Yesterday, short-seller Viceroy attacked MDax-listed leasing company Grenke AG (HERE). Today it raised some more allegations (HERE). One important point relates to the accusations of accounting misstatement of the franchise business and consequences for the cash account. We would like to shortly comment on this below.

The franchise model is Grenke’s way of entering new markets. The rollout is in most cases done via franchise businesses that are operated under the Grenke brand. But Grenke provides even more to these businesses: Expertise, infrastructure, different services and even refinancing of operations. For this Grenke retains the right to buy the franchise firm within a time frame of 3-6 years at pre-fixed terms.

- Consolidation

The first point touches the question whether Grenke has to consolidate these businesses. In this context, IFRS 10 mainly says that an entity has to consolidate another entity if it “controls” it. So the question of consolidation goes down to the question of control. In simple cases the majority (50+%) of voting rights is a clear indication of control, but in some cases this could also be misleading and in other cases control can be exerted also without the voting majority. The rules for control under IFRS 10 are (IFRS 10.7):

“An investor controls an investee if and only if the investor has all of the following three elements:

power over the investee, i.e. the investor has existing rights that give it the ability to direct the relevant activities (the activities that significantly affect the investee’s returns)

exposure, or rights, to variable returns from its involvement with the investee

ability to use its power over the investee to affect the amount of the investor’s returns.”

From the explanations regarding the nature of Grenke’s franchise business one might get the impression that there is a clear liaison between Grenke and the franchise companies. The acquisition option at pre-arranged terms is a strong indication of power and exposure, and the general setting of the relationship also indicates that Grenke has the ability to use its power over the franchise company.

However, for me this is not a clear case. I do not know enough of the relationships to clearly judge whether this is a situation of “control” according to IFRS 10. And additionally, these relationships are clearly one of the focus points of auditors. And I think that it is not super-complicated to make an auditor judgement here that this structure is off-consolidation. In many cases companies that do not want to consolidate set the terms of the relationship to partner companies according to the auditors’ guidelines, they do not go beyond. Hence, I think the consolidation issue is not an accounting fraud (as I believe in auditors’ ability to understand the structures).

However, the economic consequences of Grenke’s franchise strategy are worth a deeper look here. In particular two aspects might be of relevance for readers of financial statements. The first one has already been highlighted by memyselfandi007 HERE.

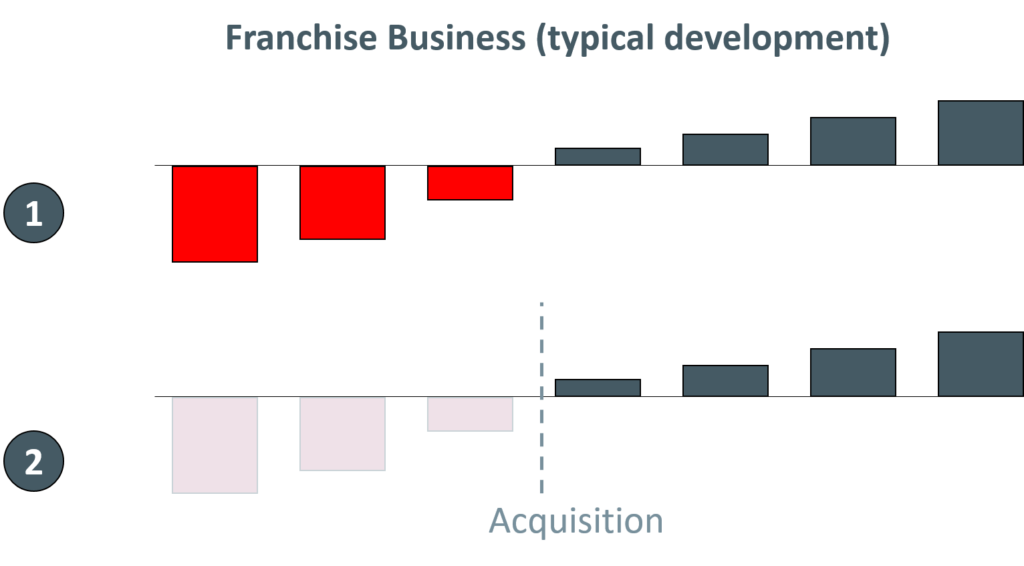

As long as Grenke can create businesses outside of its consolidation sphere (case 2 below), it can step in at a later point in time and does not have to record any losses from starting up businesses in its P&L. According to IAS 38.69 companies cannot bring start-up costs and initial losses as an asset onto the balance sheet. So, if the businesses were developed internally at Grenke (case 1 below) then the P&L and the equity account would have suffered more over the first years. Over the whole period this leads to higher total earnings of Grenke (as compared to the internal generation case). The counter-entry is (depending on the way of structuring such deals) either a lower debt position at the balance sheet, a higher receivables position or some goodwill.

A second effect of “buying your customer” is something which is similar to a trick we have already explained in a former blog post HERE. If a company buys an entity with which it had former business relationships then it can generate some revenues and earnings out of nowhere. We do not think that this is a big issue at Grenke but it is worth having a closer look at because the technique is so nice.

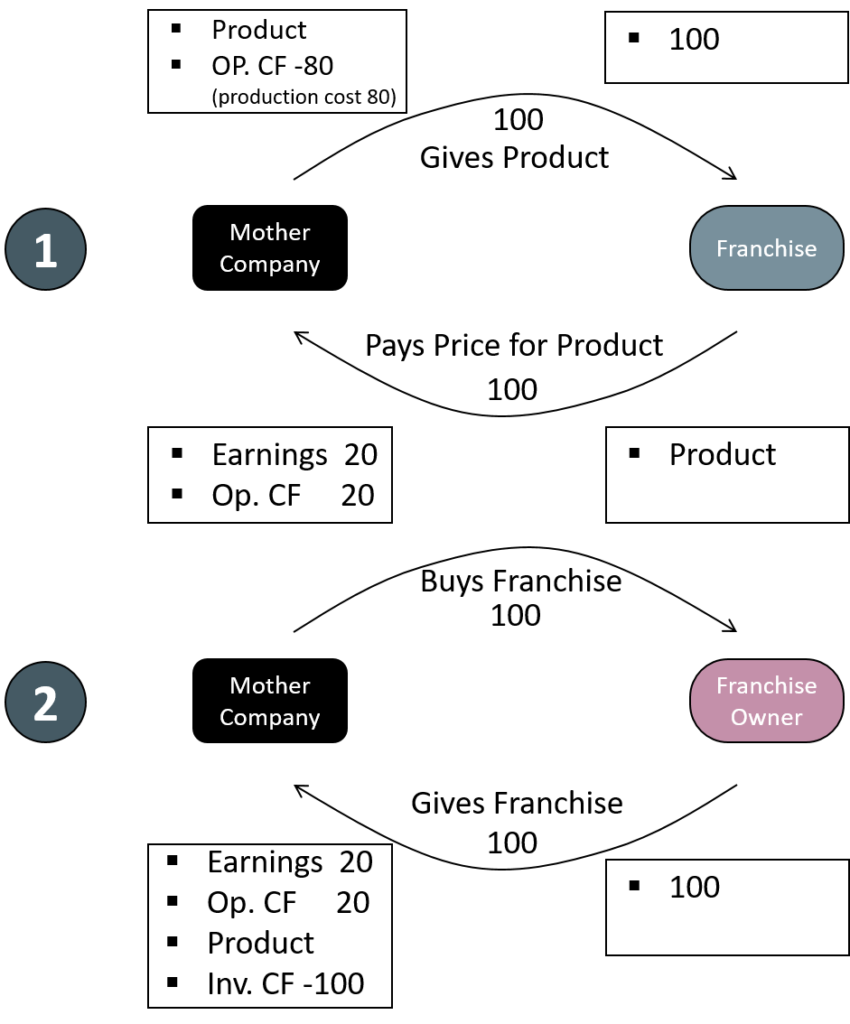

Below is just the standard case of double earning (again: not directly related to the Grenke-case but with some cross-reading). The starting point here is a company that has spent 80 Euros for producing a certain product. Now it sells the product to a franchise company. The franchise company pays a price of 100 Euros. Now the company has earnings of a.o.t.b.e. 20 Euros (same as cash flow) and the franchise has the product valued at 100 Euros on its balance sheet.

In a next step the company buys the whole franchise from the franchise owner for a value of 100 Euros (no debt assumed). Now at the side of the franchise owner everything is as before, he owns 100 Euros. At the side of the company the total cash situation is also as before, they have a positive operating cash flow of 20 Euros and a negative investing cash flow of -100 Euros and hence a position of -80 Euros. The company also has the product back – so -80 Euros and the product: exactly as at the beginning. But stop: The company also has a gain of 20 Euros (the difference in the value of the product). And the company could also show a positive operating cash flow – which is always nice.

We think that some minor effects of this technique are also relevant for the Grenke case (the cash flow statement looks a bit odd, too), but nothing material.

- Related Party Disclosure

The question how to treat the franchise businesses from an accounting point of view also has to be seen in the light of “related party disclosure” (as also mentioned in the Viceroy report). IAS 24.9 says in this context:

“ a) A person or a close member of that person’s family is related to a reporting entity if that person: (i) has control or joint control over the reporting entity; (ii) has significant influence over the reporting entity; or (iii) is a member of the key management personnel of the reporting entity or of a parent of the reporting entity.”

So, the basic structure where former employees which – as far as we understand – are not and have not been member of the key management personnel while or before he/she acts as the manager in the franchise, is usually not enough for assuming a related party. However, if the beneficial owner of these transactions is – as the Viceroy report states – a company that at time of transaction was controlled by key management personnel of Grenke (the report mentions CTP Handel-und Beteligungs GmbH and Sacoma AG) then it is a clear related party transactions.

- Cash

The most dramatic point of the Viceroy accusations touches the cash position. It states that “Viceroy believes that a substantial portion of Grenke’s cash does not exist”. This should – according to the report – basically be a consequence of the transactions with the franchise businesses.

For us, however, it seems highly unlikely that due to the above discussed franchise transactions a fake cash account should have been built. What is possible (but only in small scale) is the above explained effect that the operating cash flow is overstated and the investing cash flow is understated – all netting-out at the total cash flow line. If such techniques are applied (we do not know) it is not at all a great thing because analysts tend to see a positive change in the operating cash flow as a positive thing while a negative investing cash flow is rather something neutral (“let’s see how this investment develops”) or – to say the least – it could be something positive, negative or neutral.

However, these techniques are not made for generating cash out of nowhere. Hence, we do not see the relationship between these techniques on the one-hand-side to the calling into question of the existence of the cash on balance sheet.

Of course, there might be problems – of which we do not know – with the cash account, but we do not think that this is related to the franchise business.

- Summary

I do not like any ugly related party transactions. But I also have to admit that these are rarely issues that really kill the business model. Furthermore, the step from the franchise transaction topic to the calling-into-question of the existence of a substantial portion of the cash on the balance sheet seems far too far in our eyes.

Disclaimer: We hold no economic stake in the company involved in this blog post – in whatsoever direction. We base our analysis on imperfect information and hence we might be wrong with some conclusions. This is just our subjective view and no investment recommendation at all!