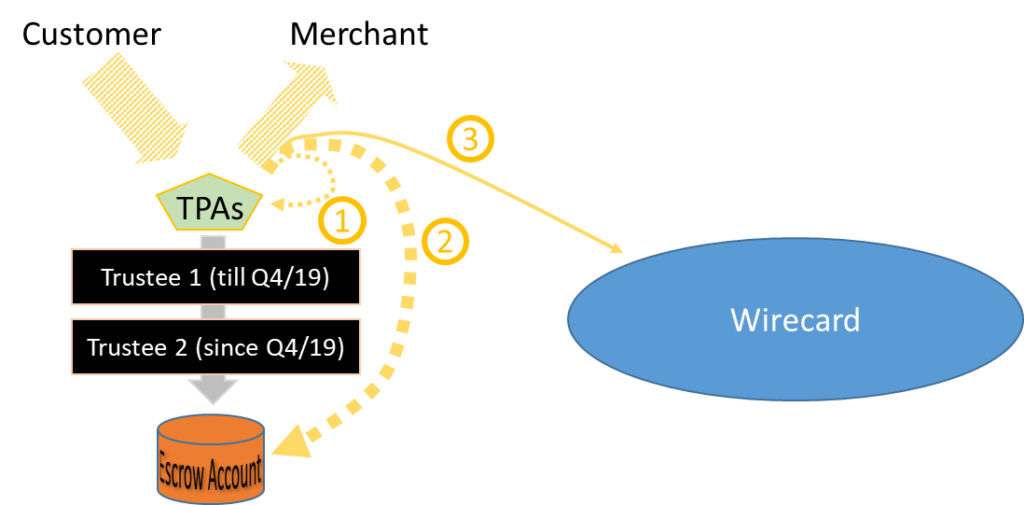

- There was some fraud at the account level. I.e. somebody related to the bank or the trustee has just taken the money.

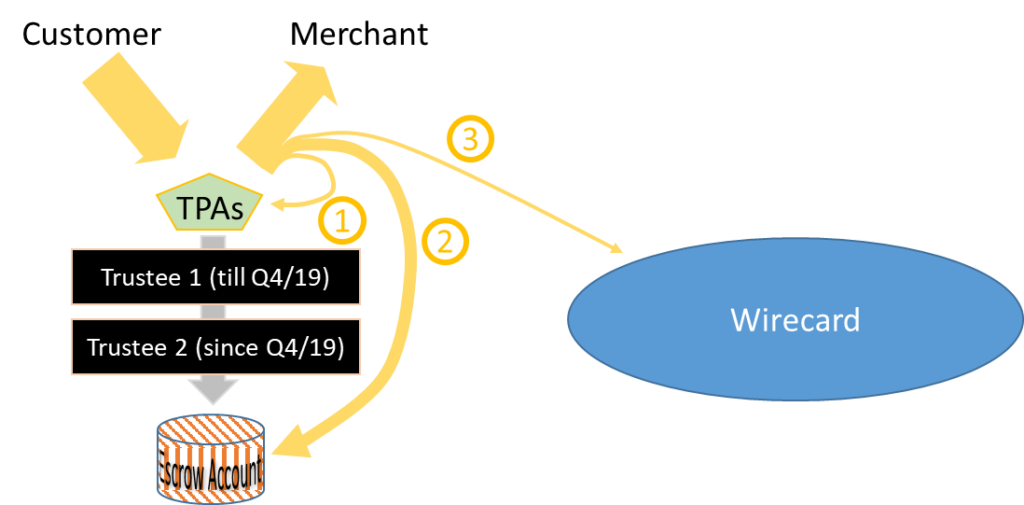

- There was indeed some fraud at the revenue level. I.e. perhaps some of the transactions of TPAs have simply not taken place, there was no feeding of the escrow accounts – they stayed empty – and hence it was never necessary to open up these escrow accounts at banks. This would mean that the allegations about the missing revenues of Wirecard could be true. It is scary that the fact that EY hit dead end in ist search for the 1.9 bn Euros seems to be a support for this big fraud hypothesis.

But these are only potential explanations. Perhaps there is also some other explanation – and hopefully there is (for all parties involved). However, our explanations fit somewhow to the other information we got over time and from the KPMG report (and which we have not discussed in this blog post).

Summary (so far)

- The business model of Wirecard required to stuff a lot of cash into escrow accounts held in totally different regions of the world. The balance sheet cash number does not mirror this effect.

- We are still not clear how much cash is now available to Wirecard. However, we think that the available cash should be close to zero if the 1.9 bn Euros are really gone. For a clearer analysis, it would be necessary to understand whether there are other material amounts outstanding in escrow accounts.

- According to our analysis, the missing cash could be taken by an outright theft or by a complicated structure to generate fake revenues in the TPA business (which would be in line with some accusations made in the past). However, we have no further indication and this is only our estimate of what happened.

- Both variants are possible also without the concrete cooperation of Wirecard staff. This blog post is not at all an accusation.

- There are many aspects to be discussed in this whole process, starting with corporate governance issues (on different levels), continuing with the role of auditors and finally reacting to fresh information that we will get. Short: We will continue our blog posts on Wirecard.

Disclaimer: We hold no direct economic stake in Wirecard – in whatsoever direction. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all.