It is summertime, not too busy, and hence a good opportunity to have a look at some topics which are rather not at the core of the daily work of an equity investor. So it was a nice coincidence that I had a discussion with some friends during yesterday’s lunch meeting about the new BMW-CEO Oliver Zipse and his letter to employees (https://www.reuters.com/article/us-bmw-ceo-letter/bmws-ceo-urges-staff-to-narrow-sales-gap-with-mercedes-idUSKCN1V618Q). Some of my friends commented that the letter reminds them a lot to some infamous recent CEO-letters that held the company’s employees responsible for the bad corporate performance. And in fact, Zipse’s note that costs are too high can be well understood as a warning to the BMW-staff. However, I was a bit more cautious with such conclusions. I think the letter (or what is publicly disclosed about it) reads quite different from the well-known employee-bashing-letters in other companies in recent years. I would give Oliver Zipse the credit of rather thinking in motivational terms than in bashing ones.

But whoever was right in this lunch-time discussion or whether you like such letters or not, the question of one of my friends was inevitable: Does it pay to invest in companies that engage in employee-bashing? The idea is that such letters could very well shake-up employees and motivate them for working harder in the future. Or is it perhaps even a short-signal that is triggered by open employee-bashing? Putting pressure on employees might demotivate them and the public notice might even intensify this effect. And moreover, if the management of companies feels the need for such communication strategies, it might be that the company is already in such a bad shape that further stock price losses are highly probable per se.

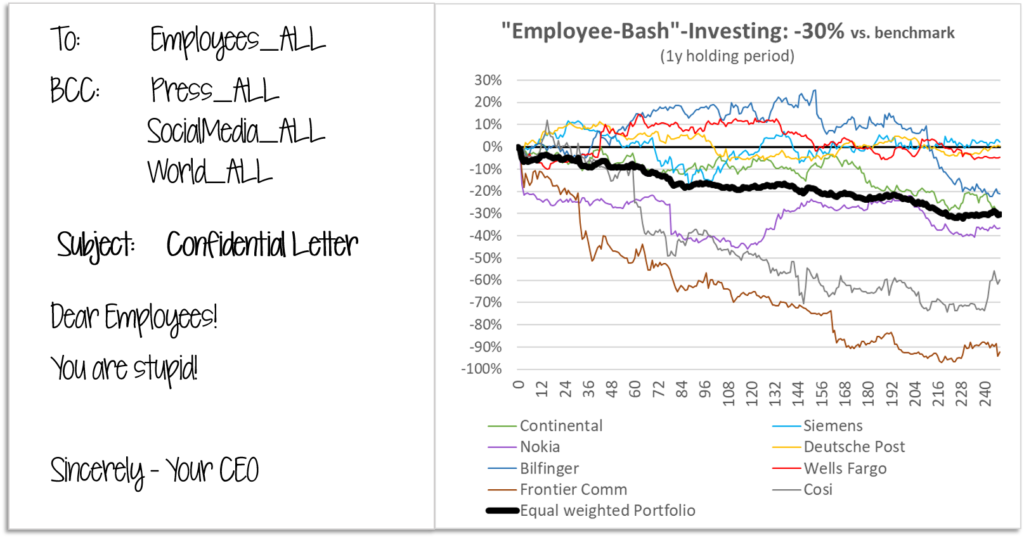

Well, I couldn’t do a complete empirical study in this short time to answer this question but at least I collected some data to get a rough picture of the stock market effects of employee-bashing via the general public. I took the dates of some well-known real worlds examples and observed the stock price development of these companies over the next 250 trading days (roughly 1 calendar year). I benchmarked the price developments to broad market indices (Stoxx Europe 600 for European companies, S&P 500 for US companies) to find out about the relative performance – and here is the result.

In the graph you can see the relative 250-day performance of some specific stocks where 0 on the x-axis is the day of public announcement. We also mapped an equal-weighted portfolio consisting of all single investments.

We can see: If an investor had invested the same amount of money at the date of the public employee-bashing in each of the example companies she would have generated an average return of –30% against the benchmark over one year with this intertemporal portfolio (as the dates of public announcement differ from company to company this is just a virtual portfolio). Moreover, while some companies really showed a very bad performance there is basically no company that effectively outperformed the benchmark by more than a nuance. Hence, this all here looks like it is quite a nice short-selling strategy!

But some caveats are necessary:

- This is just a snapshot of some company examples that I am aware of. I am quite sure that I have forgotten a couple of nice examples in my analysis. And the number of data points is simply too low to really derive significant results.

- The performance of the equal-weighted portfolio is massively driven by the two US bad-performers Frontier Communications and Cosi Restaurants (although the portfolio would even end up in the negative when excluding these two stocks)

- The overlaying drivers (general shape of the company) are what really drives the performance. The public employee-bash is not the cause for the bad performance but rather a symptom.

As a summary: news on CEOs’ open letters to employees are something to watch closely. What is the motivation? What is the tone? At my experience such letters (at least the ones which blame employees) are often something that we can see when not much else will fix the problems. So they are an indication of a lot going wrong within the company. Not rarely they are also a means of CEOs saving themselves by holding others responsible when the water is already up to the company’s neck. But there might also be other reasons for such letters, in particular if the tone is more motivational. And this is also what I would read from the Oliver Zipse-letter. But let’s see what the next months will bring to BMW…

Appendix: The selected Companies

- Continental AG

In September 2018, the management board of automobile supplier Continental in an open letter blamed the division managers of roughly a dozen (unnamed) business units of not living up to their promises and underperforming.

- Siemens AG

Just after his arrival at Siemens in July 2008, CEO Peter Löscher announced the necessity of job cuts. In this context he also mentioned that he is planning to ablate the “clay layer” (German: Lehmschicht), which targeted at the lower and middle (often backoffice) management levels. The term “Lehmschicht” is since then a contemptuous word for these employee categories in the German language.

- Nokia Oyj

In February 2011, CEO Stephen Elop send internally (but leaked) to employees his now famous “standing on a burning platform”-letter. There he also wrote: “We poured gasoline on our own burning platform. I believe we have lacked accountability and leadership to align and direct the company through these disruptive times. We had a series of misses. We haven’t been delivering innovation fast enough. We’re not collaborating internally.”

- Deutsche Post AG

In July 2018, CEO Frank Appel criticised his employees in the staff magazine “Premium Post” with the words “We do not really work as a team, and I mean at all levels.”

- Bilfinger SE

Only a few weeks after he took over at Bilfinger, CEO Peter Utnegard in August 2015 wrote to its employees in a leaked letter that costs are too high and have to be cut, in particular in the company’s administration. Furthermore he remarked that the public trust in the company has reached a low point and that “the market knows no compassion for inefficient companies”

- Wells-Fargo & Co

In a September 2016 Wall Street Journal interview, CEO John Stumpf blamed low-level employees – and not the corporate culture – for the massive fraud scheme that the company build up in the past.

- Frontier Communications Corp

In March 2017 CEO informed employees in a (leaked) email that lower-level staff is responsible for the bad fundamental and capital market performance of the company.

- Cosi Restaurants Inc

On a conference call in August 2013, CEO Stephen Edwards blamed staff for the losses of the company: “People love our sandwiches, they love our salads,” and “We hear it time and time again, it’s never a complaint – a complaint is because someone was rude to me, my sandwich or my salad was incomplete in the ingredients that it was supposed to have … or I got the wrong order or it took me 20 minutes to get my order when there was nobody else in the store.”