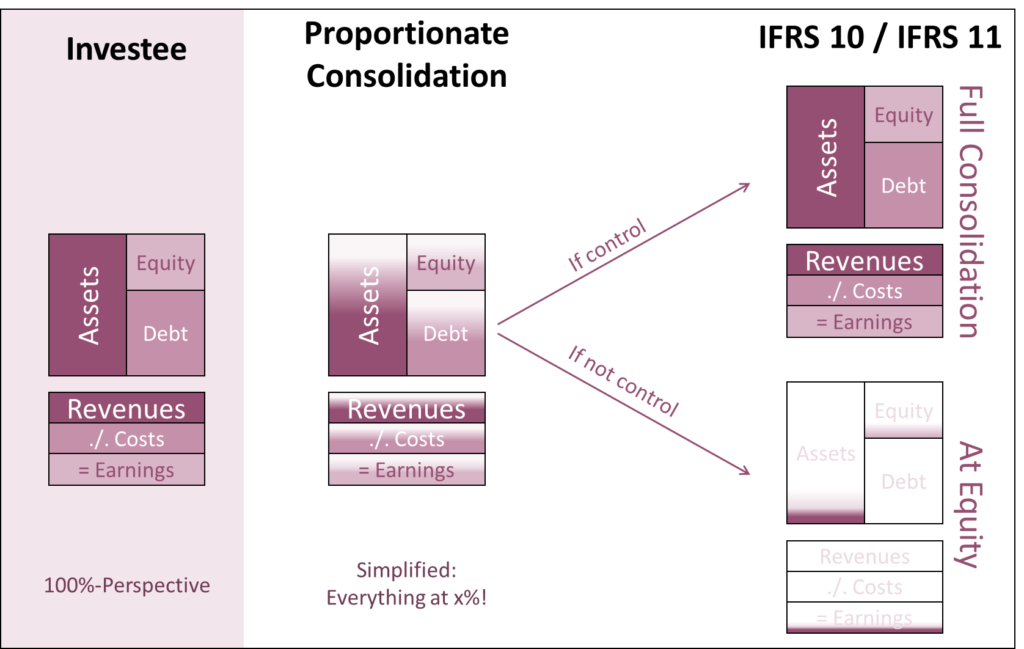

In 2011, the International Accounting Standards Board (IASB) disclosed a whole package of new and revised standards that all addressed the topic ‘reporting entity’. Amongst these standards were the new IFRS 10 Consolidated Financial Statements and IFRS 11 Joint Arrangements. One of the core messages of these two new standards was: The so far existent policy choice of ‘proportionate consolidation’ for jointly controlled entities (i.e. joint ventures) has been eliminated. Starting at 1 January 2014, the date where IFRS 10 and 11 become effective, such jointly controlled entities either have to fully consolidated (if controlled) or accounted for at-equity (if not controlled).

For financial presentation reasons this meant: While with the former possibility of proportionate consolidation, companies could take assets, liabilities, revenues and costs of investee companies at the percentage of ownership into their books, they now have to take them at 100% (full consolidation) or not at all (only the equity-participation value shows up at the asset-side of the balance sheet, net earnings contribution shows up as part of the financial result).

The change in opinion of the IASB came a bit as a surprise. In fact, the old IAS 31 Joint Ventures (which regulated joint ventures accounting before) did not recommend the application of the equity method with the statement that proportionate consolidation better reflected the substance and economic reality of an entity’s interest in a jointly controlled entity. Now, with the introduction of IFRS 10 and 11 the IAS staff explained that it is now believed that the ‘economic substance’ of the arrangement is rather defined by the ‘rights and obligations’ assumed by the parties when carrying out the activities of the arrangement. And these rights follow rather the contractual arrangements of control (or not control).

Many companies and investors were not very happy with this new set of rules. In fact, proportionate consolidation helped a lot both in presenting the share of performance of such investee companies but also in analysing the performance contribution of these holdings. But since 2014, proportionate consolidation is history in IFRS.

SBM Offshore N.V., a dutch supplier to the oil and gas industry, was also rather dissatisfied with the developments in IFRS. The company is building and operating floating production and storage facilities for offshore drilling activities. Their main products are floating production storage and offloading (FPSO) units – floating vessels that can be used for production and processing of hydrocarbons, and for the storage of them. The vessels are either owned and operated by SBM Offshore and leased to its clients (Lease and Operate arrangements) or supplied on a Turnkey sale basis (construction contracts). Even in the latter case, the vessels can be operated by the Company, under a separate operating and maintenance agreement, after transfer to the clients. But due to SBM also delivering operation services of these vessels they are often not leased or sold in full but only a share in it, so that they can be run as a joint venture. As a result, the asset portfolio of SBM offshore is a big collection of participations in such or similar projects with ownership between 30% and 75%.

SBM has already been quite unhappy with the rules for leasing from the lessor point of view (IAS 17 at that time, now IFRS 16). The rules for finance leases led to revenue and profit recognition quite early in the construction phase, well before rents are invoiced to, and paid by, the client. This led to a disconnect of earnings and cash flows and a lot of need for explanation to investors. Now, with the introduction of IFRS 10/11 it all seemed a bit too much for SBM Offshore.

As a consequence, in June 2013, SBM offshore introduced the ‘Directional Reporting’ methodology in addition to IFRS, in order “to provide greater transparency of the underlying business performance.” (Source: SBM AR 2013, p. 57.) but also to allow investors to follow management’s approach to running the business: “In addition to reporting under International Financial Reporting Standards (IFRS) guidelines, the Company’s Directional reporting methodology was implemented to reflect Management’s view of the Company and how it monitors and assesses financial performance.” (SBM AR 2019, p. 36).

And SBM took it seriously. Bruno Chabas, CEO of SBM Offshore, said in the Q4/2013 Earnings Conference Call: “So the guidance; I’m pleased to tell you that the guidance will be based on directional reporting. That’s – you’re never going to hear me any more speak about IFRS; never. Peter [van Rossum, former CFO, my complement], for sure, but not me (laughter).” Source: Reuters Street Events, Transcript to the Q4/2013 Earnings Conference Call, 6 February 2020. And as far as we know, Bruno Chabas lived up to his promise – except for mentioning the effect of IFRS 16 Leasing on the Directional guidance a couple of times.

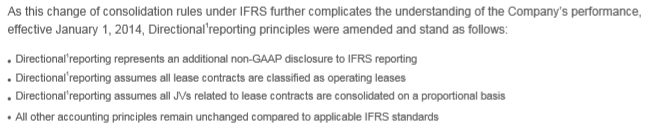

The main features of SBM’s ‘Directional Reporting’ are the following:

Source: SBM AR 2014, p. 116

The effects of this ‘Directional Reporting’ are as follows:

- For lease contracts classified under IFRS as finance leases for accounting purposes the fair value of the leased asset is recorded as a ‘sale’ during construction (mainly relevant for the ‘Turnkey’ segment). This accounting treatment results in the upfront recognition of lease revenues and profits already during the construction phase of the asset, whereas the asset generates the cash mainly only after construction and commissioning activities have been completed (i.e. “at first-oil” [beginning of the lease phase]), as that is the moment SBM is entitled to start receiving the lease payments. In the case of an operating lease (as it is assumed under ‘Directional Reporting’), lease revenues and profits are recognized during the lease period which should more closely track cash receipts.

- All assets, liabilities, revenues and costs of held projects flow into the accounts of SBM according to their respective share of ownership (instead of some being fully consolidated, some at-equity accounted under IFRS).

In this context it is also worth noting that “in 2018, the Company expanded its ‘Directional’ reporting. In addition to the Directional income statement, reported since 2013, a Directional balance sheet and cash flow statement are also disclosed …” (SBM AR 2019, p. 88).

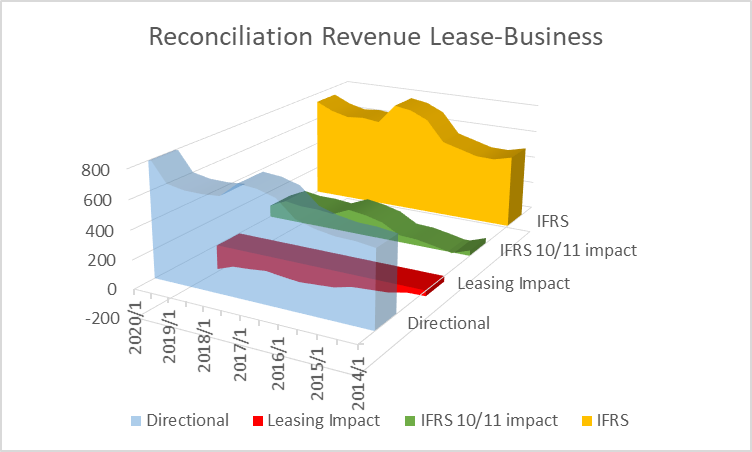

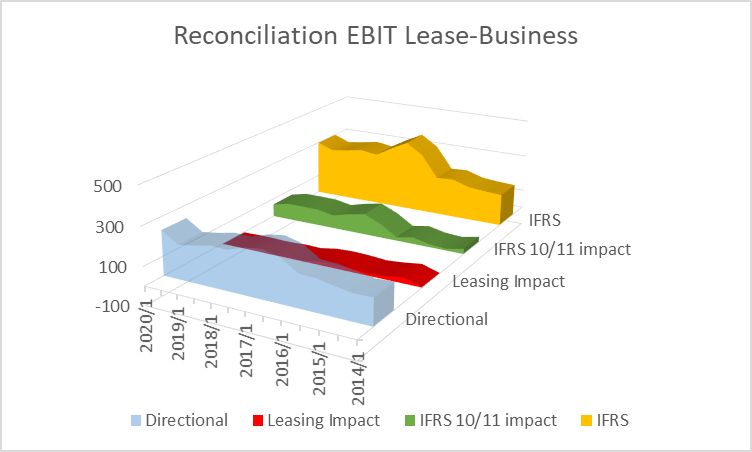

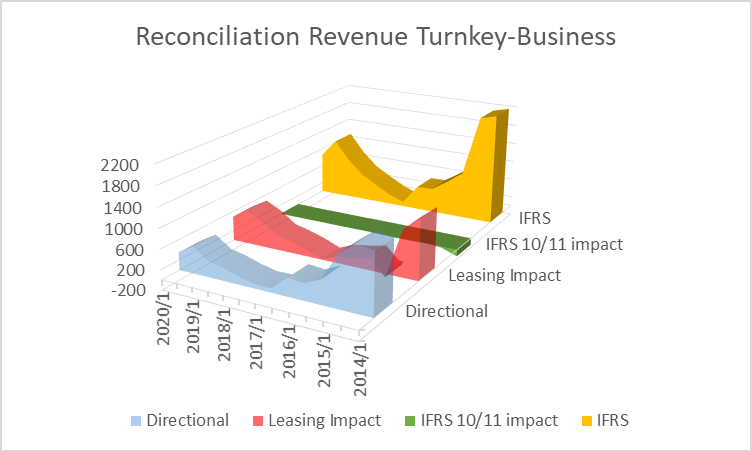

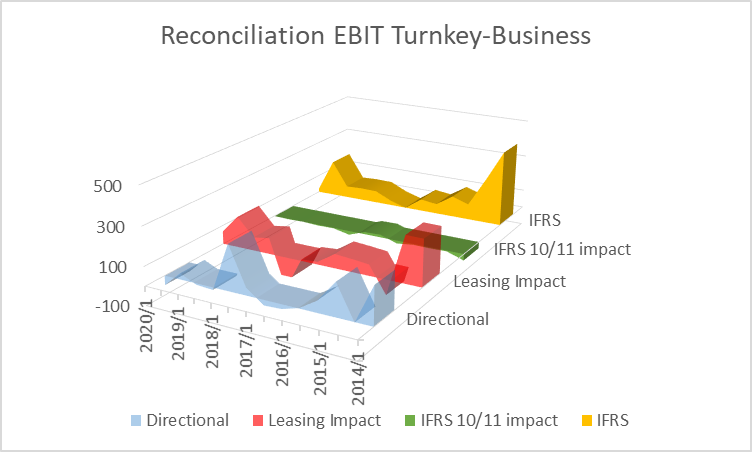

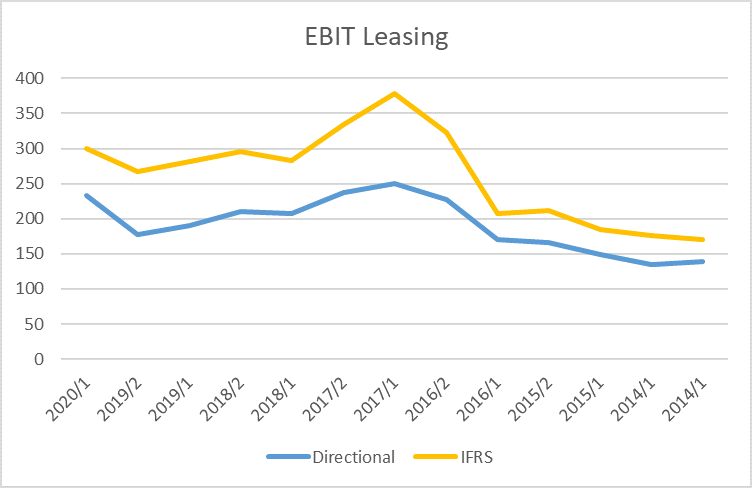

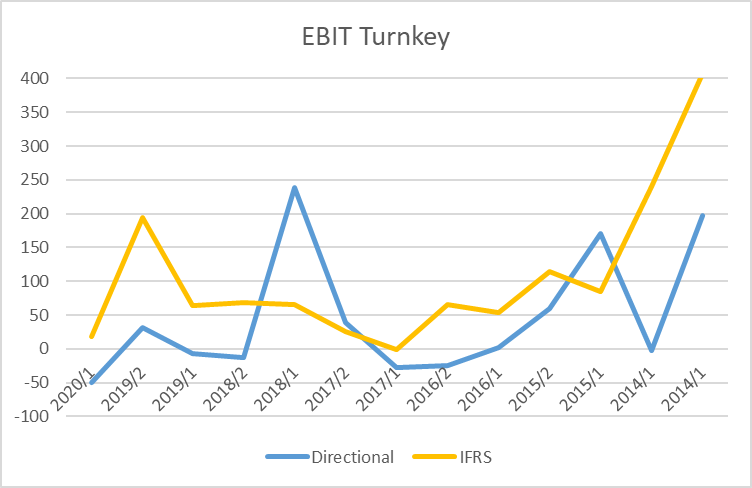

Ok, let’s now see how SBM’s directional reporting compares to IFRS reporting. Below we show the reconciliation on a semi-annual basis since beginning of 2014. We show them in a split way for the two SBM segments ‘Lease and Operate’ and “Turnkey”:

For the “Lease and Operate” business segment we can see the negative impact from finance lease adjustments on the revenue level that evens more or less out on EBIT level. What is left is the consolidation method (i.e. IFRS 10/11) impact which remains a material difference at the EBIT level.

In the Turnkey business segment it is rather the leasing impact – as already explained above – that matters on both levels, revenue and EBIT.

Over time, it can be seen that due to the consolidation effect in the Lease and Operate Business, Directional EBIT is systematically below IFRS EBIT. For the Turnkey segment this is not so fully clear. However, here too, the Directional EBIT is on average lower than the IFRS EBIT.

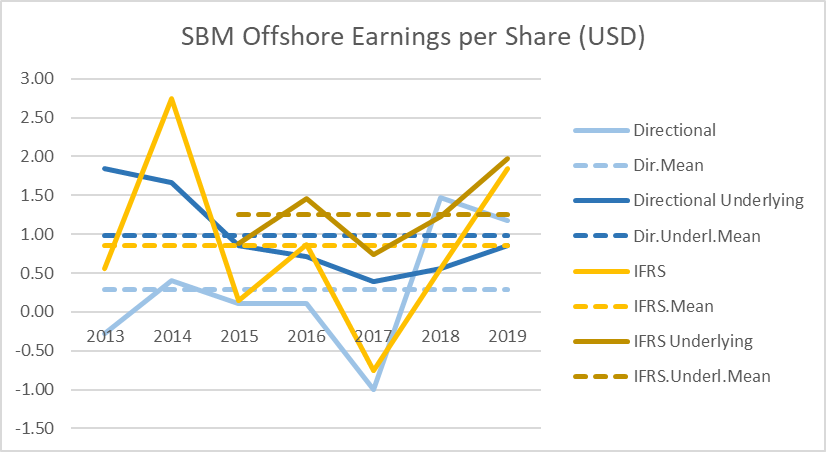

This general tendency of Directional results being lower than IFRS results is also highlighted when looking at the total company earnings per share (EPS) both unadjusted and underlying. Here too, we can see that the Directional values are below the IFRS values. In terms of volatilities of results, we cannot draw a clear picture: While unadjusted results are less volatile for Directional reporting, underlying results show a lower volatility for IFRS reporting.

Of utmost interest is now whether the SBM view or the IFRS view is more relevant as a tool for deriving information. While we cannot answer this question in full because there are many details related to the decision usefulness of information, at least we can see whether the idea of SBM to bring results more in line with the cash recognition of the company has been proven to be correct.

For this we perform two analyses:

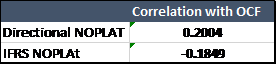

- First we calculated correlation coefficient for the semi-annual NOPLATs (Directional and IFRS) with the semi-annual operating cash flows (OCFs). On average the correlation coefficients were not super-high but we could see clear differences. While Directional NOPLAT showed a low but at least positive correlation, IFRS NOPLAT ran at a negative correlation coefficient to OCFs.

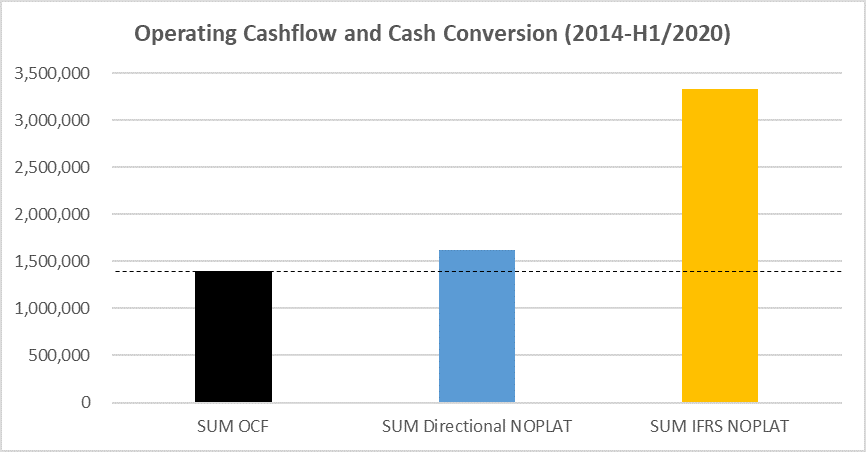

- Second, admitting that there are always some period-to-period shifts in earnings and cash receipts which make a correlation analysis based on semi-annual figures always a bit weak, we also looked at the total period 2014-H1/2020 and compared the total NOPLAT with total OCF. And this is a quite striking result: While Directional EBIT is very close to OCF, IFRS EBIT is much too high as compared to cash receipts over this period.

So, looking at fundamentals and cash-conversion-effects it seems as if SBM’s Directional Reporting is quite a good information tool for investors. And this is also what we get as a feedback from investors and analysts.

In recent months the discussion about SBM Offshore’s reporting has resurfaced again. And it was the IASB itself which got the ball rolling via its proposal on “General Presentation and Disclosures (Primary Financial Statements)”. The proposal and additional information can be found HERE. We have already discussed this proposal in one of our recent blog posts HERE and so we do not want to go too deep into things today. However, it is worth noting here that the IASB recommended to include a special line item: “Share of profit or loss of integral associates and joint ventures” into the profit & loss statements.

As we have extensively explained in our recent post, if one wishes to include such a performance line into the P&L he/she ends up ultimately at the point where one has to seriously think about reintroducing proportionate consolidation. Without proportionate consolidation this performance line will lead to more confusion than clarification.

So, the questions are now: What does the IASB want to tell us with the exposure draft on the Primary Financial Statement project? Do they think about reopening the proportionate consolidation case again (we do not think so)? Do they at least want to soften their arguments for the elimination of the proportionate consolidation policy choice (we could imagine that this is the case)? Will this give SBM Offshore some support in continuing with its ‘Directional Reporting’ (we definitely expect this)?

Let’s see how the further discussion on “General Presentation and Disclosures (Primary Financial Statements)” continues. We think the SBM Offshore case is a quite interesting one to analyse in this context. And it contains a couple of lessons with regard to performance presentation of not fully consolidated entities.

Disclaimer: We hold no economic stake in SBM Offshore N.V. – in whatsoever direction. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all!